Environment

Climate Change

Policies and Basic Approach

How we respond to climate change and increasingly frequent and severe natural disasters – whether through initiatives such as the Sustainable Development Goals (SDGs), the ratification of the Paris Agreement at the United Nations, or other initiatives – is one of the most pressing issues of our time. Businesses must also play their part, and it is becoming increasingly important for companies to act responsibly in supporting the creation of a sustainable society.

The material issues ("Materiality") identified by Mitsui include "secure sustainable supply of essential products", "enhance quality of life", and "create an eco-friendly society", and our Environmental Policy stipulates that we will pursue the kinds of business that will help us act to reduce greenhouse gas (GHG) emissions, as well as mitigate and adapt to climate change. We have positioned climate change as one of the key themes of our sustainability management in our Medium-term Management Plan 2023. Moreover, we position technological innovation in environment and clean tech as one of the core strategic fields, and are working to pursue and expand investment opportunities in these areas.

We have set targets that aim to contribute to the goals of the Paris Agreement and Japan's own medium-term GHG emission reduction targets. Through our global and wide-ranging business activities, we will contribute to the development of economies and societies in many countries across the world and to solutions to the global challenges we face, such as mitigating and adapting to climate change.

Mitsui presented its climate change and green transformation initiatives at the Mitsui & Co. Investor Day held on December 2, 2022. Please refer to the link below for more information.

Mitsui & Co. Investor Day 2022: Path to Green Transformation (PDF 2.81MB)

Disclosure Based on TCFD Recommendations

Disclosure Policy

In December 2018, Mitsui declared its support for the Task Force on Climate-related Financial Disclosures (TCFD). In accordance with the recommendations of the TCFD and as a responsible company operating globally, we actively promote information disclosure with an awareness of stakeholder demands.

Disclosure Based on TCFD Recommendations (December 2022) (PDF 536KB)

Governance

Governance System for Climate Change Response

We have positioned addressing climate change as a key management issue. Basic management policy, business activities, and corporate policies and strategies that concern climate change are planned developed, and advised on by the Sustainability Committee, an organization under the Corporate Management Committee.

The Sustainability Committee is structured so that its activities are appropriately supervised by the Board of Directors, and matters discussed by the Sustainability Committee are regularly discussed and reported to the Corporate Management Committee and the Board of Directors.

Sustainability Committee

| Officer in Charge | Makoto Sato (Representative Director, Senior Executive Managing Officer, Chief Strategy Officer (CSO), Chairperson of the Sustainability Committee) |

|---|---|

| Administrative Office | Corporate Sustainability Div., Corporate Planning & Strategy Div. |

Climate Change-Related Discussions

There were 13 major climate change-related discussions by the Sustainability Committee over the past three years.

- Discussion on climate change scenario analyses

- Discussion on key priorities established in relation to sustainability

- Discussion on the introduction of internal carbon pricing system

- Discussion on establishment of GHG-related targets

- Discussion on establishment of GHG-related targets

- Discussion on climate change scenario analyses

- Report on investigations into GHG emissions

- Progress reports and discussions on the progress of initiatives such as the internal carbon pricing system and building of a GHG emissions database

- Free discussion and report on roadmap for achieving long-term GHG targets

- Report on development of GHG reduction contribution calculation tools

- Free discussion on introduction of ESG assessment in executive remuneration

- Report on climate change/review of internal systems and policies, and deliberations on future response policy

Sustainability Advisory Board

We have established the Sustainability Advisory Board (formerly the Environmental and Societal Advisory Committee), a group comprising external experts in societal and environmental topics such as climate change. The Sustainability Committee uses information and advice from Sustainability Advisory Board members in their deliberations. In fiscal year ended March 2022, the Committee held a total of four meetings to discuss climate change initiatives.

Please refer to the links below for more information on Mitsui's Sustainability Management Framework and the activities of the Sustainability Committee.

- Our Approach to Sustainability: Sustainability Governance and Oversight

- Our Approach to Sustainability: Sustainability Committee

- Our Approach to Sustainability: Sustainability Advisory Board

Reflecting Climate Change Responses in the Executive Remuneration Plan

The company decided to introduce a new performance-linked restricted stock remuneration plan from the fiscal year ended March 2023, which was approved at the Ordinary General Meeting of Shareholders on June 22, 2022. The renumeration plan has been introduced to incentivize the company to fulfill our social responsibilities and to continuously improve our medium-to long-term performance and corporate value. As one of the management evaluation indicators, ESG elements, including our response to climate change are included. For more information, please see "4. Corporate Information, 4. Corporate Governance, (4) Remuneration of Directors and Audit & Supervisory Board Members" in the Annual Securities Report for the fiscal year ended March 31, 2022.

Annual Securities Report for the fiscal year ended March 31, 2022

Strategy

Scenario Analysis Policy and Process

Since declaring our support for the TCFD recommendations in December 2018, we have been engaged in a step-by-step scenario analysis process to enhance the resilience of our strategy by responding flexibly to changes in the global business environment. Traditionally, business units have analyzed risks, countermeasures, quantitative impact, etc. for their selected businesses and discussed them at the Sustainability Committee; however, in response to its growing importance, we have integrated scenario analysis into the formulation process for the business plan starting the fiscal year ending March 31, 2023. By incorporating scenario analysis into the business planning process, which is approved by the Board of Directors after reporting and deliberation by the Corporate Management Committee, the results of scenario analysis are confirmed and deliberated by management and reflected in the business plan and business portfolio strategy.

Selected Scenarios

We are conducting scenario analysis in short- (0-1 year), medium- (1-10 years), and long-term (10-30 years) timeframes up to the year 2050. We conduct scenario analysis of transition risks*1 and opportunities with reference to the scenarios set out in the World Energy Outlook (WEO) published by the (International Energy Agency) IEA. In addition, with reference to the RCP (Representative Concentration Pathway) used by the IPCC (Intergovernmental Panel on Climate Change), Mitsui has conducted analysis of investment assets above a certain value by surveying the impact of physical risks*2 based on natural disasters that have occurred over the last five years.

*1. "Transition risks" refer to risks caused by changes in policy/legal regulations, technology development, market trends, market evaluation, etc.

*2. "Physical risks" refer to the risk of physical damage caused by increases in natural disasters and abnormal weather arising from climate change.

- IEA Stated Policies Scenario (STEPS): Scenario that reflects the current policy targets of each country

- IEA Sustainable Development Scenario (SDS): Scenario needed to uphold the Paris Agreement, which seeks to keep global warming within 2.0°C (and further pursue efforts to limit the temperature increase to 1.5°C) of the pre-Industrial Revolution level

- IEA Net Zero Emissions by 2050 Scenario (NZE): Scenario for achieving the goal of limiting global warming to less than 1.5°C compared to pre-Industrial Revolution level

- IPCC RCP 8.5 scenario: Scenario in which the world's average temperature rises by around 4.0°C by 2100

Major Risks and Opportunities Associated with Climate Change

Mitsui is engaged in a wide range of business in countries and regions around the world, and we view the diverse risks and opportunities presented by climate change as important factors that we must consider when formulating our business strategies. We are identifying the short-, mid-, and long-term risks and opportunities that accompany climate change, and we review them periodically. We also review each segment in response to changes in the macroenvironment and trends, and adjustments in our business portfolio, along with other changes in the internal and external environment, and reflect them in our business strategy in a timely manner.

| Transition Risks | Policy and Legal Risks |

|

|---|---|---|

| Technology Risks |

|

|

| Market Risks |

|

|

| Physical Risks | Acute Risks |

|

| Chronic Risks |

|

Further, for each of our segments we have analyzed the internal and external environment and identified risks and opportunities.

| Segment | Risks | Opportunities |

|---|---|---|

| Mineral & Metal Resources |

|

|

| Energy |

|

|

| Machinery & Infrastructure |

|

|

| Chemicals |

|

|

| Iron & Steel Products |

|

|

| Lifestyle |

|

|

| Innovation & Corporate Development |

|

|

* CCS = Carbon Capture and Storage; CCUS = Carbon Capture, Utilization and Storage

Transition Risk Assessments

We use multiple climate change scenarios for the selected business to assess the impact of transition risks on financial planning and business strategies, and use the results to investigate necessary countermeasures.

