Medium-term Management Plan 2026

Creating Sustainable Futures IR Meeting

on May 9, 2023

Review of Medium-term Management Plan(MTMP) 2023

Hori, CEO (Hori) : Good morning, thank you for joining us today. I am Kenichi Hori, CEO. I would like to present the details of our Medium-term Management Plan 2026.

Today, I will begin with a review of the previous Medium-term Management Plan and then address the new Medium-term Management Plan with the theme of “Creating Sustainable Futures”, and will go over what we are aiming to achieve over the three-year term, as well as the strategies regarding this.

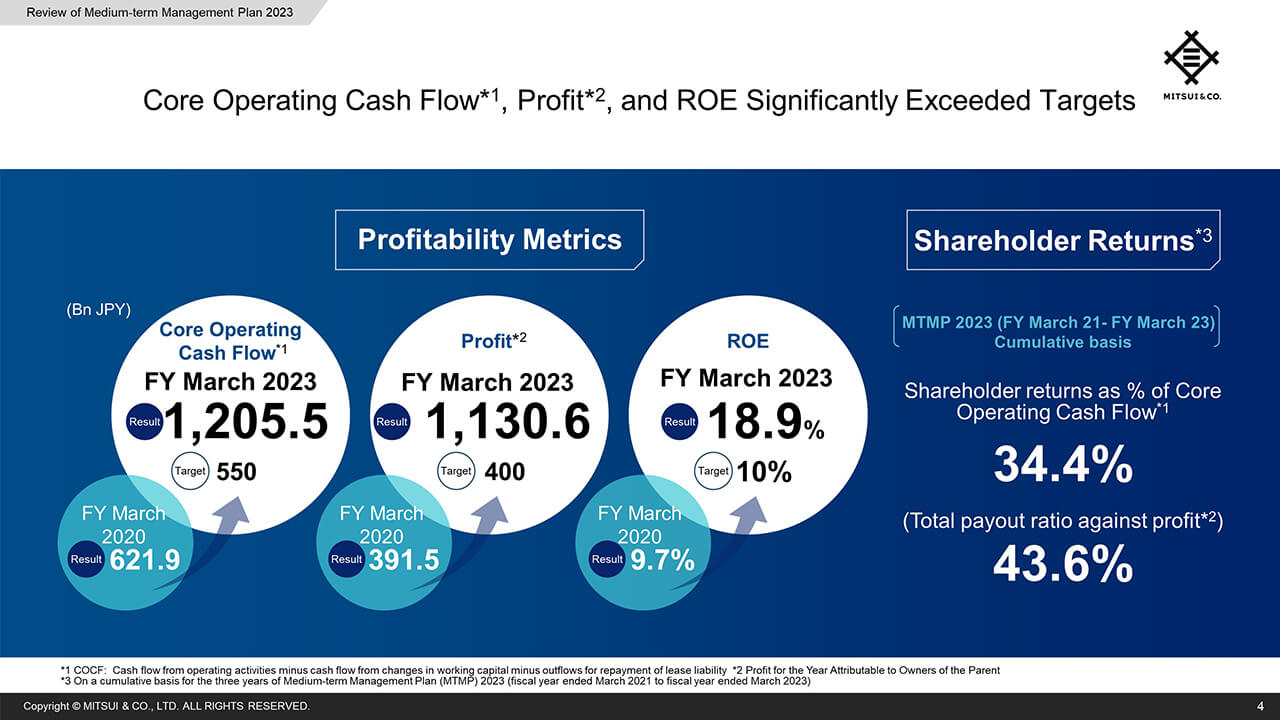

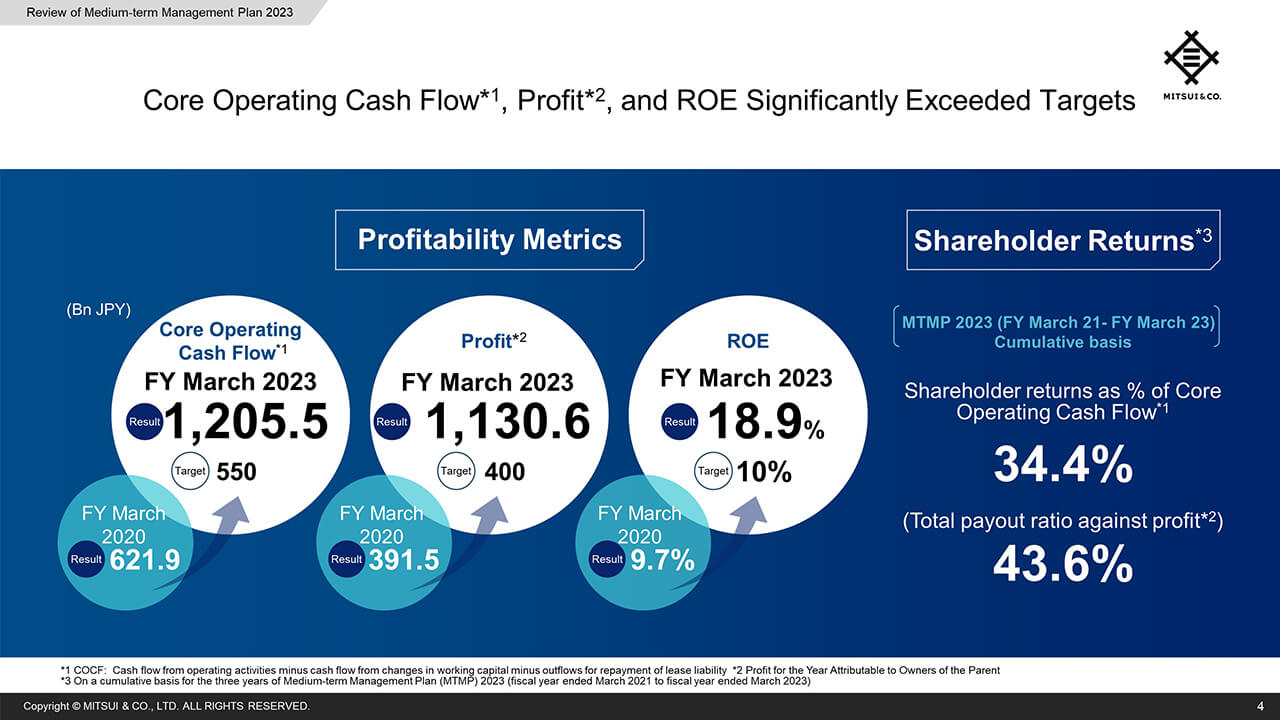

The period covered by the previous Medium-term Management Plan, or MTMP, was a period in which the companies’ ability to respond to significant changes in the environment was tested. Under these conditions, Mitsui posted Core Operating Cash Flow of 1 trillion 205.5 billion yen and profit of 1 trillion 130.6 billion yen, both hitting record levels, while ROE reached 18.9%.

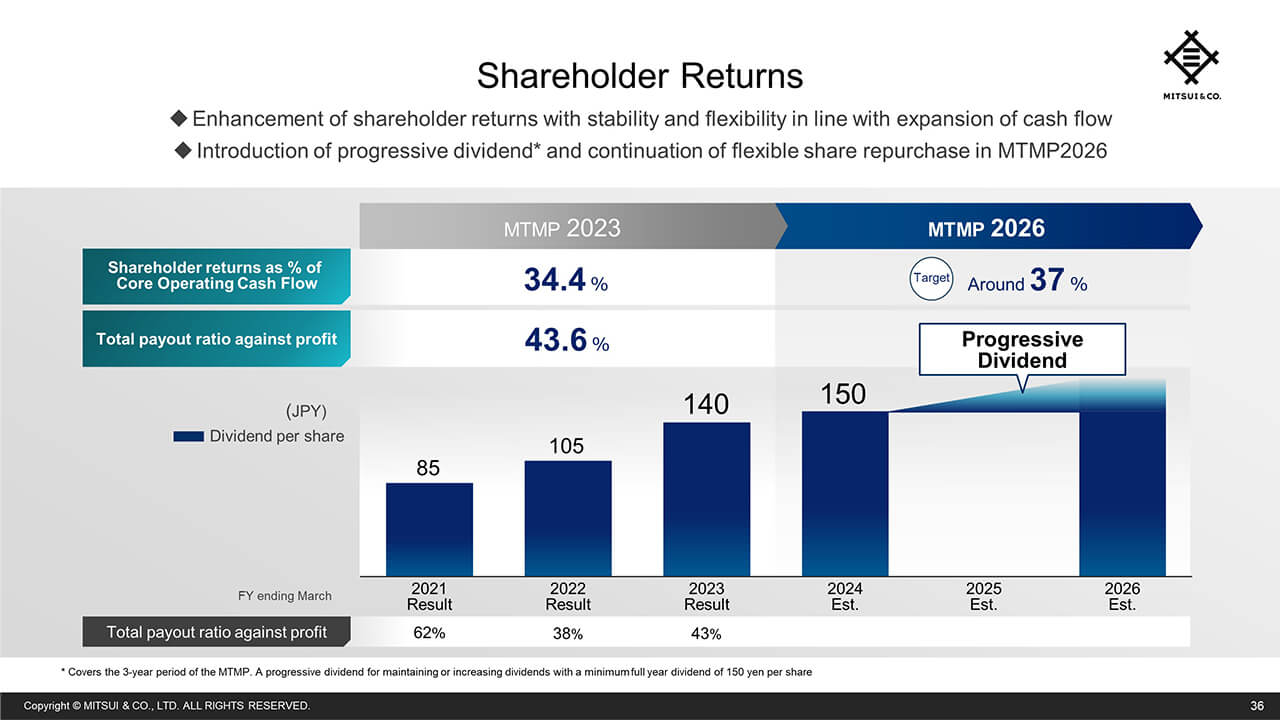

Shareholder returns as a percentage of Core Operating Cash Flow over the three-year period was 34.4%, exceeding our target of 33%. When calculated against profit, the total payout ratio was 43.6%.

