For inquiries on this matter, please contact

- Mitsui & Co., Ltd.

Investor Relations Division - Contact form

- Mitsui & Co., Ltd.

Corporate Communications Division

Telephone: +81-80-5912-0321

Facsimile: +81-3-3285-9819 - Contact form

At a meeting held on April 26, 2019, the Board of Directors of Mitsui & Co., Ltd. (the "Company" or "Mitsui", Head Office: Tokyo, President and CEO: Tatsuo Yasunaga) resolved to revise the remuneration system for Directors and Audit & Supervisory Board Members by introducing a system of compensation involving the grant of share performance-linked restricted stock (hereinafter referred to as the "System"). This notice is intended to inform you that an item concerning the system will be submitted to the 100th Ordinary General Meeting of Shareholders, which will be held on June 20, 2019 (hereinafter referred to as the "General Meeting of Shareholders").

Details

The purpose of the System is to provide an additional incentive to directors other than external directors (hereinafter referred to as "Eligible Directors") to achieve sustaining growth in the Company's medium to long-term performance and corporate value, and to foster a heightened sense of shared value with shareholders, by paying remuneration consisting of the Company's ordinary shares to Eligible Directors (shares allocated under the System will be referred to below as the "Shares"). This new compensation system is a share performance-linked remuneration system, since the number of Shares held by Eligible Directors at the end of a certain period (hereinafter referred to as the "number of Shares after valuation") would vary based on a comparison of the growth rates of the Company's stock price and the Tokyo Stock Price Index (TOPIX) over a specified period. By taking into account not only movements in the Company's stock price, but also the performance of the Company's stock compared with the stock market as a whole, the System is intended to give the Eligible Directors a heightened awareness of the need to improve the Company's corporate value by amounts greater than the growth of the stock market.

Under the System, Eligible Directors would be granted an entitlement to receive monetary remuneration and will be issued Shares in exchange for the in-kind investment of their full entitlement. The introduction of the System is conditional on approval for the payment of entitlements to monetary remuneration by shareholders at the General Meeting of Shareholders.

Compensation for Eligible Directors currently consists of (1) basic fixed remuneration, (2) results-linked bonuses based on the Company's key performance indicators, and (3) stock-based compensation stock options with stock price conditions as medium to long-term incentive compensation. The maximum limits are ¥1 billion per year for basic remuneration (based on a resolution of the Ordinary General Meeting of Shareholders held on June 21, 2017), ¥700 million per year for bonuses (based on a resolution of the Ordinary General Meeting of Shareholders held on June 21, 2017), and ¥500 million for stock-based compensation stock options with stock price conditions, which are provided under a separate allocation from Items (1) and (2) above (based on a resolution of the Ordinary General Meeting of Shareholders held on June 20, 2014). We plan to seek shareholder approval at the General Meeting of Shareholders for the abolition of stock-based compensation stock options with stock price conditions, as described in Item (3) above (excluding stock options that have already been granted), and for this to be replaced with the System, and for the maximum limit for remuneration under the System to be set at ¥500 million per year. If this approval is granted, we would thereafter cease issuing stock options as remuneration for directors.

The maximum limit for the total amount of the entitlement to receive monetary remuneration that would be paid to Eligible Directors under the System would be ¥500 million per year as a separate allocation from Items (1) and (2) above. The specific time for, and amount of, payments to Eligible Directors would be decided by the Board of Directors in consideration of deliberations by the Remuneration Committee, which is chaired by an External (Independent) Director and functions as an advisory body for the Board of Directors.

The total number of ordinary shares that would be newly issued or disposed of by the Company under the System would be no more than 500,000 per year (however, this number may be changed within reasonable limits if the Company's ordinary shares are affected by a stock split (including a free allotment of new ordinary shares in the Company) or a reverse stock split with an effective date after the date of the resolution by the General Meeting of Shareholders, or if other circumstances arise that require adjustments to the total number of the Company's ordinary shares that are issued or disposed of as restricted shares). The paid-in amount per Share will be decided by the Board of Directors based on the average daily closing price for the Company's ordinary shares on the Tokyo Stock Exchange (excluding days on which there is no closing price, the price will be rounded up to the nearest whole yen) in the three months immediately prior to the month containing the date on which the Board of Directors made a resolution concerning issuance or disposal of the shares (hereinafter referred to as the "date of the Board of Directors' resolution"), within a range that is not especially advantageous to the Eligible Directors.

The issuance of Shares under the System is conditional on the entry into between the Company and the Eligible Directors of allocation agreements for the granting of the Shares (hereinafter referred to as the "Allocation Agreements"). To ensure that Eligible Directors would not be able to transfer, pawn, or otherwise dispose of the Shares during the period of transfer restriction stipulated in Item 3.(2) below, the Shares will be managed in dedicated accounts established with a securities company nominated by the Company.