Selection of Business for Scenario Analyses

In consideration of scale of business operations and climate change impact, upon categorizing business as "high", "medium" or "low" priority, we have selected "high" priority business as targets for scenario analyses.

Results of Scenario Analysis

The results of scenario analysis for the ten businesses selected for this study are shown below. The scenarios referred to in the scenario analysis are organized into Current and Transition Scenarios as follows.

- Current Scenario: A scenario in which current climate related initiatives of each country are maintained, demand (mainly in emerging countries) for fossil fuels and other resources that emit GHGs remains to a certain extent, and business practices which could impact climate change continue (STEPS, etc.).

- Transition Scenario: A scenario in which there is a slowdown in demand for fossil fuels and other resources that emit GHGs, and a rapid increase in demand for renewable energy and other resources, as a result of the international development of advanced initiatives and systems to address climate change as well as a shift towards energy conservation and electrification driven by widespread decarbonization and technological innovation (SDS, NZE, etc.).

The impact of the Current Scenario and the Transition Scenario on the business between now and 2050 is shown in the following three levels.

: Positive impact on business

: Positive impact on business : No change or slight impact on business

: No change or slight impact on business : Negative impact on business

: Negative impact on business

Upstream Oil and Gas Business and LNG Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Growth in oil demand is expected to gradually slow, with demand peaking in the mid-2030s and then leveling off toward 2050. Demand for natural gas is expected to grow steadily for the power and industrial sectors in emerging Asian countries, centered on China and India. Transition Scenario (2°C: SDS, etc.) Oil demand is expected to decline by half through to 2050 amid progress towards a low-carbon and decarbonization, mainly through electrification of the transportation sector in developed countries. Natural gas demand is expected to remain firm for the next 5 to 10 years as a substitute for coal-fired power generation. By 2050, however, demand is expected to decline to about two-thirds, centered on the power generation sector, due to the spread of renewable energies. Meanwhile, new demand for hydrogen feedstock and other applications is expected to grow over the long term. Transition Scenario (1.5°C: NZE, etc.) Although global demand for natural gas is expected to gradually decline after 2025 and halve between 2030 and 2050, its importance as a raw material for hydrogen is expected to rise together with the global trend toward decarbonization. Meanwhile, oil demand is expected to decline sharply after 2030, falling to about a quarter of current demand by 2050. |

Current Scenario |

Transition Scenario |

Transition Scenario (1.5°C) |

In order to enhance our risk tolerance to sudden changes in supply and demand trends, we will continue to work on improving asset value, including strengthening the competitiveness of existing business assets, reducing GHG emissions, and low carbon/decarbonization initiatives, while considering the global energy and geopolitical situation. Particularly for new projects, we will carefully select highly competitive projects, taking into account potential future carbon costs including policy changes and the introduction of carbon taxes in each country, and build a well-balanced portfolio of business assets, including implementing timely asset recycling. While contributing to the low-carbon and decarbonization of the entire value chain, we will continue to work on upstream development of natural gas, which is a transition energy and can be used as a feedstock for next-generation fuels, and to increase our liquefaction capacity. Utilizing our upstream business knowhow, and while paying attention to technological development trends and regulatory reforms in each country, we aim to realize the early commercialization of our CCS/CCUS business and geothermal business, along with our hydrogen and ammonia business, leveraging our gas upstream assets and our existing customer network. |

| While faced with the dual challenge of needing to expand quantity and improve quality, renewable energy will steadily expand, and fossil fuels will remain indispensable as a primary energy source for the time being. Although oil demand is expected to peak and then remain flat or decline in all scenarios, the impact is limited due to the expected increase in the ratio of gas production in our overall crude oil and gas equity production in the future. Natural gas is an important transition energy source with relatively low environmental impact and a realistic solution to meet growing demand while addressing climate change challenges. Although we expect strong demand for LNG/natural gas particularly in Asia in the medium term under both Transition Scenarios, there is a risk that the value of upstream assets will be impacted if demand declines under the Transition Scenario (1.5°C). Therefore, ongoing verification and monitoring of demand trends and their impact on our business is necessary. |

||||

Financial Results FY Mar/2023 Presentation Material (P.26 Energy: Main Businesses) (PDF 1.19MB)

Metallurgical Coal Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) In developed countries, demand is expected to gradually decline from the 2030s against a backdrop of declining crude steel production and lower blast furnace ratios due to utilization of ferrous scrap, while demand in India and Southeast Asia is expected to grow from the late 2020s onward due to addition of blast furnaces in the region. Global demand for metallurgical coal is expected to increase moderately from current levels through to 2050. The supply of metallurgical coal is expected to remain flat over the medium to long term as increases in new projects and other factors will be offset by the termination of existing mines, resulting in a tightening of the supply-demand balance. Transition Scenario (2°C: SDS, etc.) Demand for metallurgical coal is expected to remain flat over the medium to long term and remain at current levels in 2050, due to further acceleration in the use of ferrous scrap and alternative raw materials in developed countries, as also expected in the Current Scenario. On the supply side, countries are stepping up their efforts to address climate change, making it more difficult to obtain development permits and financing for new projects or expansion plans. As a result, supply is expected to decrease, and the supply-demand balance may become even tighter. Transition Scenario (1.5°C: NZE, etc.) Greater demand for carbon reduction is expected to drive a shift towards more efficient steel use, and both crude steel production and metallurgical coal demand are expected to decline further compared to the other scenarios. New projects or expansion plans may be more difficult to implement under the Transition Scenario (1.5°C), resulting in a decline in supply and a further tightening of the supply-demand balance. |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

As demand for metallurgical coal is expected to remain strong over the medium to long term, we will strive to improve the quality of our assets while maintaining stable supplies to customers. We will closely monitor changes in the external environment, and strengthen our efforts such as utilizing the methane gas produced and shifting to alternative fuels and raw materials, with a view to realize a low-carbon/decarbonized society together with our business partners. |

| Under the Current Scenario, demand for metallurgical coal is expected to remain flat or increase slightly, and the competitiveness of our assets will be maintained, and therefore business profitability is expected to remain strong. Under the Transition Scenarios, new projects and expansion plans are expected to slow down on the supply side in response to declining demand, resulting in a decline in the volume of supplied. Although our assets will remain competitive, there is expected to be an increase in costs relating to the introduction of emission reduction technology, environmental compliance, and financing. Continuous close attention must be paid to the business impact that these costs have on metallurgical coal prices, along with the business impact of policies and policy trends in each country. Additionally, we are no longer adding to our assets that only produce thermal coal. |

||||

Thermal Power Generation Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Fossil fuel-based power generation will gradually decline over the long term, particularly in developed countries. Meanwhile, demand for new power plants is expected to continue in the medium term in some emerging countries where electricity demand will continue to grow and where renewable energy alone is not sufficient to meet supply needs. Transition Scenario (2°C: SDS, etc.) Fossil fuel-based power generation is expected to decline at a faster rate in the medium to long term than under the Current Scenario, particularly in developed countries. Although developed countries are shifting to renewable energy sources, a certain amount of coal-fired power generation demand is expected in emerging countries even as late as 2050. In addition, demand for gas-fired power generation as a transition energy source is expected to continue over the medium to long term in both developed and emerging countries. Transition Scenario (1.5°C: NZE, etc.) Electricity demand is expected to increase significantly in the medium to long term against the backdrop of rapid progress in the low-carbon and decarbonization trends, with demand increasing by 50% in 2050 compared to the Current Scenario. Compared to the 2°C scenario, fossil fuel-based electricity generation is expected to decline at a faster rate, and by 2050, power plants with decarbonization facilities such as CCUS will become mainstream. The share of renewable energy is expected to further increase, with renewable energy, mainly wind and solar, supplying the majority of electricity demand. |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

