For inquiries on this matter, please contact

- Mitsui & Co., Ltd.

Investor Relations Division - Contact form

- Mitsui & Co., Ltd.

Corporate Communications Division

Telephone: +81-80-5912-0321

Facsimile: +81-3-3285-9819 - Contact form

Mitsui & Co., Ltd. ("Mitsui", Head Office: Tokyo, President & CEO: Masami Iijima), has agreed with Vale S.A. ("Vale"), a global mining company, to participate in integrated logistics business in Brazil ("Business") and signed an agreement on September 18 Brazilian time.

VLI S.A. ("VLI"), which conducts the Business currently as a 100% subsidiary of Vale, will allocate new shares worth BRL2 billion (JPY88 billion) to Mitsui and FI-FGTS, an investment fund managed by a Brazilian state-run bank Caixa Econômica Federal. Mitsui will acquire 20% equity of VLI for BRL1,509 million (JPY66 billion) by subscribing new shares amounting to BRL 800 million and by purchasing outstanding shares for BRL 709 million from Vale. The final transaction values are subject to certain adjustment in accordance with the terms and conditions of the agreement. Meanwhile, FI-FGTS will acquire 15.9% equity of VLI by subscribing the remaining new shares through the capital increase. Closing of Mitsui's acquisition is expected to occur by the end of 2013, upon satisfaction of certain conditions, including obtaining approvals from Brazilian regulatory authorities.

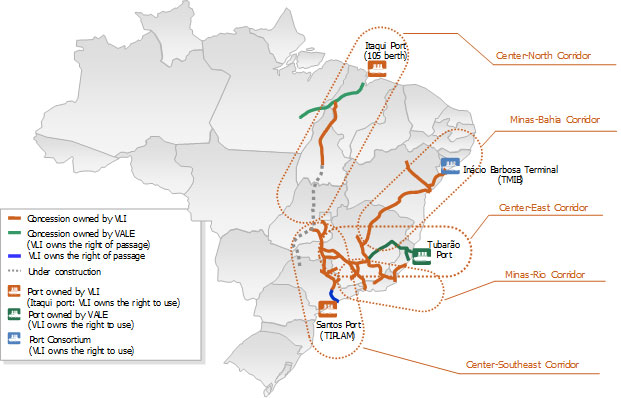

VLI provides integrated logistics services for general cargo such as grains, fertilizers and steel materials and products, in central and northern Brazil, by utilizing its railway network of approximately 10,700 kilometers which is connected to several port terminals. VLI aims to double its cargo handling volume by newly investing approximately BRL9 billion (JPY396 billion) in the coming 5 years in locomotives, wagons, rail network, and port terminal capacity. The capital expenditure will be financed by the BRL2 billion capital increase, operating cash flow and debt.

Mitsui is currently engaged in locomotives & wagons leasing businesses and logistics management and maintenance service in Brazil, US, Europe and Russia. Mitsui also globally operates port terminal business. Through the participation in the Business, Mitsui intends to strengthen its partnership with Vale, in conjunction with their existing strategic alliance agreement, and to create synergy in other business fields in Brazil, such as the agricultural production and grain distribution.

It is expected that cargo volume in Brazil will continue to increase, as Brazil is one of the few countries that can meet the expected growth in demand for grains caused by the growing world population. Another driver is the strong demand for steel-related cargo for domestic construction enhanced by infrastructure investment projects of the Brazilian government. On the other hand, high logistics costs have become a serious problem in Brazil, mainly caused by immature railway network inducing excessive dependency on trucks, and by lack of port terminal capacity. Mitsui, through cooperation with Vale and FI-FGTS in this Business, will continue its efforts to contribute to the development of efficient logistics infrastructure and optimization of railway transportation in order to reduce logistics costs and environmental load, consequently supporting the economic and social development of Brazil.

| Corporate Name | VLI S.A. |

|---|---|

| Shareholders | Mitsui 20%, FI-FGTS 15.9% and Vale 64.1% |

| Headquarter Location | Sao Paulo, Brazil |

| Representative | Marcello Spinelli, CEO |

| Main Business | Integrated logistics services for general cargo |

| Establishment | December, 2010 |

| Total Asset (FY 2012) | Approximately BRL6 billion |

| Corporate Name | Vale S.A. |

|---|---|

| Headquarter Location | Rio de Janeiro, Brazil |

| Representative | Murilo Ferreira, CEO |

| Main Business | Production and sales of iron ore, nickel, copper, fertilizer materials, and coal |

| Establishment | June, 1942 |

| Name | Fundo de Investimento do Fundo de Garantia do Tempo de Serviço |

|---|---|

| Fund Manager | Caixa Econômica Federal (100% owned by Brazillian Finance Ministry) |

| Establishment | July, 2008 |

| Total Asset (FY2012) | Approximately BRL26.5 billion |

Notice:

This announcement contains forward-looking statements. These forward-looking statements are based on Mitsui's current assumptions, expectations and beliefs in light of the information currently possessed by it and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause Mitsui's actual results, financial position or cash flows to be materially different from any future results, financial position or cash flows expressed or implied by these forward-looking statements. These risks, uncertainties and other factors referred to above include, but are not limited to, those contained in Mitsui's latest Annual Securities Report and Quarterly Securities Report, and Mitsui undertakes no obligation to publicly update or revise any forward-looking statements.

This announcement is published in order to publicly announce specific facts stated above, and does not constitute a solicitation of investments or any similar act inside or outside of Japan, regarding the shares, bonds or other securities issued by us.