Review of MTMP2023: Robust Cash Flow

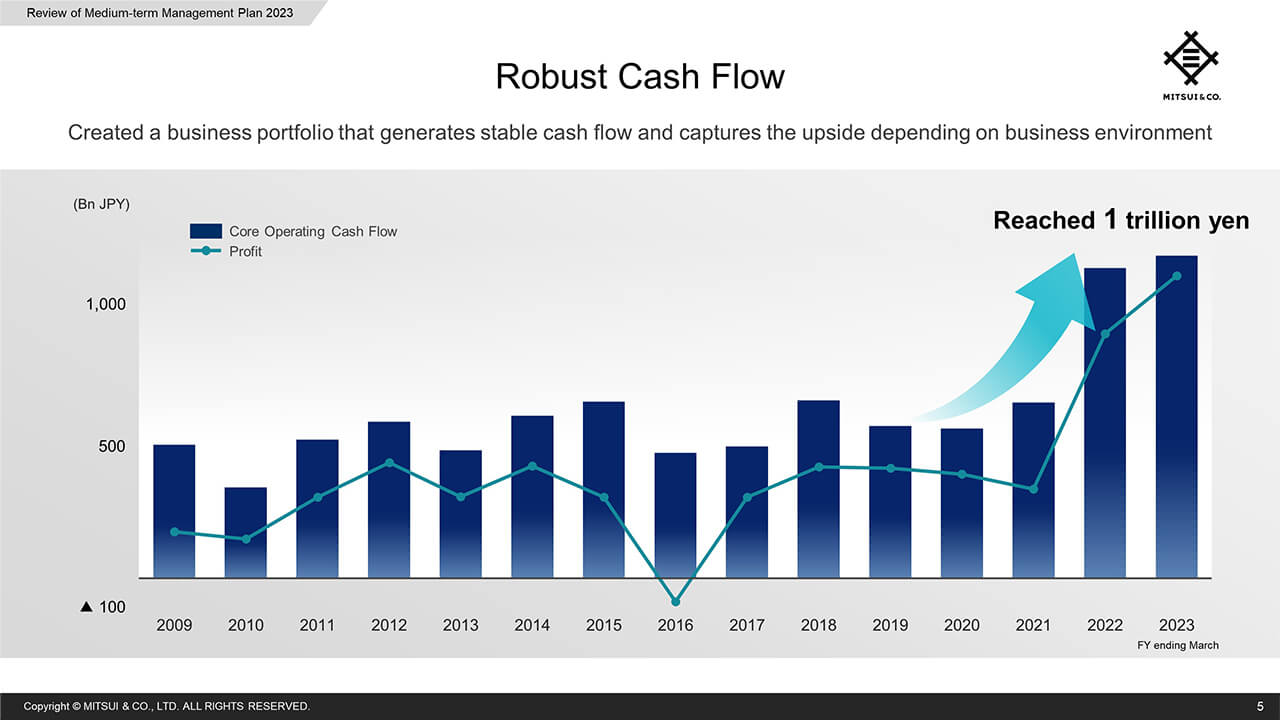

I will now reflect on Mitsui’s earning power over the last 15 years, starting from FY March 2009, when the Global Financial Crisis occurred. In FY March 2016, commodity prices plunged. I think you can see that we have been able to stably generate Core Operating Cash Flow which forms the base for future growth investment and shareholder returns, even in situations such as these.

Furthermore, by reducing costs in each business and making rearrangements in our portfolio, we have been able to build a strong business portfolio that can securely capture the upside of the changing business environment. This led to increases in Core Operating Cash Flow and profit, both of which reached over 1 trillion yen in FY March 2023.

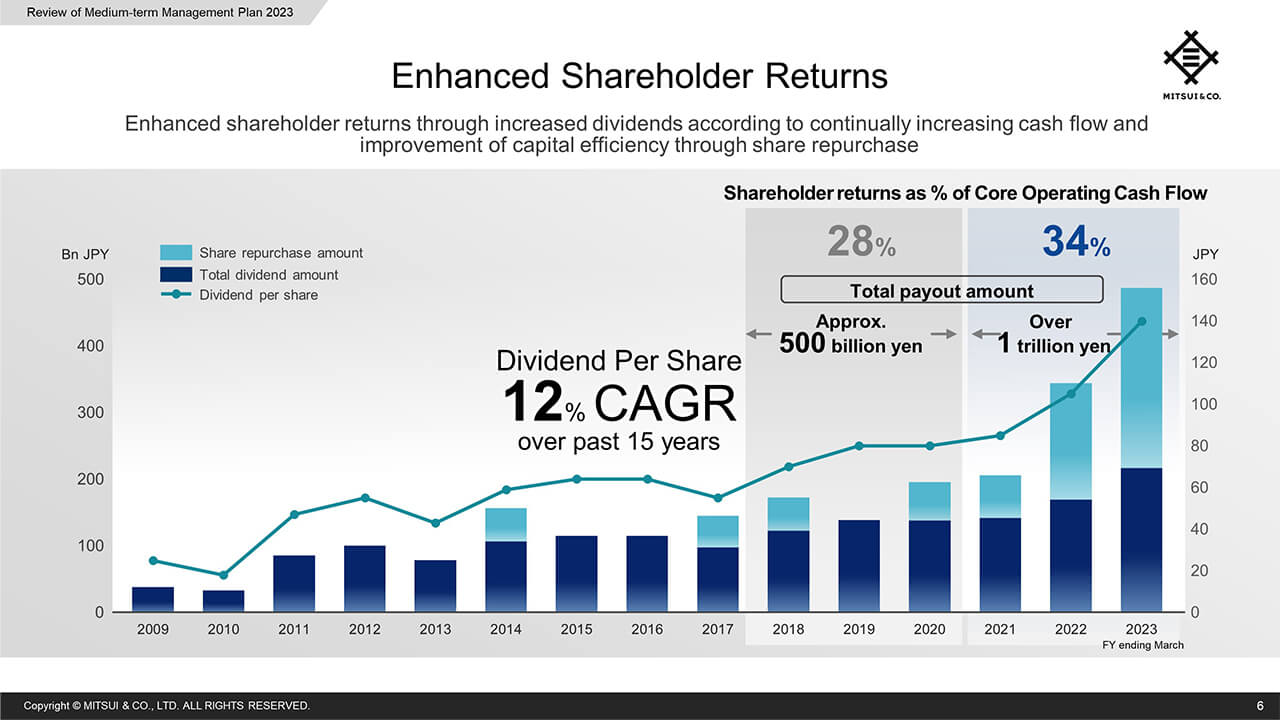

Review of MTMP 2023: Enhanced Shareholder Returns

Mitsui has expanded shareholder returns by increasing dividends in line with the continuous increase in cash flow, and increasing capital efficiency through share repurchases since FY March 2014. As a result, shareholder returns as a percentage of Core Operating Cash Flow over the three years of the previous MTMP was 34%, cumulative total payout exceeded 1 trillion yen, and dividend per share increased by 12% annually over the past 15 years, reaching 140 yen per share in FY March 2023, 5 yen raise from previous forecast.

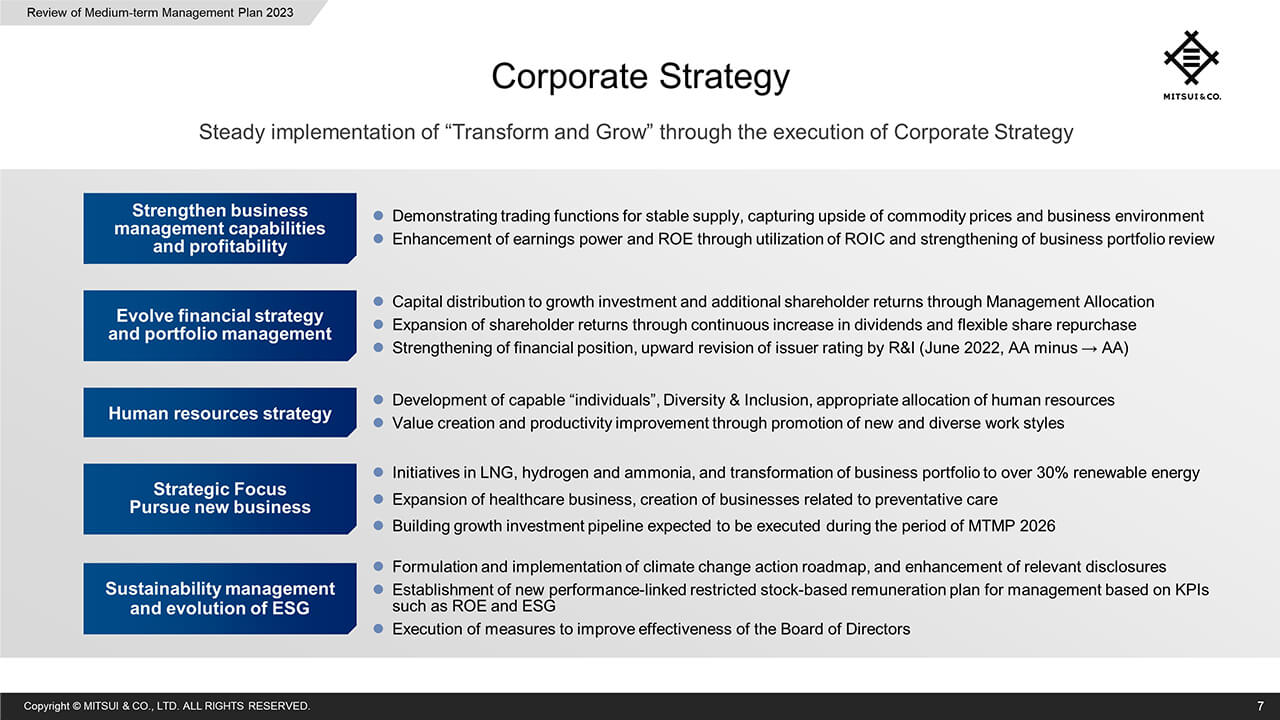

Review of MTMP 2023: Corporate Strategy

When we look at the previous MTMP from a qualitative perspective, Mitsui has increased its ability to generate cash and shareholder returns as mentioned earlier, by steadily promoting “Transform & Grow” through the execution of our Corporate Strategy as shown here.