Amid the global trend towards low carbon and decarbonization, we will work to transform our power generation portfolio and improve quality in accordance with changes in the environment. Specifically, we intend to reduce our coal-fired thermal power footprint from our power generation capacity over the medium to long term, while increasing the ratio of renewable energy in our power generation portfolio, including hydroelectric power, to over 30% by 2030, and continue with the transformation of our power generation portfolio as necessary to achieve net zero by 2050. In addition, as a responsible power producer, we will continue to examine ways to improve the efficiency of our existing thermal power assets, including utilizing CCUS, ammonia co-firing, and other low-carbon and decarbonizing technologies. We will consider new gas-fired power projects, taking into account the need for gas-fired power as a transition energy source in accordance with each scenario, as well as potential future carbon costs the power supply mix, and electricity demand outlook for each region. |

| The impact of changes in the external environment on our existing business is limited, as most of our power asset portfolio is based on long-term power purchase agreements—in which consideration is paid for the generation capacity rather than for generated volume. However, under the Transition Scenarios, the global trend towards low carbon and decarbonization will rapidly accelerate, which may affect the business viability of some assets after power purchase agreements expire, and therefore ongoing verification and monitoring of stranded asset risks is required. | ||||

Iron Ore Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Although crude steel production in China, the world's largest producer, is expected to decline in the future, this is expected to be offset by increased production in India and Southeast Asia. We predict that global crude steel production will remain steady over the medium to long term. Transition Scenario (2°C: SDS, etc.) With higher rates of use of electric furnaces, and an increase in production of direct-reduced iron, which mainly uses high-grade ore, we expect an increase in demand for high-grade ore, and a corresponding increase in premiums and discounts for high-grade iron ore/low-grade iron ore. Transition Scenario (1.5°C: NZE, etc.) In response to the growing demand for a shift to low carbon, the use of scrap iron and direct-reduced iron is expected to further expand, and crude steel production itself is expected to decrease due to more efficient steel use. Iron ore demand is expected to decrease compared to the Transition Scenario (2°C). |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

For the foreseeable future, we will work to strengthen the competitiveness of our assets while providing stable iron ore supplies to customers, and continue to closely monitor the rate at which electric furnace production methods spread as a means of low-carbon and decarbonization in the steel industry, and the speed of change regarding new steelmaking technologies. In addition, we will strengthen efforts towards realizing a low-carbon society together with our business partners, while closely monitoring changes in the external environment. |

| Although crude steel production is expected to be affected by a peak-out in China in the mid-2020s, India and Southeast Asia are expected to offset the decline in China. Crude steel production and iron ore demand are expected to remain steady over the medium to long term under both the Current and Transition Scenario (2°C). Under the Transition Scenario (1.5°C), iron ore demand is expected to decline relative to other scenarios. The Transition Scenario (2°C) incorporates an increase in premiums and discounts for high-grade and low-grade ore, but the impact on overall earnings will be limited. A similar trend is expected under the Transition Scenario (1.5°C), however downward pressure on iron ore prices and profitability is expected due to lower demand. The business impact of policies and policy trends in each country will need to be continuously examined. | ||||

Offshore Oil and Gas Production Facilities Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Demand for new production facilities will decline over the medium to long term in line with a slowdown in oil demand growth; however, the timeline of this will differ by region. Transition Scenario (2°C: SDS, etc.) Oil demand will decline earlier than under the Current Scenario due to the promotion of electrification in developed countries, dropping by half through to 2050. As a result, demand for new production facilities is expected to decline faster than under the Current Scenario. Transition Scenario (1.5°C: NZE, etc.) Oil demand is expected to decline sharply after 2030, and fall to about a quarter of the current level by 2050. With the rapid decline in demand, crude oil prices are expected to fall to about half by 2030 and one-quarter by 2050, compared to the Current Scenario. As a result, demand for new production facilities is expected to decline more than under the Transition Scenario (2°C). |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

Considering the scenario of declining demand in the medium to long term, we will work to transform our businesses into a field where we can utilize the expertise we have accumulated from our existing business (e.g., floating offshore wind power). |

| Many of our projects related to offshore oil and gas production facilities, such as FPSO facilities and drillships, that continue beyond 2030, are based on committed long-term use by customers under long-term contracts. Therefore, the impact of the Current and Transition Scenarios on existing businesses is expected to be limited. However, under the Transition Scenario (1.5°C), a significant decline in oil demand and oil prices beyond 2030 may impact the continuity of production activities of energy companies, and will require continuous verification and monitoring of the impact on business. | ||||

Gas Distribution Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Natural gas demand is expected to increase steadily in line with rising gas demand in emerging countries. Transition Scenario (2°C: SDS, etc.) Natural gas demand is expected to remain firm for the next 5-10 years due to its use as a substitute for coal-fired power generation, however through to 2050, demand is expected to fall to about two-thirds, with the majority of this reduction in the power generation sector, due to the spread of renewable energy. In emerging countries, gas demand is expected to increase, but grow at a slower pace than under the Current Scenario. Transition Scenario (1.5°C: NZE, etc.) Global natural gas demand is expected to gradually decline after 2025 and halve from 2030 to 2050. Oil demand is also expected to decline sharply after 2030, falling to about a quarter of current demand by 2050. |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

We will continue to work on improving asset value, including decarbonization initiatives such as biogas utilization and GHG emissions reduction. For new projects, we are working in consideration of potential future carbon costs. |

| Our gas distribution businesses located in emerging countries are granted exclusive long term concession rights in each of the concession areas. Under the Current and Transition Scenario (2°C), in which gas demand in emerging countries is expected to increase in the medium to long term, the impact on existing businesses is expected to be limited. Under the Transition Scenario (1.5°C), demand for gas is expected to decline in emerging countries due to a decrease in associated gas production resulting from a decline in oil production, and a rapid increase in the share of renewable energy in the power generation sector, potentially impacting business revenues due to lower gas distribution volumes. |

||||

LNG Shipping Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Demand for natural gas is expected to grow steadily over the long term for use in the power and industrial sectors in emerging Asian countries, and therefore, demand for operation of ships for natural gas is expected to increase. Transition Scenario (2°C: SDS, etc.) Demand for natural gas is expected to continue in the medium to long term as a substitute for coal-fired thermal power generation, and demand for operation of ships is expected to increase through to 2050. Transition Scenario (1.5°C: NZE, etc.) Natural gas demand is expected to decline after the mid-2020s due to global decarbonization, and demand for ship operations is expected to decline through to 2050. |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

With consideration for medium- and long-term supply and demand and price trends, we will strive to maintain and improve the profitability of individual businesses, as well as working to ensure stable and streamlined operations, and at the same time identify and capture growth opportunities in new businesses including next-generation fuel tankers and new fuel carriers. |

| In the LNG shipping business, most of the recent projects have secured earnings based on long-term contracts. Therefore, in all scenarios, the impact on the Company's earnings will be limited in the near term. However, under the Transition Scenario (1.5°C), there is a risk that the value of assets will be impacted after the end of long-term chartering, as demand is expected to decline toward 2050, and the impact on our business requires close monitoring. | ||||

Renewable Energy Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Demand is expected to increase substantially over the medium to long term in response to low carbon and decarbonization trends and energy security. Transition Scenario (2°C: SDS, etc.) Demand is expected to increase substantially at a faster rate than in the Current Scenario. Electrification and other factors, especially in developed countries such as the U.S. and Australia, will drive demand growth, and by 2050 the majority of electricity demand is expected to be met by renewable energy sources. Transition Scenario (1.5°C: NZE, etc.) Rapid progress in the global low carbon and decarbonization trend is expected to drive the spread of electrification, and electricity demand will rise significantly in the medium to long term, increasing by 50% in 2050 compared to the Current Scenario. The share of renewable energy is expected to further increase compared to the Transition Scenario (2°C), with the majority of electricity demand expected to come from renewable energy sources, mainly wind and solar, by 2050. Continued large-scale investments will be required for the promotion of renewable energy, and demand is also expected to increase for power grid reinforcement, storage batteries, demand response, etc., to ensure the stability of power networks in each region. |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