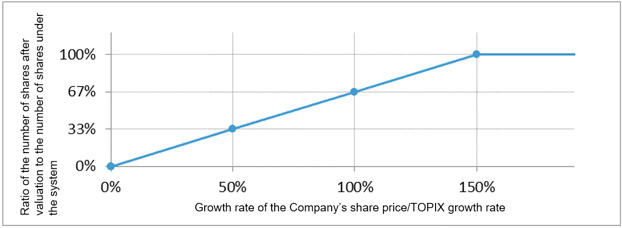

If the growth rate of the Company's share price in the three years after the date of the Board of Directors' resolution (if an Eligible Director retires as a director or managing officer of the Company before the elapse of three years, the period up to the date of retirement, referred to hereinafter as the "Valuation Period") is equal to or greater than 150% of the growth rate of the TOPIX, the entire number of Shares will be deemed to be the number after valuation. If the growth rate of the Company's share price is lower than 150% of the TOPIX growth rate, the number of Shares after valuation will be a percentage calculated using the formula in the attachment entitled "Details of Share Performance Linkage Conditions". The remainder of the Shares will be acquired by the Company without compensation at the end of the Valuation Period.

The Eligible Directors will be unable to transfer, pawn, or otherwise dispose of the Shares (hereinafter referred to as "Restriction on Disposal") for a period of 30 years from the pay-in date (hereinafter referred to as the "Restriction on Transfer Period").

Irrespective of the provisions of (2) above, the Restriction on Disposal will be lifted if an Eligible Director retires as a director or managing officer of the Company before the end of the Restriction on Transfer Period.

In addition to the condition that there will be an acquisition without compensation under the conditions for linkage to the share performance in (1) above, the Company will acquire all or part of the Shares during the Restriction on Transfer Period if an Eligible Director engages in actions that contravene laws and regulations, or on other grounds as stipulated in the Allocation Agreement.

Irrespective of the provisions of (2) above, the Company would make reasonable adjustments to the number of Shares to be acquired without compensation or the time when the Restriction on Disposal will be lifted, by resolution of the Board of Directors, if the Company enters into a merger agreement resulting in the absorption of the Company, or a share swap agreement or share transfer plan under which the Company becomes a wholly owned subsidiary, or otherwise undertakes organizational restructuring, etc., during the Restriction on Transfer Period, pursuant to a resolution of a General Meeting of Shareholders (or a resolution of the Board of Directors in the case of a matter for which a resolution of a General Meeting of Shareholders is not required).

Based on resolutions of the Board of Directors, following the introduction of the System, we also plan to pay compensation for the stocked-indexed restricted shares to managing officers who are not also serving as directors, on the same basis as payments to Eligible Directors under the System (non-residents of Japan will receive monetary remuneration linked to the share price under conditions equivalent or similar to the system, mutatis mutandis). For this reason, stock-based compensation stock options with stock price conditions will also be abolished for managing officers who are not also serving as directors. Thereafter, no new stock options will be issued as remuneration for managing officers, except for the residual portion of options granted to managing officers serving overseas.

(1) If the growth rate of the Company's share price(*1) is equal to or greater than 150% of the growth rate of the Tokyo Stock Price Index (TOPIX)(*2), the number after valuation will be deemed to be the entire number of Shares issued(*3).

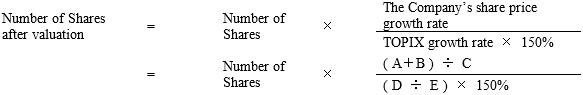

(2) If the growth rate of the Company's share price is lower than 150% of the TOPIX growth rate, the number of Shares after valuation will be a number calculated using the following formula, and the remainder of the Shares will be acquired by the Company without compensation at the end of the valuation period.

(*1) This is the growth rate of the Company's share price during a valuation period defined as three years from the date of the Board of Directors' resolution (or the period to the date of retirement if an Eligible Director retires from their role as a director or managing officer of the Company before the elapse of three years. The same applies to (*2)). The growth rate will be specifically calculated as follows:

A: The average closing price of the Company's stock on the Tokyo Stock Exchange during the three months immediately prior to the month in which the final day of the valuation period falls

B: The total dividend per share for the Company's ordinary shares during the valuation period

C: The average closing price of the Company's stock on the Tokyo Stock Exchange during the three months immediately prior to the month in which the date of the Board of Directors' resolution falls

Growth rate of the Company's share price = (A+B) / C

(*2) This is the growth rate of the TOPIX during a period of three years from the date of the Board of Directors' resolution. It will be specifically calculated using the following formula.

D: The average TOPIX closing price on the Tokyo Stock Exchange during the three months immediately prior to the month in which the final day of the valuation period falls

E: The average TOPIX closing price on the Tokyo Stock Exchange during the three months immediately prior to the month in which the date of the Board of Directors' resolution falls

TOPIX growth rate = D/E

(*3) Number of Shares = Entitlement to monetary compensation determined according to rank / Paid-in amount per Share