Theme of MTMP 2026

I will now outline our new MTMP.

The theme of the new MTMP is “Creating Sustainable Futures.” Mitsui aims to create strong business clusters and new industries by placing sustainability at the center of management, unearthing social challenges in all industries from the perspective of global sustainability, and using that as a foundation for creating new business innovation.

MTMP 2026: Recognition Towards 2026

The theme of “Creating Sustainable Futures” was established based on key environmental recognition on the largest of scales: our planet. We will raise the stakes of our achievements in the previous MTMP, and press ahead with further transformation and growth.

MTMP 2026: Quantitative Targets

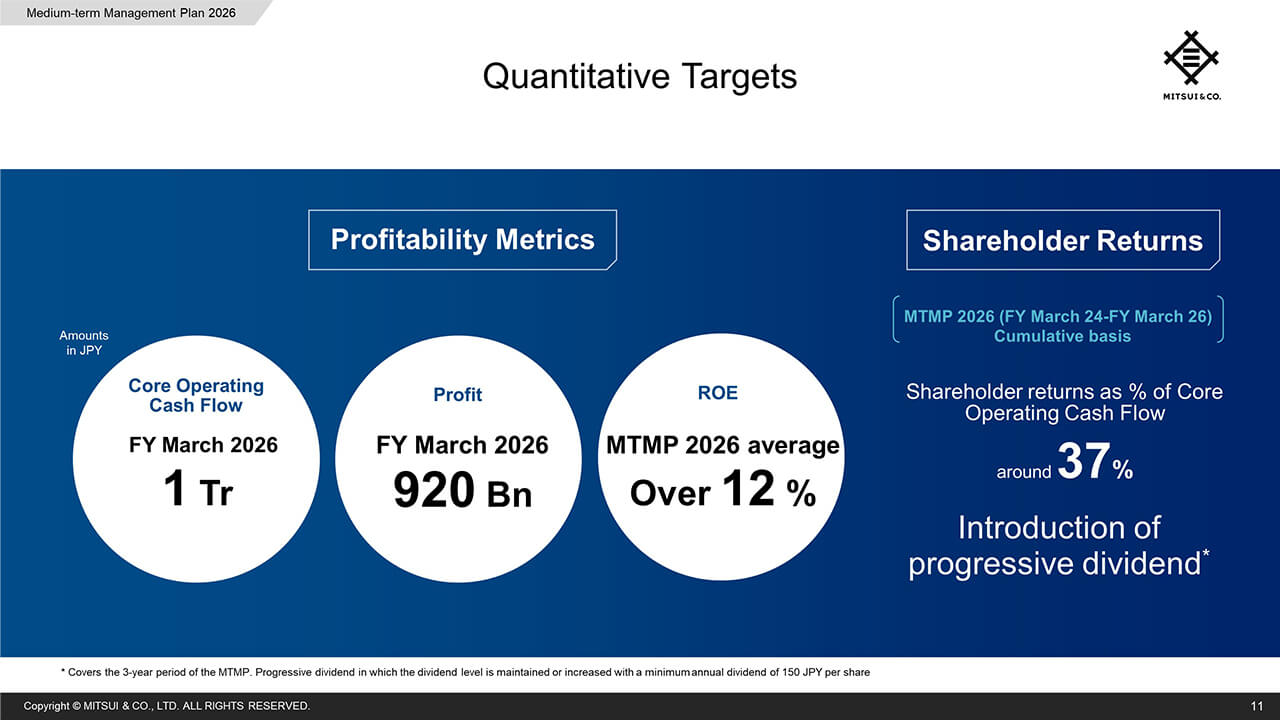

Next, I will explain our quantitative targets of the new MTMP.

The Core Operating Cash Flow and profit illustrated here are the quantitative targets for FY March 2026, which is the final year of the new MTMP. We will aim for 1 trillion yen in Core Operating Cash Flow, and 920 billion yen in profit. In addition, we will aim for ROE averaging over 12% for the three years of the MTMP.

Also, to further expand shareholder returns, we will target raising the level of shareholder returns as a percentage of Core Operating Cash Flow to around 37% for the three cumulative years of the MTMP. We will newly introduce a progressive dividend with a minimum annual dividend of 150 yen per share in FY March 2024, 10 yen increase from FY March 2023.

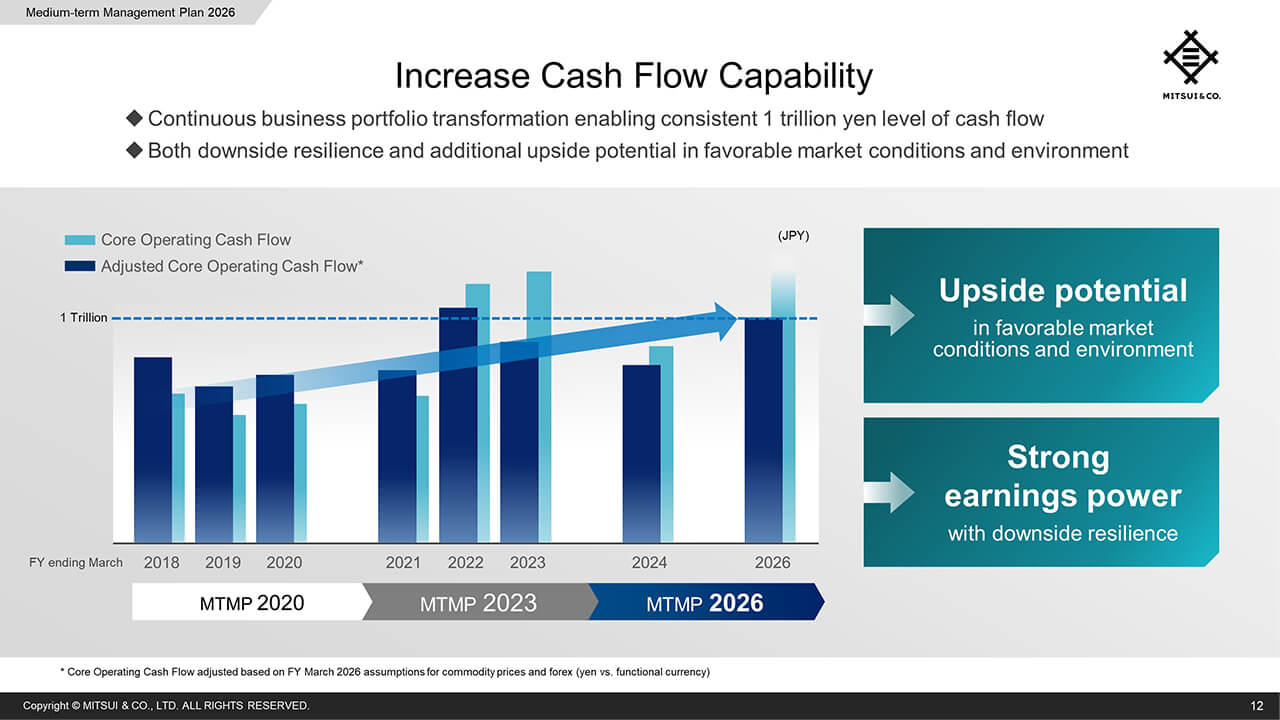

MTMP 2026: Increase Cash Flow Capability

This graph shows the cash flow trend of “adjusted” Core Operating Cash Flow based on commodity prices and foreign exchange assumptions for FY March 2026.

Through continuous transformation of the business portfolio, we have shown resilience to downward pressure in our ability to generate cash flow even in the COVID-19 environment, and have also captured pent-up demand in the recovery period from COVID-19 to achieving significant growth. You should be able to see that our business portfolio has both downside resilience and the ability to capture upside potential depending on the business environment.

From FY March 2024, we have assumed that commodity prices will revert, but even in such an environment, we are projecting a stable Core Operating Cash Flow of around 1 trillion yen in FY March 2026 onwards. Also, it is possible that we will capture further upside depending on the business environment.