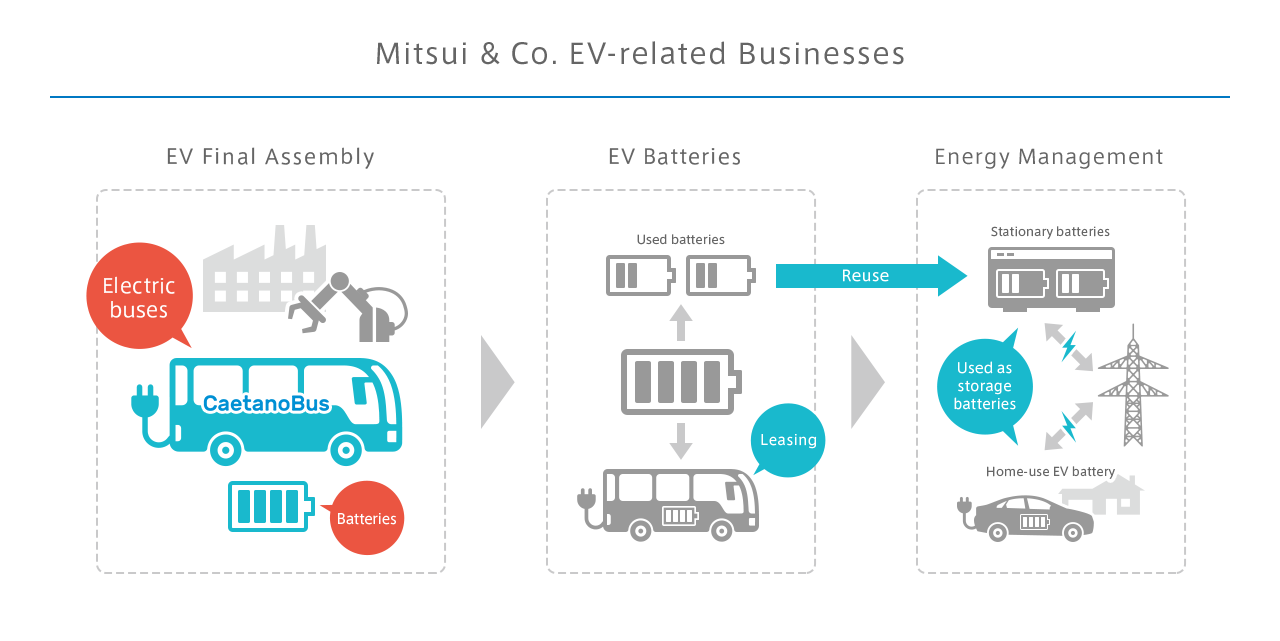

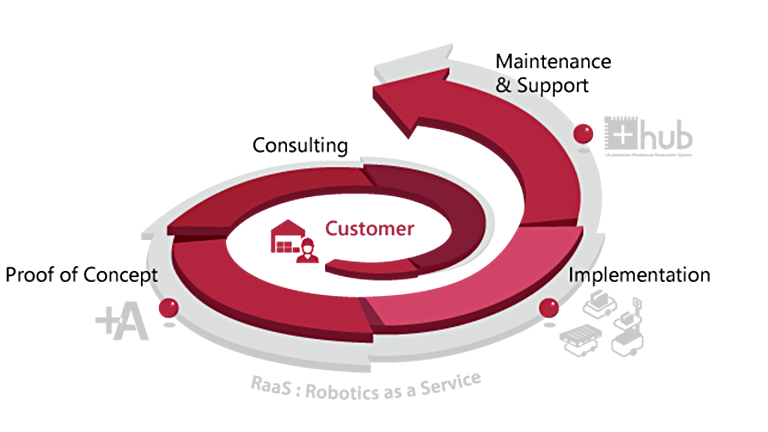

In line with the global trend towards low carbon and decarbonization, we will work to transform and improve the quality of our power generation asset portfolio in response to the changing environment. Specifically, in order to raise the ratio of renewable energy in our power generation portfolio to over 30% by 2030, we will engage in large-scale renewable energy projects including solar power, onshore wind power, and offshore wind power, as well as local production for local consumption type distributed renewable energy projects, to meet local demand. In addition, in view of the potential for intensified competition among operators, we will aim to capture added value by establishing a renewable energy business cluster, leveraging our comprehensive strengths to engage in peripheral fields including the production and sale of green hydrogen, ammonia, and methanol using renewable energy, clean energy sales, EV infrastructure, and offshore wind power infrastructure. |

| While the renewable energy industry is expected to experience significant growth in demand, competition is likely to intensify as the number of operators in the segment grows. Meanwhile, supply-demand balance adjustment needs are expected to expand in some regions in order to cope with grid instability caused by the rapid increase in the rate of renewable energy sources. In addition, the energy solution business utilizing digital technology is also expected to expand. The Electric Vehicle (EV) market is also expected to grow with the support of government policy in various countries, and demand for clean power is expected to grow. |

||||

Power Generation Businesses (Renewable Energy Business) as of March 31, 2023 (PDF 118KB)

Next-Generation Energy Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Demand for biofuels and other next-generation energy is expected to continue to grow strongly over the medium to long term, mainly as a replacement for liquid fossil fuels. Transition Scenario (2°C: SDS, etc.) Demand for biofuels is expected to grow rapidly in the medium term, and while the growth rate will slow over the long term, demand for biofuels for aviation and marine transportation is expected to continue to expand. Hydrogen and fuel ammonia are expected to grow, replacing natural gas in the medium to long term. Transition Scenario (1.5°C: NZE, etc.) Demand for biofuels will grow more than the Transition Scenario (2°C) in the medium term, but will then plateau. However, demand for aviation and shipping applications is expected to grow steadily over the medium to long term. Under the Transition Scenario (1.5°C), hydrogen and fuel ammonia demand is expected to grow much faster than under the Transition Scenario (2°C) through to 2050. |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

In the biofuel business, which is expected to be the center of demand in the medium term, we are working to expand our business leveraging the technology and expertise of our existing investees, after assessing the potential environmental impact. In addition, we are moving forward with initiatives in hydrogen and fuel ammonia, geothermal power generation projects, and other areas, which we view as realistic solutions for realizing a low-carbon or decarbonized society, and we expect to be in great demand in the long term. While these areas are expected to become next-generation alternative energy sources, further technological innovation is necessary for full-scale expansion. Accordingly, we have formed a specialized in-house team and are accelerating these efforts. |

| There is a significant expectation that demand for next-generation energy will grow, and promising next-generation energy technologies are in the process of being developed. Along with the development of new government programs, etc. in each country, we expect further accelerated investment in the development of new technologies and lower costs of producing low-carbon and decarbonized energy, stimulating further growth in demand and creating new business opportunities. | ||||

Forest Resources Business

Please scroll horizontally to look at table below.

| Awareness of Business Environment Under Each Scenario | Impact on Businesses | Countermeasures | ||

|---|---|---|---|---|

| Current Scenario (STEPS, etc.) Demand for forest resources (timber, woodchips, etc.) is expected to grow steadily in line with global population growth, and expansion in housing and paper markets in emerging countries, especially in Asia. Additionally, the value of forest resources, mainly plantation timber, is expected to increase due to the tightening of natural forest protection policies and logging regulations in each country. Transition Scenario (2°C: SDS, etc.) As in the Current Scenario, demand for forest resources such as woodchips, which are used as a raw material for housing materials and paper, is expected to increase steadily. In addition, heightened interest in the CO2 absorption capabilities of forest resources and their characteristics as renewable natural materials is expected to result in growth in the market for forest-based emission credits, an increase in the price of emission credits, and an expansion of the market for high value-added wood-derived products such as bio-chemicals. Transition Scenario (1.5°C: NZE, etc.) Carbon prices in developed countries are expected to increase by a factor of 1.5 compared to the Transition Scenario (2°C), as CO2 emission reduction initiatives are strengthened, and the market for forest-based emission credits is expected to expand, emission credit prices are expected to rise, and the market for wood-based high-value-added products such as bio-chemicals is expected to expand. |

Current Scenario |

Transition Scenario (2°C) |

Transition Scenario (1.5°C) |

We will expand our forest resources business by accumulating assets based on profitability and risk to serve as a foundation for the creation of environmental value and industrial solutions to social issues. We will aim to maximize the value of forest resources not only by expanding paper and housing applications and emission credit creation, but also by developing new needs for timber materials. |

| Under the Current Scenario, an increase in demand is expected for forest resources, especially timber, as renewable and natural materials that contribute to climate change response. Under the Transition Scenario, demand for emissions trading is expected to increase and the price of emission credits is expected to rise, and biochemicals derived from forest resources are expected to be effectively utilized, which we expect will boost profitability. | ||||

Physical Risk Assessments

We operate a wide range of businesses in various countries and regions, which may be affected by the manifestation of physical risks if climate change causes an increase in extreme weather events. In order to clarify the impact of physical risks on our business, we conducted analyses that refer to the RCP8.5 scenario and others, and for businesses with investable assets above a certain amount, we conducted research and impact analysis based on climate disasters that have occurred in the past five years. The major physical risks facing assets owned by Mitsui include the potential for localized storms, particularly strong tropical hurricanes and cyclones arising in the Atlantic and South Pacific, which could cause negative impacts on operations in our mineral and metal resources projects. Furthermore, in cases of severe damage to production plants, facilities or infrastructure, such as the roads, railways, and ports used for shipments, there is a risk that production or shipments could be suspended for long periods until these facilities are restored. On top of Mitsui's own investments, in cases where Mitsui suppliers suffer significant damage, there is a possibility of the risk of the overall supply chain failing, including failures to receive supplies of raw materials.

We place the highest priority on protecting human lives in the event of a disaster. In addition, we have established crisis management policies for business continuity that also takes into consideration coexistence with local communities. We have also taken measures to mitigate and adapt to risks, such as securing multiple suppliers, enhancing our facilities, and obtaining insurance coverage as necessary. We will continue to assess the adequacy of our risk management measures on a regular basis.

The major physical risks in our assets are as follows.

Risk Management

We identify company-wide material risks across organizational boundaries and implement a wide range of initiatives to hedge and control risks. For this purpose, Mitsui has established an integrated risk management system that centrally manages company-wide risks, through the Portfolio Management Committee under the Corporate Management Committee. Under the integrated risk management system, the Corporate Staff Divisions, which act as the secretariat, manage risks from a company-wide perspective. Material risks we assume include those related to the environment, society and governance, such as risks from climate change, compliance, and infectious disease, disasters, terrorism, etc. We position risks regarding climate change (physical and transition) in particular as second in importance only to business investment and country risks and are taking corresponding measures. For details of our risk management structure, please refer to the following page.

For Mitsui & Co., which operates in countries and regions around the world, the policies of each country and region related to climate change have a significant impact on the profitability and sustainability of each of our businesses. We use the climate-change scenarios published by the IEA and other organizations when we analyze scenarios involving businesses that have significant impacts. In this way, we are gaining an understanding of business impacts both in terms of risk and opportunity. When considering investment projects, M&A, and other business decisions, we take these scenarios into account.

In conducting business, we have put in place a system to ensure that utmost consideration is given to the environment and society in projects at all stages, including at the launch of a new business, during operations, and even at the time of withdrawal from the business. Our Sustainability Committee discusses response policies and measures regarding environmental and social risks (including climate-change risk), then reports to the Corporate Management Committee and the Board of Directors, which then applies them following approval.

Metrics & Targets

GHG Reduction Targets

- Scope 1 and 2, and Scope 3 Category 15 (Investments) of the Company and its consolidated subsidiaries (including un-incorporated joint ventures):

Formulating Mitsui's goal to achieve net-zero emissions as our Vision for 2050, and aiming to reduce GHG impact by 2030 to half of what it was in the fiscal year ended March 2020, as the path to achieve the above goal. - Scope 1 and 2 of the Company and its consolidated subsidiaries:

Halving GHG emissions by 2030 compared to the fiscal year ended March 2020. - The ratio of renewable energy in our power generation portfolio:

Raising the ratio of renewable energy to over 30% by 2030, to achieve our goal of halving our GHG impact by 2030.

GHG impact refers to the amount of our emissions minus the GHG emission reduction contribution amount we achieved through our business activities. We not only focus on reducing our own emissions, but also on contributing to the transition to a low-carbon/ decarbonized society through our business activities. Going forward, we will accelerate our company-wide initiatives by setting specific goals, including our reduction contribution amount.

Net zero emissions in 2050 means to reduce our emissions to effectively zero by subtracting only the amount of absorption and offset from our emissions. The reduction contribution amount is not included in the 2050 target figures, though we will continue to actively contribute to GHG emissions reductions for society as a whole through our business.

We promote emission reduction (Reduction) and reduction contribution (Opportunity & Transition) in a variety of ways, taking advantage of the cross-industrial business structure that only a sogo shosha can offer.

Roadmap to Halving GHG Impact by 2030

We aim to halve our GHG impact from 34 million tons in the FY Mar/2020 to 17 million tons in FY Mar/2030.

For the three-year period from FY Mar/2021 to FY Mar/2023, the GHG impact is expected to be approximately 33 million tons.

Although emissions are expected to increase slightly from FY Mar/2024 to FY Mar/2030 due to the start of operations of thermal power generation projects and other factors, we will aim to achieve our goal of halving of the GHG impact in 2030 through a robust combination of emission reduction and reduction contribution projects.

GHG Emissions Breakdown

Internal Carbon Pricing System

At Mitsui, we introduced the internal carbon pricing system in April 2020 for the purpose of improving the medium to long-term resilience of businesses emitting large volumes of GHG, and to encourage the development of projects that are effective at reducing our, and society's, GHG emissions. Regarding new business projects, in projects with potential risks or opportunities from GHG regulations, etc., we have added analysis of the potential impact of a 2°C scenario to the project screening factors, as well as the adequacy of countermeasures in the event these risks are realized. We are also using the internal carbon pricing system to assess risks in existing projects. The pricing is based on definitions and prices published by the IEA and other external organizations, taking into account the location and time horizon of the assets, and over the period through 2050 we have applied prices generally in the $10 to $200 range for developed countries and $0 to $160 for the rest of the world.

Environmental ("Green") Business Assessment Working Group

As the transition towards a low-carbon or decarbonized society accelerates, we are working to reduce the GHG emissions from our operations while simultaneously engaging in business that contributes to reducing GHG for society. We aim to realize sustainable growth while helping to solve the challenges faced by society. For these reasons, we decided to establish the Environmental ("Green") Business Assessment Working Group, which launched on April 1, 2021. Its role is to carry out comprehensive evaluations as part of the screening process for new projects with the potential to turn climate change responses, such as the development of renewable energy, into opportunities. The evaluations include qualitative factors, such as the strategic significance of initiatives from ESG perspectives.

Other Environmental Indicators/Targets

Aside from our GHG reduction targets, the following environmental indicators and targets have been established and are being monitored on an ongoing basis.

- Energy consumption:

- Reduce energy consumption intensity by 1% or higher on average per year at Mitsui & Co. (non-consolidated).

- Water Resources:

- Reduce water consumption at Mitsui & Co. (non-consolidated) to less than the amount used in the previous fiscal year, and improve the efficiency of water use.

- Pollution Prevention:

- Increase the waste recycling rate at buildings owned by Mitsui & Co. as a non-consolidated entity (Head Office, Osaka Office) to over 90% by 2030.

- Reduce paper consumption at Mitsui & Co. (non-consolidated) by 50% or more compared to the fiscal year ended March 2020 by 2030.

For specific performance data, please refer to the following.