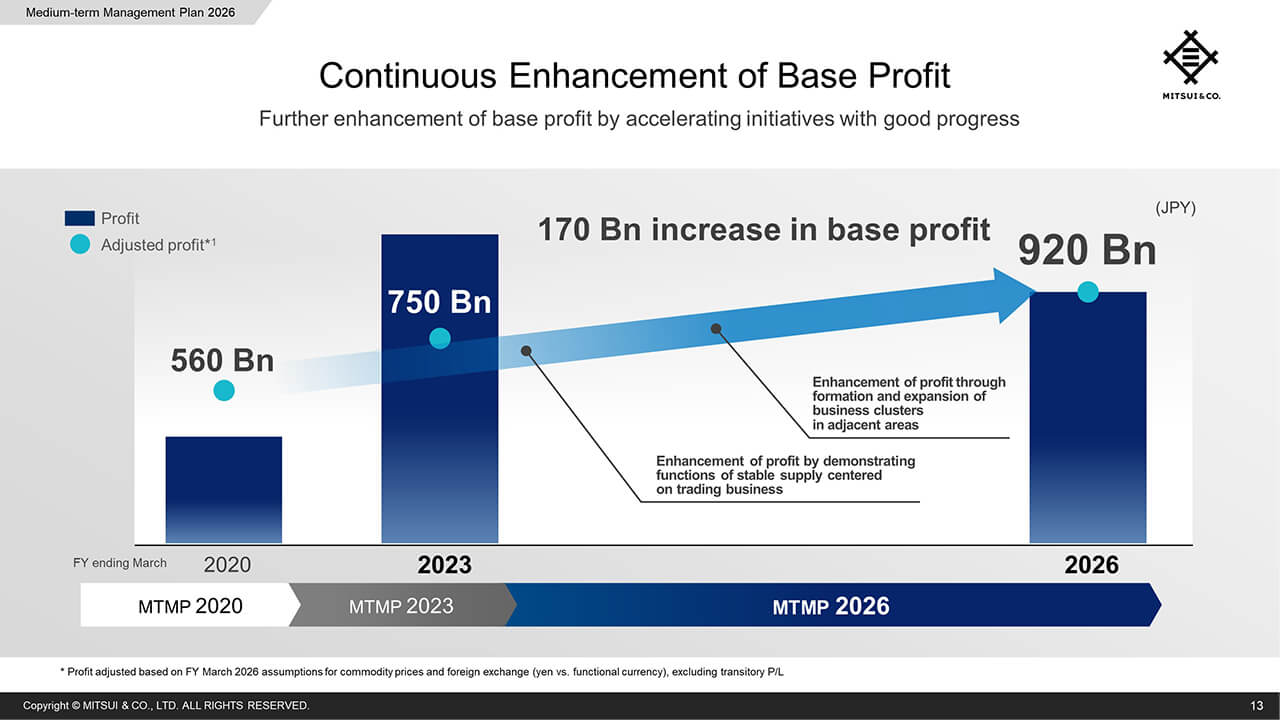

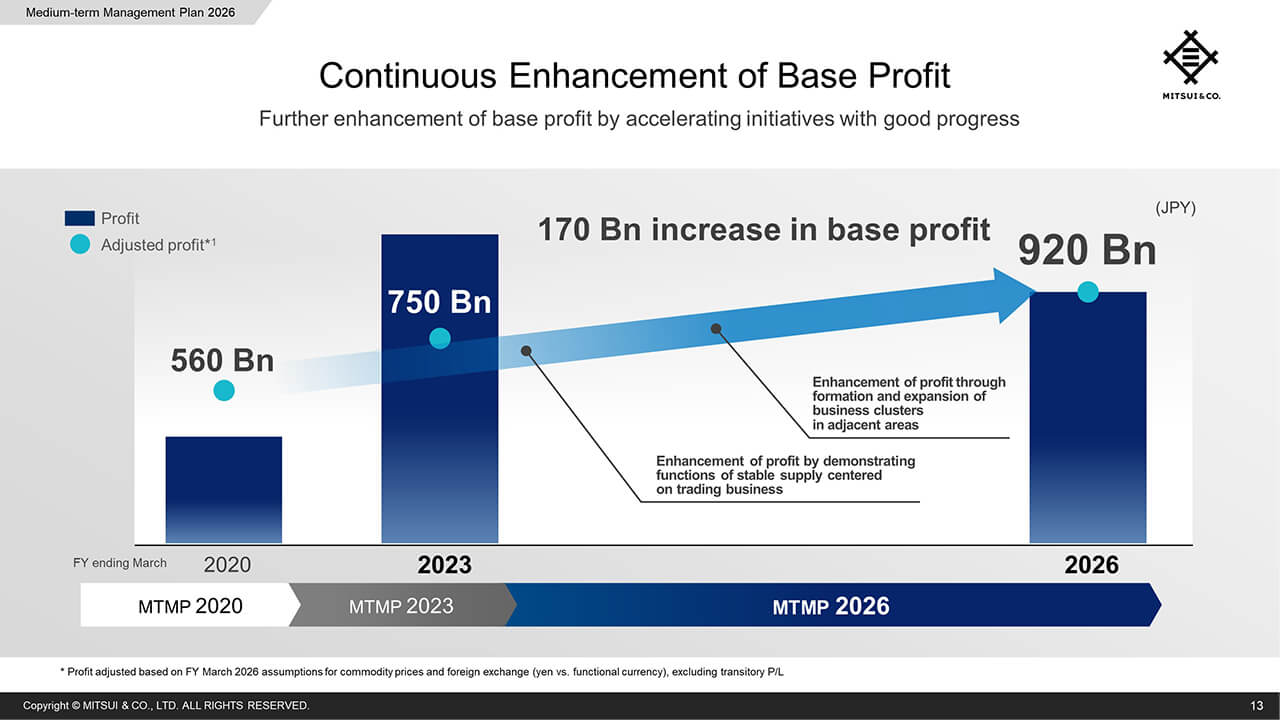

MTMP 2026: Continued Enhancement of Base Profit

This graph shows the base profit that excludes one-time factors and adjusts for commodity prices and foreign exchange set at the levels we expect them to be in FY March 2026. With these assumptions, base profit in FY March 2020 and FY March 2023, are calculated as 560 billion and 750 billion yen respectively.

In the previous MTMP, we have enhanced our base profit through our stable supply function including trading and the expansion of business clusters in adjacent areas. Our intention is to increase the base profit by 170 billion yen to 920 billion yen in FY March 2026, by accelerating the initiatives that showed material achievement in the previous MTMP.

MTMP 2026: Corporate Strategies and Key Strategic Initiatives

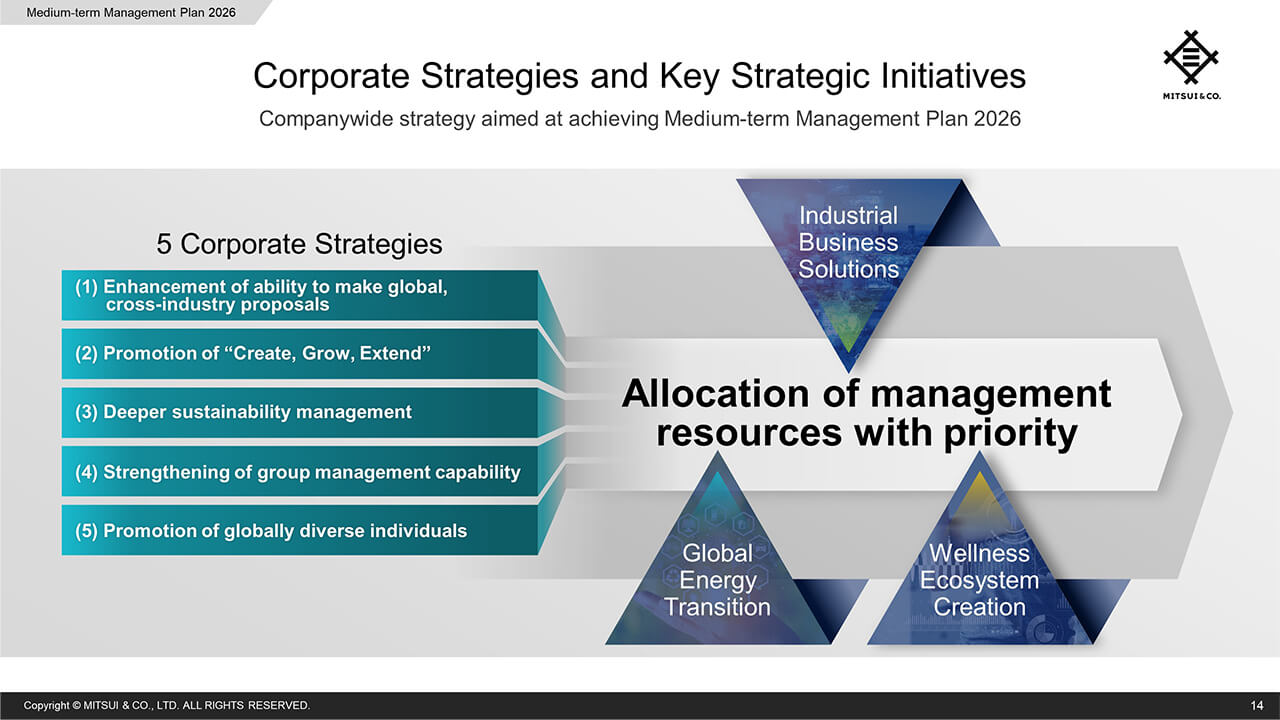

Next I will explain the strategies we will employ to address our theme of “Creating Sustainable Futures,” laid out in the new MTMP.

We have newly established five companywide corporate strategies and three Key Strategic Initiatives for the allocation of management resources with priority.