Collaborating with Stakeholders

Participation in Initiatives

As a responsible global company, we are advancing and expanding our response to climate change by participating in initiatives that encourage appropriate information disclosure to stakeholders and that make contributions which correspond with the Paris Agreement and the achievement of Japan's medium- to long-term targets for reducing greenhouse gas emissions through initiatives based on international frameworks and wide-ranging partnerships with industry organization in Japan. Our decision to participate in each initiative is made once we have confirmed that it is compatible with our basic policy and initiatives concerning climate change.

TCFD (Task Force on Climate-related Financial Disclosures)

In December 2018, Mitsui declared its support for the TCFD (Task Force on Climate-related Financial Disclosures) recommendations, which aim to facilitate companies to recognize financial impacts arising from the risks and opportunities associated with climate change and to disclose such climate-related information.

TCFD Consortium

The TCFD Consortium was established in 2019 to promote unified action between companies, financial institutions, and other organizations that have declared support for the TCFD and as a forum to further discussion on effective and efficient corporate disclosure of information, as well as the use of disclosed information by financial institutions in making appropriate investment decisions. The Ministry of Economy, Trade and Industry, Financial Services Agency, and Ministry of the Environment participate in the consortium as observers. As a member of the consortium, Mitsui will continue to practice appropriate disclosure in line with TCFD recommendations.

CDP (Climate Change)

Since 2011, we have responded to the questionnaire from the CDP Climate Change, a global disclosure program for corporate information on climate change risks. Based on our response to the questionnaire carried out in 2022, we received the score "B" in relation to Climate Change.

Maersk Mc-Kinney Moller Center for Zero Carbon Shipping

Reducing emissions is a global issue for the shipping industry. In April 2021, Mitsui became a Strategic Partner of the Maersk Mc-Kinney Moller Center for Zero Carbon Shipping (MMMCZCS), a not-for-profit international research and development center dedicated to the decarbonization of the shipping industry.

International Iron Metallics Association

The International Iron Metallics Association is a worldwide organization with a focus on ore-based metallics (pig iron, hot briquetted iron, direct reduced iron, granulated pig iron). It's members, including Mitsui, account for more than 80% of production and international trade in ore-based metallics. We have been distributing and investing in ferrous raw materials, including ore-based metallics, for a long time and amid a growing focus on these materials in relation to the low-carbonization of the iron and steel industry, we will continue contributing to industry low-carbonization through our business development in this area.

ASI (Aluminium Stewardship Initiative)

ASI was established in 2012 with a vision of maximizing the contribution of aluminum to a sustainable society. As of May 2022, approximately 226 companies and groups have joined ASI, including a variety of stakeholders such as aluminum producers and users and the International Aluminium Institute. Its purpose is to increase sustainability in the aluminum supply chain and contribute to ESG engagement by formulating international standards and establishing certification systems. Mitsui joined in January 2020 and supports these initiatives as a member.

Battery Association for Supply Chain

The Battery Association for Supply Chain (BASC) is an organization that promotes the enhancement of the international competitiveness of supply chains related to battery raw materials and components, with the aim of realizing a decarbonized society. BASC was established in April 2021, and Mitsui has been a member since its establishment. Together with other member companies, we are addressing issues such as the international standardization of lithium, and rule-making for the establishment of a battery ecosystem.

Japan Business Federation (Keidanren)

Mitsui is a member of various Keidanren committees, including the following:

- Committee on Responsible Business Conduct & SDGs Promotion, which works to make the Charter of Corporate Behavior well known, disseminate and promote "Society 5.0 for SDGs", and promote corporate social contribution activities

- Committee on Energy and Resources, which promotes energy policies that provide a balance of S+3E (Safety + Energy Security, Economic Efficiency, and Environment)

- Committee on Overseas Development Cooperation, which aims to coordinate with national governments and international institutions for the purpose of developing infrastructure overseas, in particular, in emerging countries

- Committee on Environment and Safety, which works on countermeasures to deal with climate change, formation of a circular society, and improvements in environmental regulations and systems

Japan Foreign Trade Council

As a member of the Global Environment Committee of the Japan Foreign Trade Council Inc., Mitsui is actively involved in activities in the field of climate change. In particular, we monitor energy use for all trading companies and promote reduce/reuse/recycle (3Rs) activities. We also gather information about new energy technology through our business activities, and contribute to the formulation of the Long-term Vision for Climate Change Measures. Mitsui also engages in activities as a member of the Japan Foreign Trade Council's Sustainability Promotion Committee, which studies Sustainability/CSR-related issues and conducts surveys and research about trends in Japan and overseas.

GX League Basic Concept

In February 2022, Mitsui endorsed the GX (Green Transformation) League Basic Concept published by the Ministry of Economy, Trade and Industry.

The GX League calls for companies to actively work on GX and acts as a forum for discussing the transformation of the overall economic and social system and creating new markets accordingly for achieving carbon neutrality in Japan and the world.

We will actively participate, together with other endorsing companies, in discussions of detailed design and empirical demonstration working towards the implementation of GX League.

Japan Hydrogen Association

The Japan Hydrogen Association was established in December 2020 with the aim of building and expanding the hydrogen economy by fostering global alliances and developing a hydrogen supply chain. The organization became a general incorporated association in April 2022, and Mitsui, which has participated in this initiative since the establishment of the preparatory committee and as a Board member, will continue working with other member companies toward the realization of a hydrogen society.

Forest Stewardship Council® (FSC®)

The Forest Stewardship Council® (FSC®) is an international non-profit organization that promotes management of the world's forests in a way that is environmentally appropriate, economically viable, and socially beneficial, including with regard to respect for human rights. Mitsui has obtained FSC® forest management (FM) certification (FSC®-C057355) at all 74 of its forests, which in total approximately 44,000 hectares, while Mitsui Bussan Forest Co., Ltd., a Mitsui subsidiary, has obtained Chain of Custody (CoC) certification for the processing and distribution of cut lumber (FSC®-C031328). As one of the top private-sector suppliers in terms of volume of FSC®-certified Japanese-grown lumber, Mitsui is helping to promote FSC® in Japan and to discuss and draft the Japanese version of principles, standards, and risk assessments. Mitsui has obtained FSC® certification for its forest resources business as well, and promotes responsible management of forest resources.

Carbon Recycling Fund Institute

Carbon recycling policies that see CO2 as a resource to be used and promote innovation in this field are coming to play an important role in Japan's energy policies. The Carbon Recycling Fund Institute was established in August 2019 to promote the creation of carbon recycling innovation with the aim of both addressing the global warming issue and improving energy access throughout the world. Mitsui has been a member since January 2020. We aim to pursue business opportunities and contribute to solving climate change issues by providing access to the latest information regarding CCUS (CO2 Capture, Utilization and Storage), which is important for decarbonization, and by strengthening relationships with other member companies.

The Institute of Applied Energy, Society of Anthropogenic Carbon Cycle Technology

Carbon capture and storage technology can process huge volumes of CO2 and is considered to be an effective way to reduce CO2 emissions. However, in recent years, there has been growing demand for the building of carbon capture and utilization technologies and systems that can also process large volumes of CO2. The Society of Anthropogenic Carbon Cycle Technology was established by the Institute of Applied Energy in October 2018 with the goal of investigating and researching viable technologies for utilizing CO2 and sharing relevant information in order to contribute to the earlier realization of these technologies and their social application. Mitsui has been a member since July 2020.

Clean Fuel Ammonia Association

The Clean Fuel Ammonia Association is an industrial-academic-governmental platform for the development and evaluation of technology, economic evaluation, policy proposal, and international collaboration. It aims to find social applications for energy technologies that use ammonia and to build value chains spanning from the supply to usage of CO2-free ammonia. Mitsui has participated as a member of the Board of Directors since April 2019.

Initiatives

Our Medium-Term Management Plan and Environmental Policy both call for action on climate change, and we are promoting initiatives to reduce our environmental impact through dialogue with suppliers and other business partners along the value chains in which we are involved, with the aim of achieving both economic development and a response to climate change. In addition to renewable energy and modal shift businesses, we are also working to expand and promote various businesses and technologies that contribute to the reduction of CO2 emissions and improvement in energy consumption efficiency.