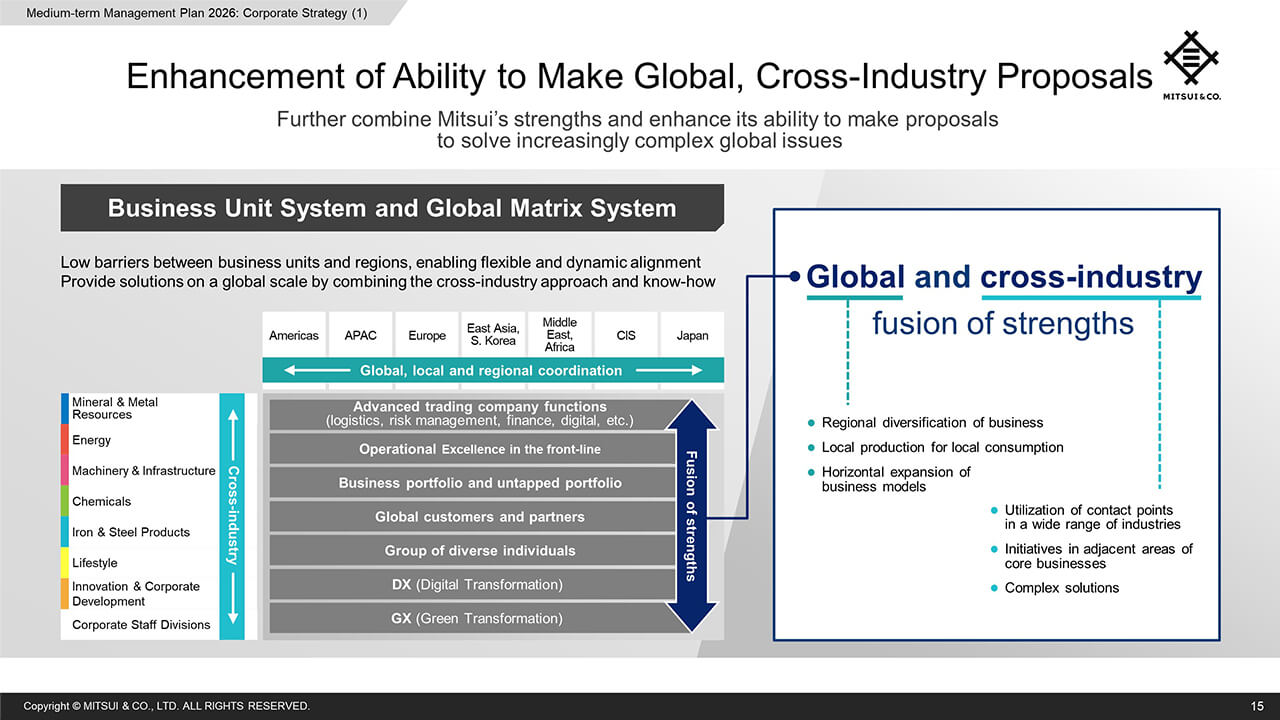

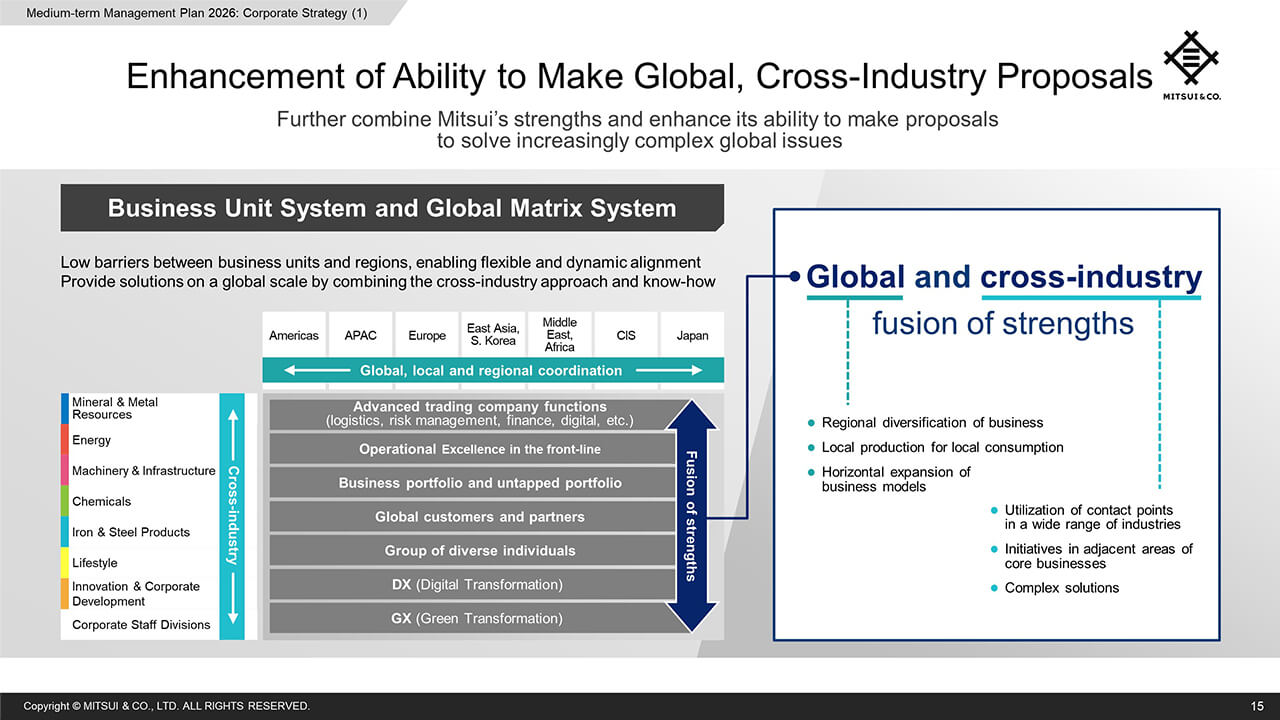

Corporate Strategy (1): Enhancement of ability to make global, cross-industry proposals

The first corporate strategy is enhancement of the ability to make global, cross-industry proposals. Cross-industry approach in a global scale is essential in providing solutions to increasingly complex global issues.

Mitsui’s Business Unit System and Global Matrix System has the strength of low barriers between Business Units and regions enabling flexible and dynamic coordination. By utilizing this, it is possible to combine Mitsui’s functional strengths globally and across industries to enhance our ability to offer the most optimal solution at the time in response to increasingly complex social issues.

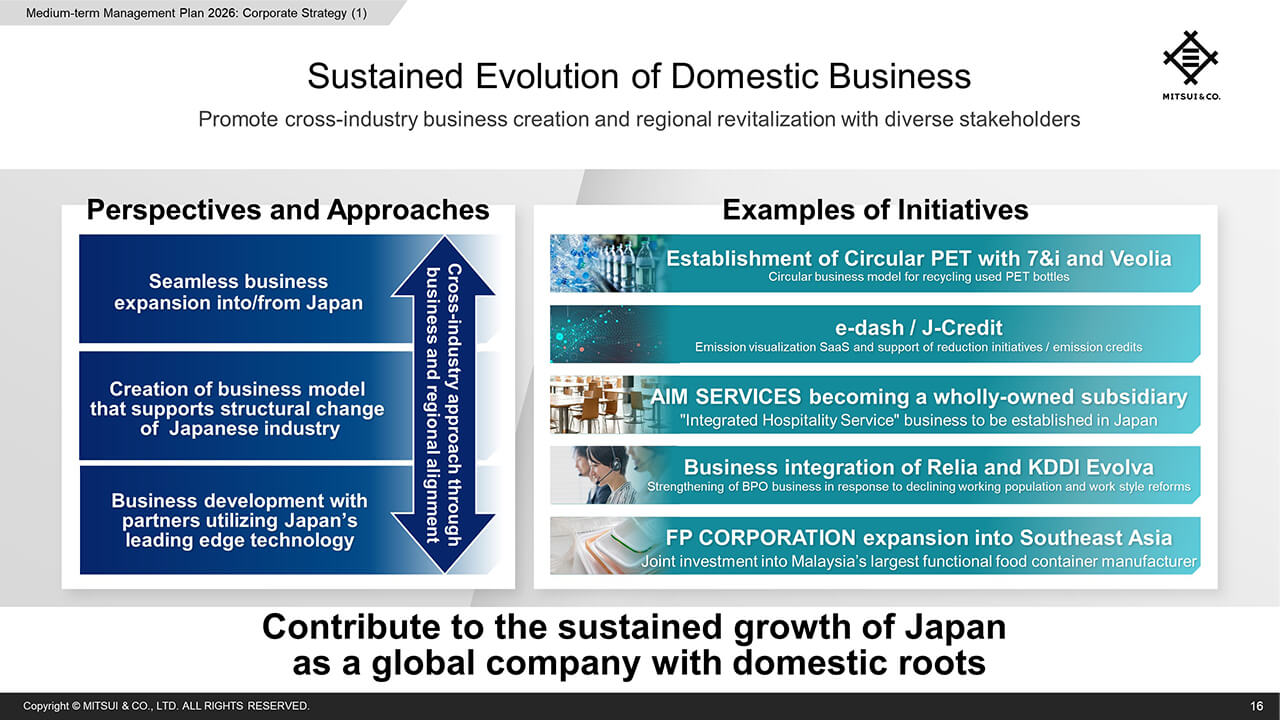

Sustained Evolution of Domestic Business

I will explain our approach in the domestic business.

We view the structural changes in Japanese industry to be a business opportunity, and will contribute to the sustained growth of Japan as a global company with our roots here by creating cross-industry businesses together with diverse stakeholders.

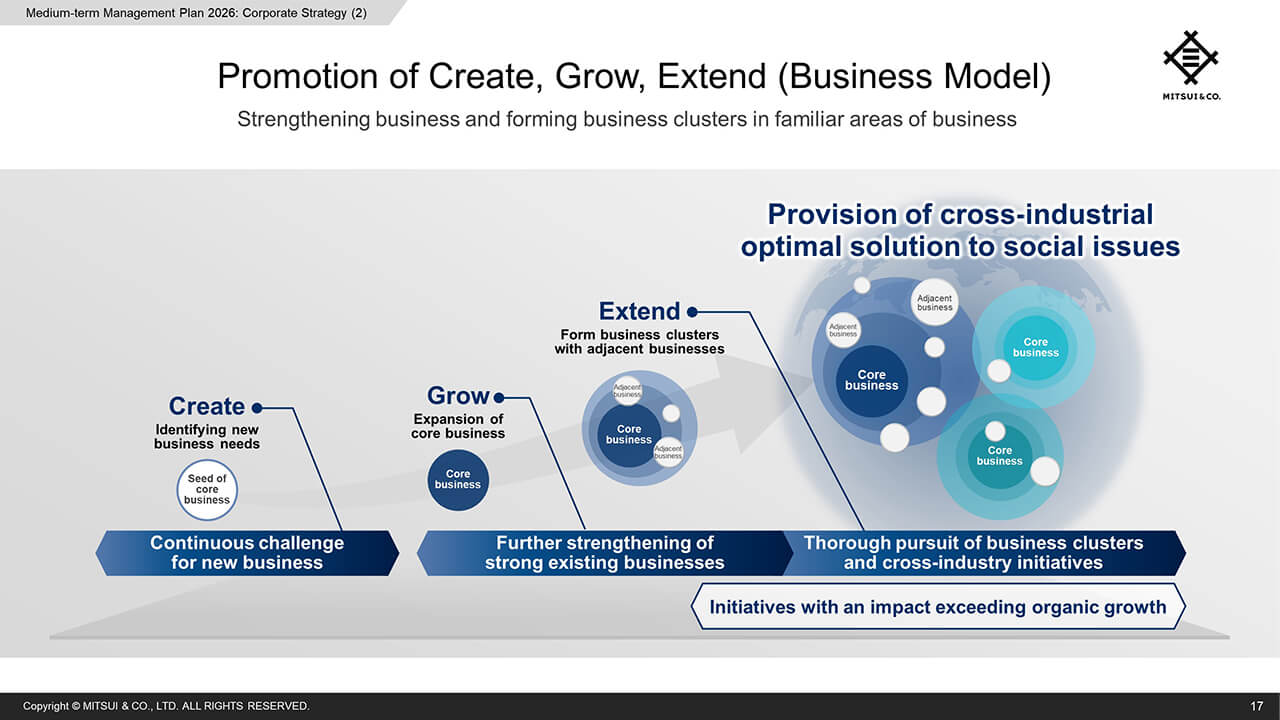

Corporate Strategy (2) Promotion of Create, Grow, Extend (Business Model)

The second corporate strategy is the promotion of our business model. Our intention is to drive forward our business model of “Create” “Grow” and “Extend” which is unique to Mitsui, and form cross-industry business clusters, by combining our core and the adjacent businesses.

By strengthening business and forming business clusters in these familiar areas where Mitsui has knowledge of the business, we aim to increase the probability of success and achieve growth.

Corporate Strategy (2) Moon Creative Lab Supporting “Create”

One of foundations for “Create” in our business model is the Moon Creative Lab that became operational in 2019. Moon is a platform that handles the R&D functions of Mitsui, forming new businesses, and accelerating challenges to address new businesses.

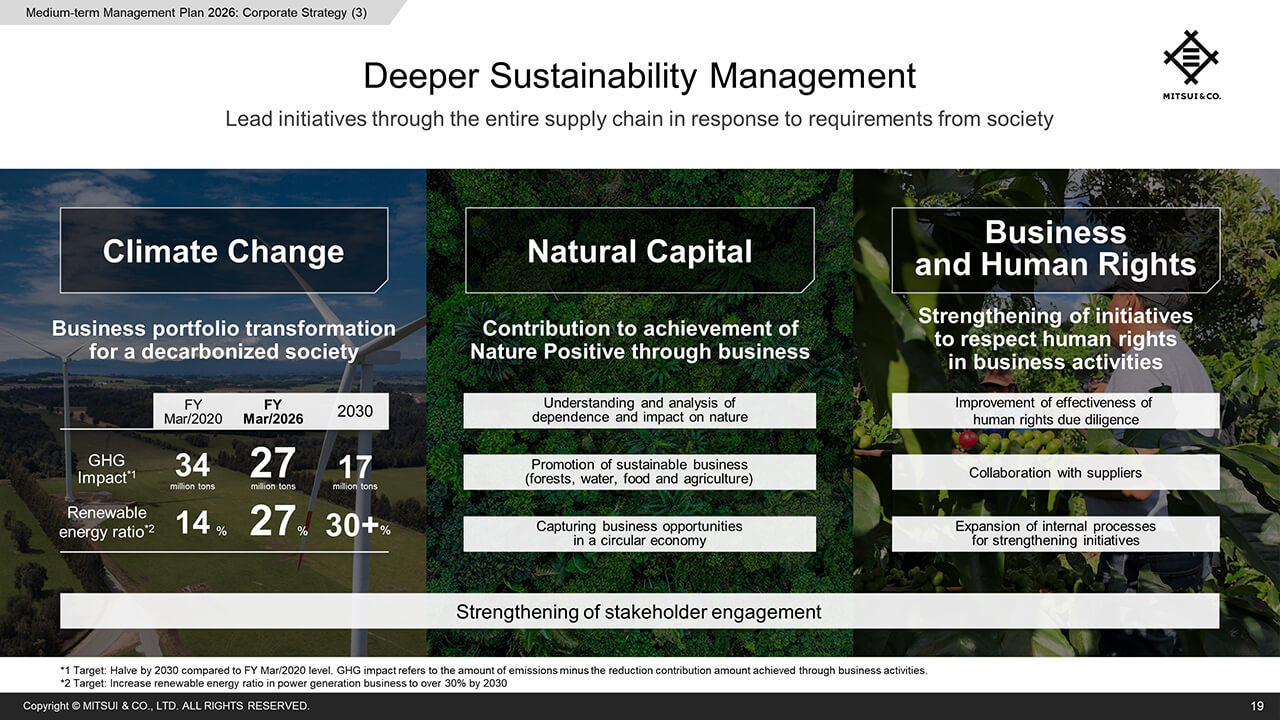

Corporate Strategy (3) Deeper Sustainability Management

The third corporate strategy is further deepening of sustainability management.

In order to realize the theme of the new MTMP – “Creating Sustainable Futures,” we are driving responses to social issues such as climate change, natural capital and business and human rights throughout the entire supply chain.

We provide optimal solutions to these issues through business and seek for both sustainability and profitability.

In our responses to climate change, we will continue to transform our business portfolio for the realization of a decarbonized society. Mitsui’s target for 2030 is to halve the GHG impact compared to FY March 2020, and achieve a renewable energy ratio of over 30% in our power generation portfolio. In FY March 2026, which is the final year of the new MTMP, we expect to reduce the GHG impact down to 27 million tons, and to increase our renewable energy ratio to 27%.