Making Electricity Use Carbon Neutral across All Business Locations in Japan (Using Renewable Energy-Derived Credits)

As one of the concrete measures aimed at realizing our 2050 vision, all power supplied to our new Head Office, which we relocated to in May 2020, is carbon neutral. This has been achieved by mainly procuring energy from the Fukushima Natural Gas Power Plant (Shinchi, Soma, Fukushima Prefecture), a facility which has Mitsui as one of its main investors, and by applying renewable energy-derived credits generated by the biomass power generation of our affiliate company Konan Utility Co., Ltd. ("Konan Utility"). We have also applied credits generated by Konan Utility and Mitsui's Forests to the electricity used in all offices and training centers in Japan, enabling us to make all business locations in Japan carbon neutral.

Initiatives in Adaptation to Climate Change — Controlled Environment Agriculture Business in the Middle East

- Nutrition & Agriculture Business Unit

A controlled environment agriculture facility operated by Zero of Italy

A controlled environment agriculture facility operated by Zero of ItalyIn March 2022 we became involved in a controlled environment agriculture (CEA) business in the Middle East. Together with retailer Tamimi Markets of Saudi Arabia, and Zero SRL, an Italian CEA business operator, we established a joint venture and will launch a pilot project to verify the production and sales capabilities of facilities for growing crops in a controlled environment, in anticipation of future large-scale production. Although the consumption of fresh produce is on the rise in the Middle East, the harsh local environment is an issue in raising levels of food self-sufficiency.

CEA facilities use less water to grow plants by controlling the volume of water needed (resulting in about a 90% reduction in water use compared to open-field cultivation). They generate 45% less CO2 emissions, and offer stable supplies of produce without being affected by the weather. Due to the close proximity from farm to shelf, food loss during transportation, and CO2 emissions (food mileage) from food transportation can both be reduced.

Due to growth in the world population, it is said that the area of cultivated land per person will decline by around 25%* by the year 2050, compared with 2005. Given this background, the need for low-environmental-impact agricultural production is expanding, and with the growing awareness of environmental and social issues in agricultural production, such as the visualization of food chains, more sustainable agricultural productivity is needed.

By enabling the local production and consumption of fresh vegetables and fruit through the CEA business, we will contribute to improving the local levels of food self-sufficiency, quality, and safety and security.

*United Nations "World Population Prospects 2019 Edition"; Ministry of Agriculture, Forestry and Industry "World Food Supply and Demand Projections for 2050 (2019)"

Renewable Energy

- Infrastructure Projects Business Unit

- Energy Solutions Business Unit

In our power generation business we intend to lower the share of coal-fired thermal power in our equity share of power generation capacity and increase the percentage of renewable energy (including hydropower) to 30% by 2030. As of June 30, 2023, renewable energy, including hydroelectric power, accounted for approximately 23% of Mitsui's total power generating capacity of 11.1GW.

Power Generation Businesses

Please scroll horizontally to look at table below.

(As of June 30, 2023)

| Energy resources | Net generation capacity (Mitsui's share) (MW) * | Ratio | Target | ||

|---|---|---|---|---|---|

| Natural gas | 6,171 | 56% | Less than 70% | ||

| Coal | 2,048 | 18% | |||

| Oil | 296 | 3% | |||

| Renewable Energy | 2,561 | 23% | More than 30% | ||

| breakdown | Solar | 783 | |||

| Hydropower | 816 | ||||

| Wind | 940 | ||||

| Solar thermal | 15 | ||||

| Biomass | 5 | ||||

| Geothermal | 2 | ||||

| Total | 11,076 | 100% | 100% | ||

* Including assets under construction

Please refer to the link below for more information.

Investment in Mainstream Renewable Power, which Develops Renewable Energy Businesses Globally

- Infrastructure Projects Business Unit

We have invested in renewable energy company Mainstream Renewable Power Limited ("Mainstream") through its holding company Aker Horizons ASA ("Aker Horizons"), a Norwegian clean energy investor.

Mainstream is, as a developer of wind and solar assets, one of the leading companies in the renewable energy sector, in particular in Latin America and Africa. It has a successful track record of having developed 6.5 GW of generation capacity to financial close-ready stage, including offshore wind farms in UK. Currently, Mainstream has a portfolio of approximately 16.6 GW of high-quality energy assets in Latin America, Africa, and Asia-Pacific, which are currently operating, under-construction or in development phases. Mainstream recognizes energy transition as an opportunity to expand its global portfolio and aims to develop 25 GW of energy assets over the next 10 years.

Aker ASA, the owner of Aker Horizons, was founded in 1841 and is an industrial investment company, the second-largest oil & gas major in Norway. Aker ASA established Aker Horizons as its platform dedicated to investing in, incubating, and developing companies within renewable energy and decarbonization technologies. In addition to Mainstream, Aker Horizons owns Aker Carbon Capture (a CO2 capture and storage development company), Aker Clean Hydrogen (a clean hydrogen and ammonia development company), and Aker Offshore Wind (an offshore wind power development company).

We will contribute to the growth of Mainstream and the enhancement of its corporate value by utilizing our know-how in the construction and operation of large-scale power plants around the world and our global customer network. Through this investment, we will promote the development of renewable energy power sources with a sense of scale, further improve the quality of our power generation portfolio, and accelerate the reduction of GHG emissions in society through our operations.

Investment in India's Large-Scale Renewable Energy Business

- Infrastructure Projects Business Unit

Through our wholly-owned subsidiary MIT Power India, we have invested in the development of a large-scale renewable energy project promoted by ReNew Power Private Limited, the largest renewable energy company in India. The project will consist of three newly built wind farms in India (900 MW in total) and one solar power plant (400 MW plus a battery storage farm with a capacity of up to 100 MW). The project will provide 400 MW of electricity to Solar Energy Corporation of India Limited ("SECI"), an entity owned by the Indian Ministry of New & Renewable Energy, based on a 25-year power purchase agreement. While it is difficult for conventional renewable energy projects to commit stable electricity supply due to the intermittent nature of winds and solar irradiation, this Project commits electricity supply of 400 MW with high capacity factor on a round-the-clock basis from a portfolio consisting of multiple wind and solar plus battery storage farms. This is the first of its kind in India ("round-the-clock scheme"). The total cost of the project will be around US$1.35billion. The commercial operations are scheduled to start by August 2023. Mitsui will contribute to the project by using its accumulated knowledge of the electric power business in Japan and other countries to ensure steady progress toward completion and the smooth start-up of commercial operations.

India, the third-largest emitter of GHG, declared its commitment to cut its emissions to net-zero by 2070 at the 26th Conference of Parties ("COP26") held in November 2021 and announced that it will raise its non-fossil energy capacity to 500 GW by 2030. This round-the-clock scheme Project, enabling electricity supply with 100% renewables, is in line with the Indian Government's policy and is expected to play an important role in the future to replace coal-fired generation currently dominant in India. Renewable energy is a business field that is likely to continue to expand in India, where continuous growth in population and GDP is expected. Through this project, we will contribute to solving the power shortage in India and encourage decarbonization.

Alternative Fuels

Hydrogen Related

- Energy Solutions Business Unit

When hydrogen is consumed, it generates no greenhouse gases or environmentally harmful substances. Hydrogen is a focus of attention around the world as a clean fuel that does not generate an environmental burden. With our Energy Solutions Business Unit at the core, we are engaged in a cross-company collaboration utilizing the networks and knowledge of each business segment, working on our hydrogen business in a way that demonstrates our comprehensive strength. We regard the hydrogen business as an effective approach to achieve our net-zero emissions goal. We will work together with our stakeholders to build needed social infrastructure and create profitable businesses.

Development of Clean Hydrogen Production Technology

- Energy Solutions Business Unit

We have invested in EKONA Power Inc. of Canada, which has been developing a novel methane pyrolysis process for making clean hydrogen from natural gas.

Hydrogen will play a critical role in industrial decarbonization and has significant potential as a clean energy source, as hydrogen emits no CO2 when burned and can be used in power generation, mobility, and other industries. However, technical and economic challenges lie in clean H2 production such as CCS (Carbon dioxide capture and storage) needed for abating CO2 emitted from production process of hydrogen.

EKONA is developing a methane pyrolysis process, which enables the production of hydrogen and solid carbon from methane. This technology will achieve lower CO2 emissions in the production process, while curbing the production cost to the same level as other conventional hydrogen production technologies, such as a steam methane reforming. With this technology, the majority of carbon is generated in solid form, which eliminates the need for CCS. In addition, existing infrastructures for natural gas and LNG can be maintained, as natural gas is used as feed gas for this production process. Amid the rapid shift toward industrial decarbonization, we will explore a clean hydrogen business opportunity in Japan utilizing EKONA's technology.

* The method of producing hydrogen by of converting fossil fuels into gas through endothermic catalytic reaction and extracting hydrogen from the gas is called the "reforming method". In particular, the method to produce hydrogen by reforming methane is called the steam reforming method and has been widely used in industry. While the production cost is relatively low, the accompanying CO2 emissions are a challenge.

This technology can produce clean hydrogen by decomposing methane into hydrogen and solid carbon under high temperatures using a proprietary pyrolysis method that does not require any catalysts.

Green Hydrogen Production Business in Europe

- Performance Materials Business Unit

On April 2022, we invested 10 million euros (approximately ¥1.35 billion) in French company Lhyfe SA, which produces green hydrogen in Europe using renewable energy through a production process that emits zero CO2. Lhyfe was established in 2017 by former employees of the French Alternative Energies and Atomic Energy Commission (CEA), to reduce GHG emissions through the production of green hydrogen. Its first commercial plant, to produce renewable green hydrogen using power from wind turbines, was inaugurated in 2021. The company is already active in ten countries in Europe and has over 90 pipeline projects, with production start dates between 2022 and 2028. Lhyfe's target markets are mobility and industry usage.

Under its "Green Deal" policy, the European Union has set a target of achieving net zero emissions by 2050, as well as installation of 40 GW of renewable hydrogen electrolyzers by 2030. Systems are being designed and introduced to encourage the use of hydrogen. Through our participation in Lhyfe, which produces green hydrogen locally for local consumption, we will become an insider in the European hydrogen market and will contribute to the enhancement of Lhyfe's corporate value by developing customers and leveraging synergies with its existing hydrogen-related business. Furthermore, we will establish a hydrogen earnings base in Europe and contribute to the accelerated reduction of GHG emissions via the development of the green hydrogen industry there.

Green Hydrogen Refueling Station Business for Fuel Cell-Powered Heavy Vehicles in New Zealand

- Energy Solutions Business Unit

Based on a strategic alliance agreement that we concluded with Hiringa Energy Limited ("HE") in June 2020, we invested in Hiringa Refuelling New Zealand Limited (a subsidiary of HE) in September 2021 to develop a network of green hydrogen refueling stations for fuel cell-powered heavy vehicles in New Zealand.

New Zealand is blessed with an abundance of renewable energy sources ("renewables") that include hydropower, geothermal energy, and wind power. The New Zealand government aims to increase the proportion of electricity generated by renewables from the current 85% to 100% by 2030. While the GHG emissions ("emissions") from the country's power generation sector are limited, the emissions from the transportation sector are relatively high and likely to further increase.

In its initial stage, Hiringa Refuelling New Zealand Limited will set up hydrogen refueling stations in New Zealand's four transportation hub cities by the end of 2022, to supply green hydrogen derived from renewable energy to large vehicles that have high emission levels. Although large vehicles only account for around 4% of all road vehicles registered in New Zealand, the emissions of the road transportation sector, to which large vehicles belong, are responsible for about 40% of emissions. The aim is to significantly reduce these emissions. In the future, we aim to expand hydrogen supply bases and accelerate the reduction of emissions in New Zealand's transportation sector.

Through our initiatives with HE to realize a sustainable system of local hydrogen production for local consumption to help promote a hydrogen-based economy in New Zealand, we will take on the challenge of the green hydrogen business, which is one of the solutions to the urgent and complex global issue of responding to climate change.

Biofuels

Agricultural Biomass Supply Chain Management Business in India

- Energy Solutions Business Unit

In August 2021 we invested in Punjab Renewable Energy Systems Pvt. Ltd. ("PRESPL"), a biomass supply-chain management company in India.

India is one of the world's leading agricultural powers. One of the major causes of air pollution in India today is the practice of burning straw stubble and other agricultural residues left after crops have been harvested. To help address this problem, the Indian government has introduced policies to promote the effective utilization of non-edible resources such as biomass residue that does not compete with food. The biomass energy market in India is expected to further expand. Since its start in 2011, PRESPL has utilized the strong network that it has built up with local farmers. The company is expanding its operations in a range of businesses, from the collection and supply of agricultural biomass to the manufacture of briquettes from agricultural biomass and the supply of biomass fuels.

Through this investment, we will promote and enhance energy businesses in India that use agricultural biomass. Following this investment, we will use the synergies with our wide range of business assets to expand PRESPL's business and expand the biofuel business in India and around the world. This will help solve air pollution and other societal issues in India, and will also contribute to solving global issues such as global warming.

Fuel Ammonia

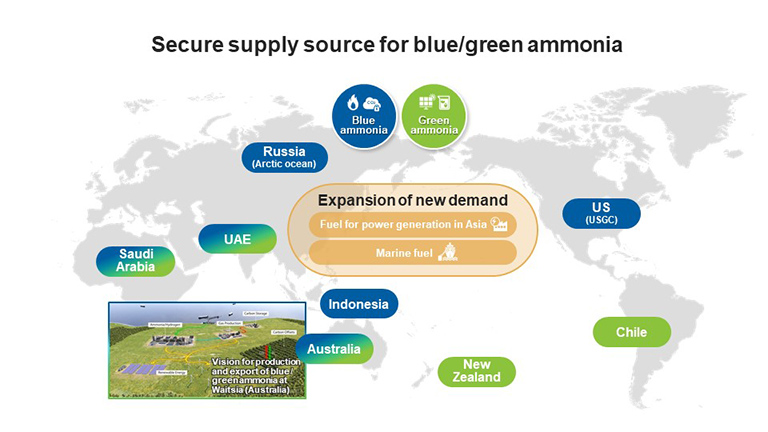

We will work to build value chains that leverage our strengths as a general trading company active across many industries. Examples of these strengths include our partnerships with host countries, our customer base that we have built up over many years, our marketing know-how, and our involvement in the Clean Fuel Ammonia Association.

Joint Feasibility Study for the Creation of a Supply Chain of CCS Clean Fuel Ammonia in Western Australia

- Energy Business Unit I

Mitsui & Co., Ltd. and Japan Oil, Gas and Metals National Corporation ("JOGMEC"), looking ahead to the commercialization of clean fuel ammonia production in Western Australia, reached an agreement in 2021 to conduct a joint feasibility study into carbon capture and storage (CCS). Our wholly-owned subsidiary Mitsui E&P Australia Pty. Ltd. ("MEPAU") concluded the agreement with JOGMEC.

In addition, MEPAU has also agreed with Wesfarmers Chemicals, Energy & Fertilisers Limited ("WesCEF") to jointly study the commercial and technical viability of building a low carbon ammonia production plant in Western Australia. The two companies exchanged memorandums of understanding.

MEPAU is developing the Waitsia gas field in Western Australia, in which it has a 50% working interest. MEPAU also holds a 100 percent working interest in depleted gas fields near the Waitsia gas field. By linking these two underground resources (natural gas production and CO2 storage) that are near to one another, we plan to not only be an operator of oil and gas production in Western Australia but also be involved in the production of clean fuel ammonia using our excellent gas assets and to export this fuel to Asia, including Japan.