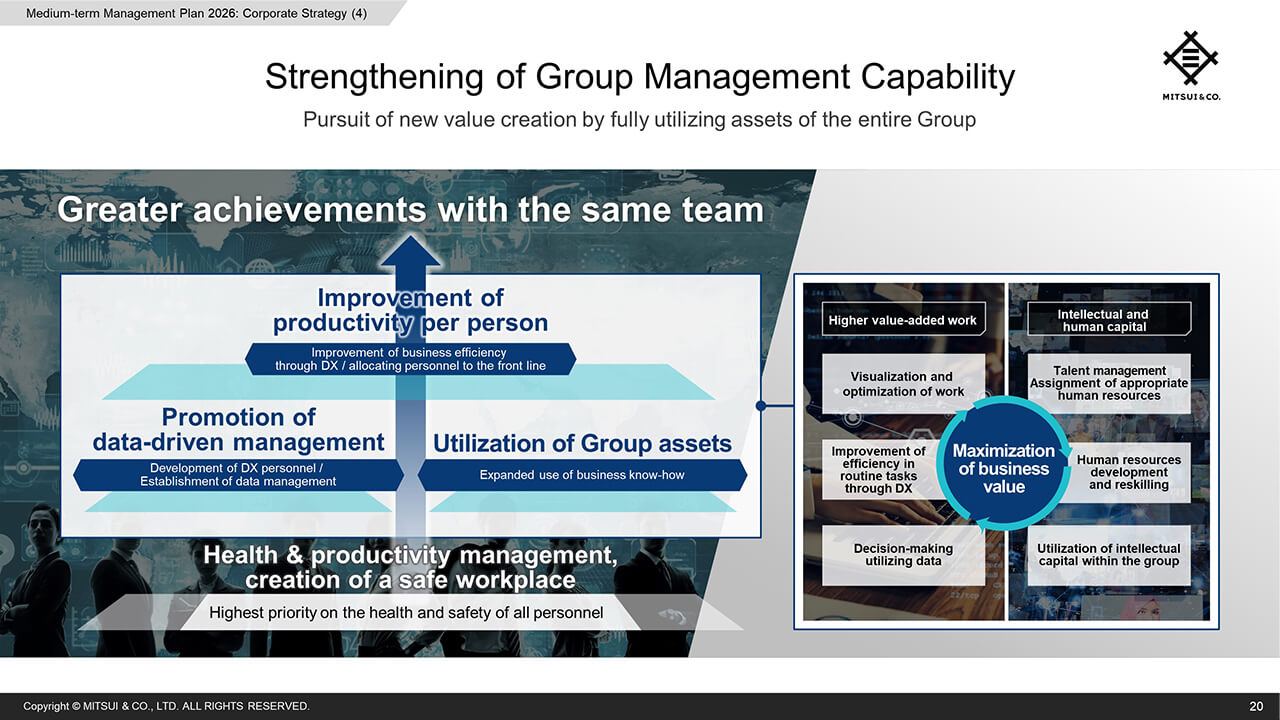

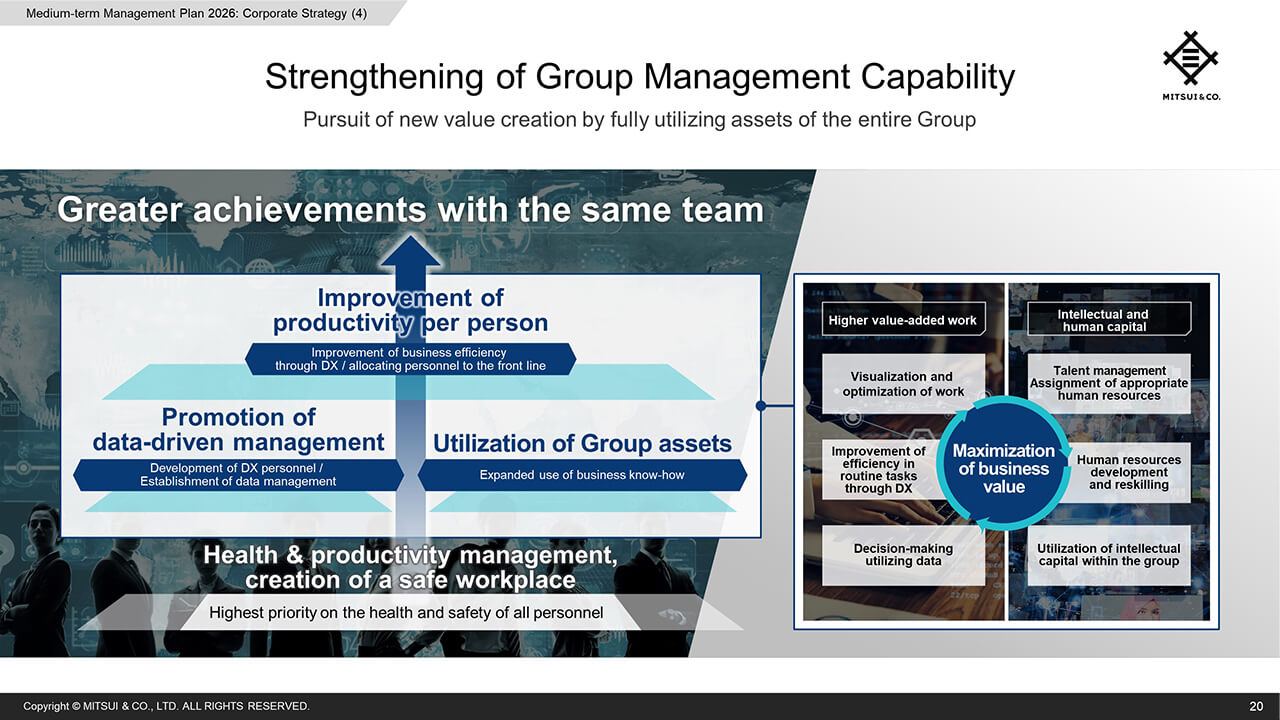

Corporate Strategy (4) Strengthening of Group Management Capability

The next corporate strategy is strengthening of group management capability.

It is necessary to increase productivity per person in order to continuously drive the transformation of Mitsui’s business portfolio. We will efficiently and effectively implement greater achievements with the same number of personnel through both data-driven management and full utilization of Group assets.

Corporate Strategy (5) Promotion of Globally Diverse Individuals

The fifth corporate strategy is the promotion of globally diverse individuals.

We will further accelerate investing in our people, in order to promote autonomous career development.

The three-pronged human resources strategy of developing capable individuals, inclusion and strategic assignment of personnel remains unchanged from the previous MTMP. Furthermore, we will support the transformation of the business portfolio by improving the productivity of each employee and seeking value-added work.

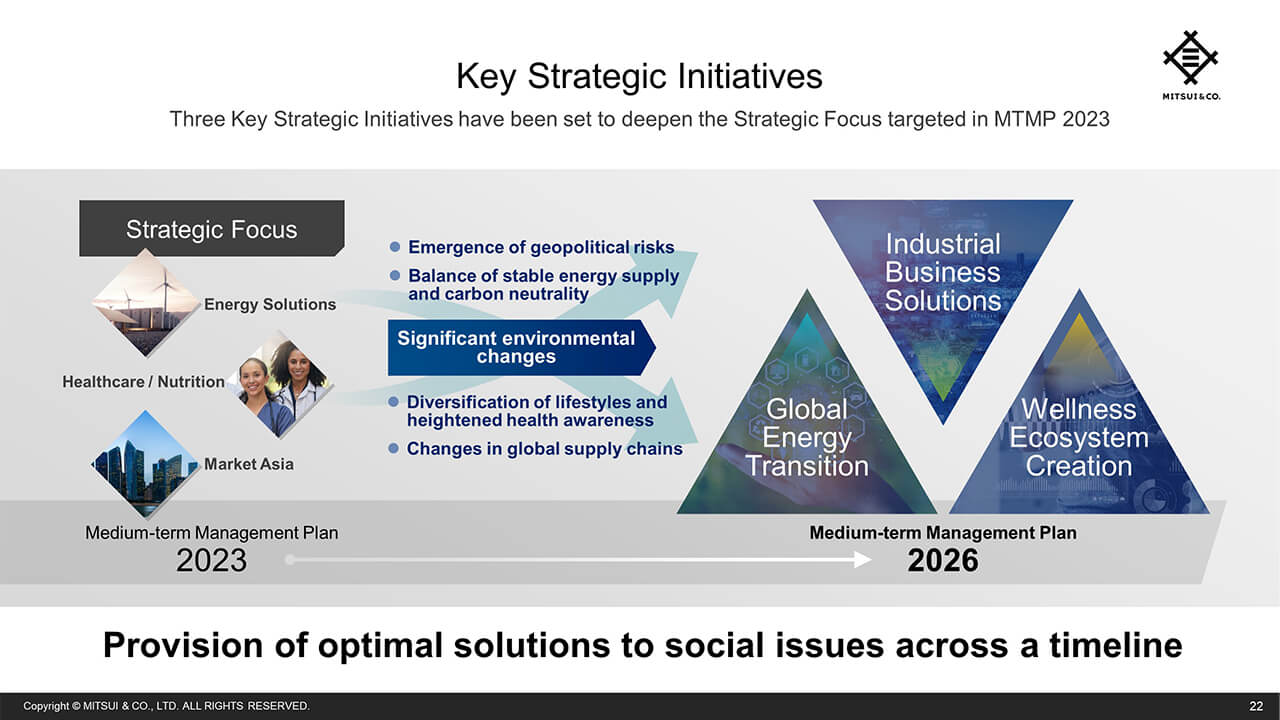

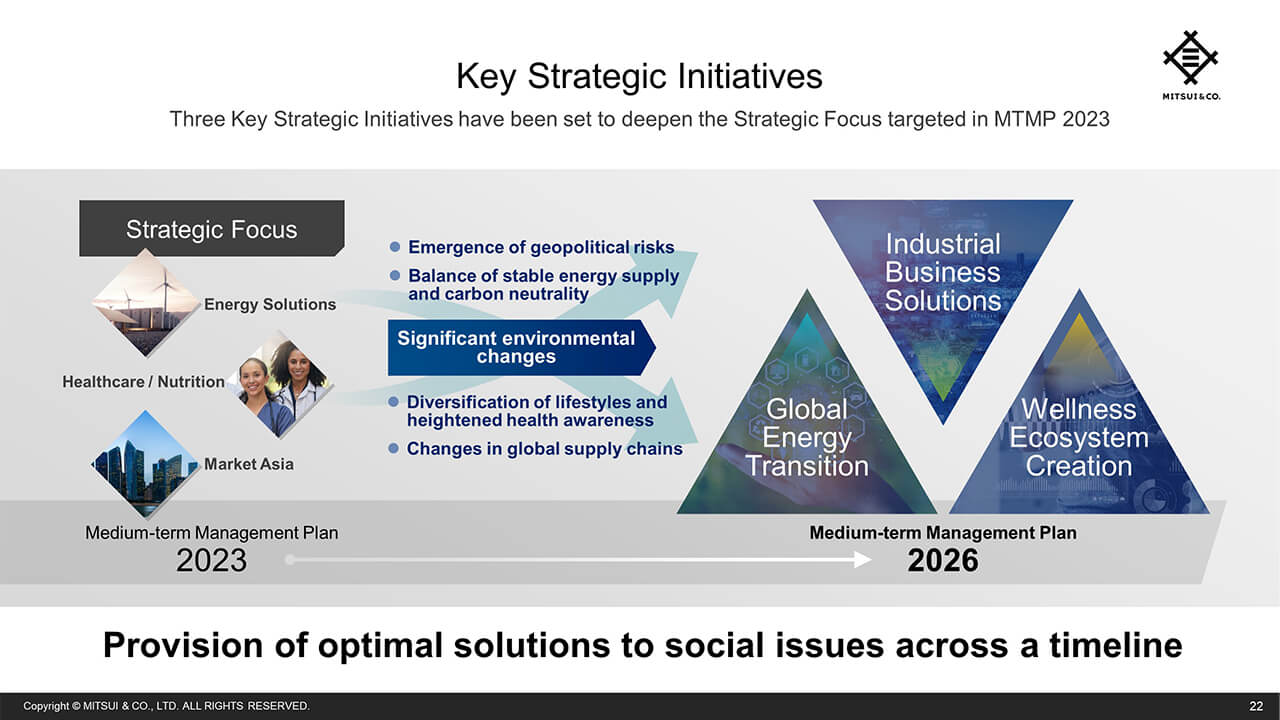

Key Strategic Initiatives

I will now explain the Key Strategic Initiatives in our new MTMP.

Based on the deepening of the Strategic Focus initiatives of the previous MTMP and key changes in the environment occurring in recent years, we have established 3 Key Strategic Initiatives as areas where Mitsui can demonstrate its strengths.

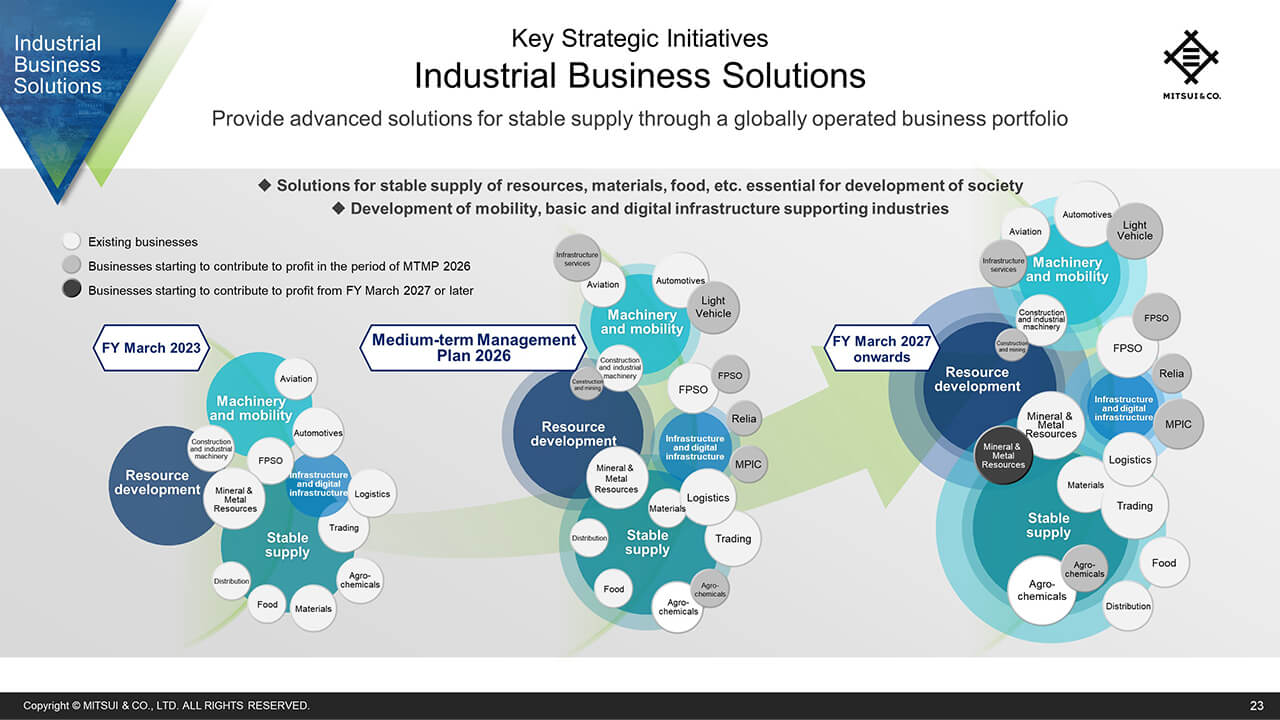

Industrial Business Solutions (1)

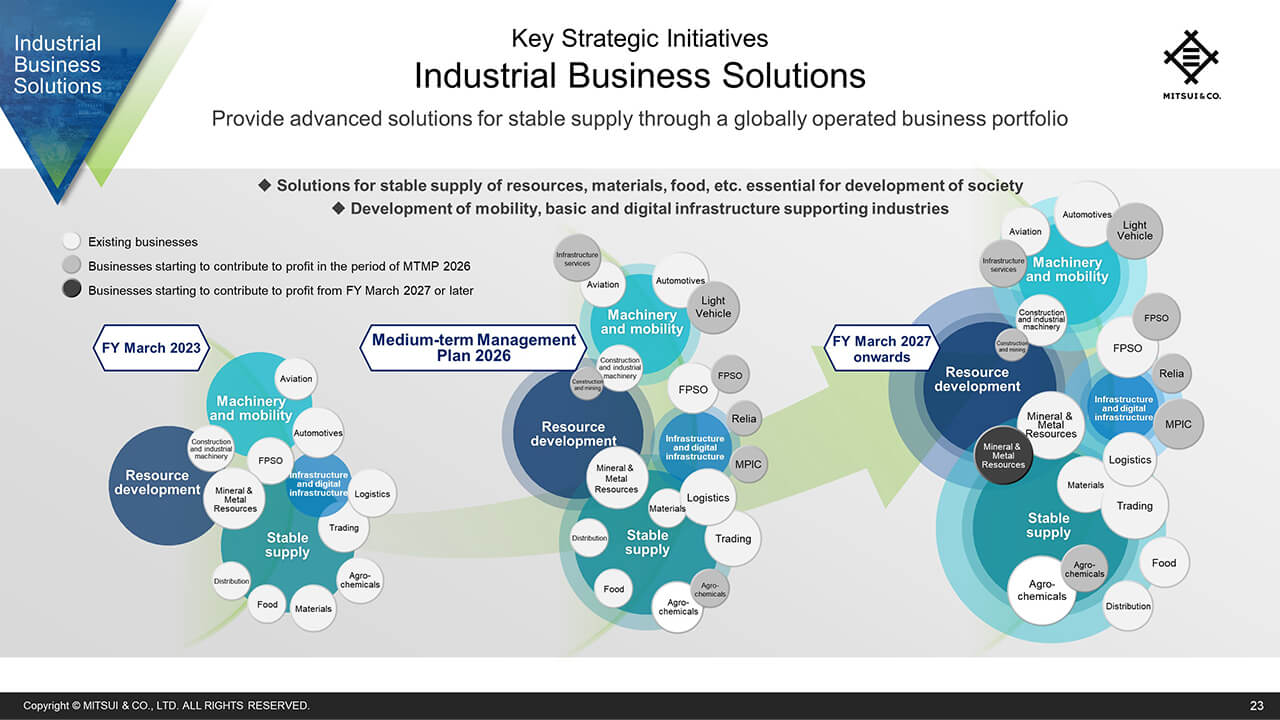

The first Key Strategic Initiative is Industrial Business Solutions. This diagram shows our strategy and path to profit enhancement through the creation and growth of business clusters in adjacent business areas.

In Industrial Business Solutions, we provide advanced schemes contributing to stable supply through our globally extended business portfolio. This is an initiative related to resource development, materials and food, etc. essential for the advancement of society, and the mobility, infrastructure including digital etc. supporting industry.

Industrial Business Solutions (2)

I will introduce our efforts in the mobility area as a specific example.

By utilizing our business portfolio spanning globally by region and function, we plan to form mobility business clusters supporting industry.

For example, in North America, we will seek synergies with existing businesses such as Penske Group, and develop businesses in adjacent areas. In Asia, we will form business clusters capturing the economic growth of each country. Through these initiatives, we will increase the number of business clusters in the mobility area from 3 in FY March 2023to 9 in FY March 2026.

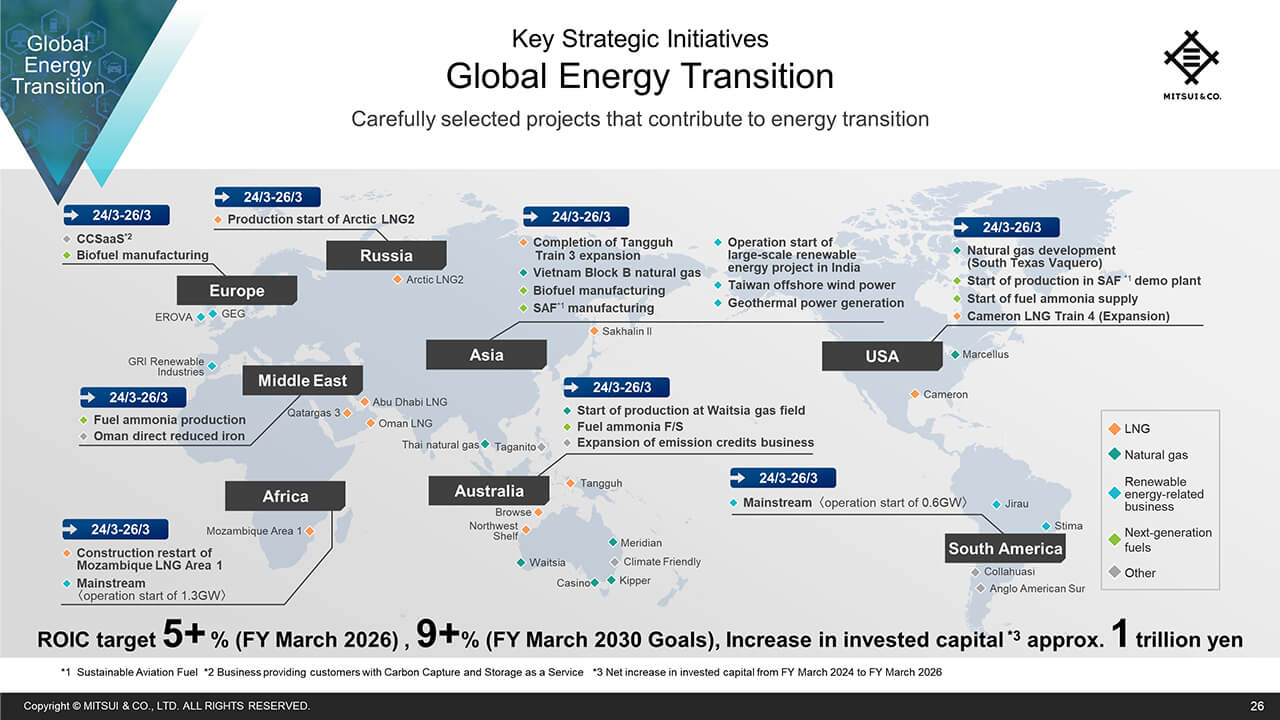

Global Energy Transition (1)

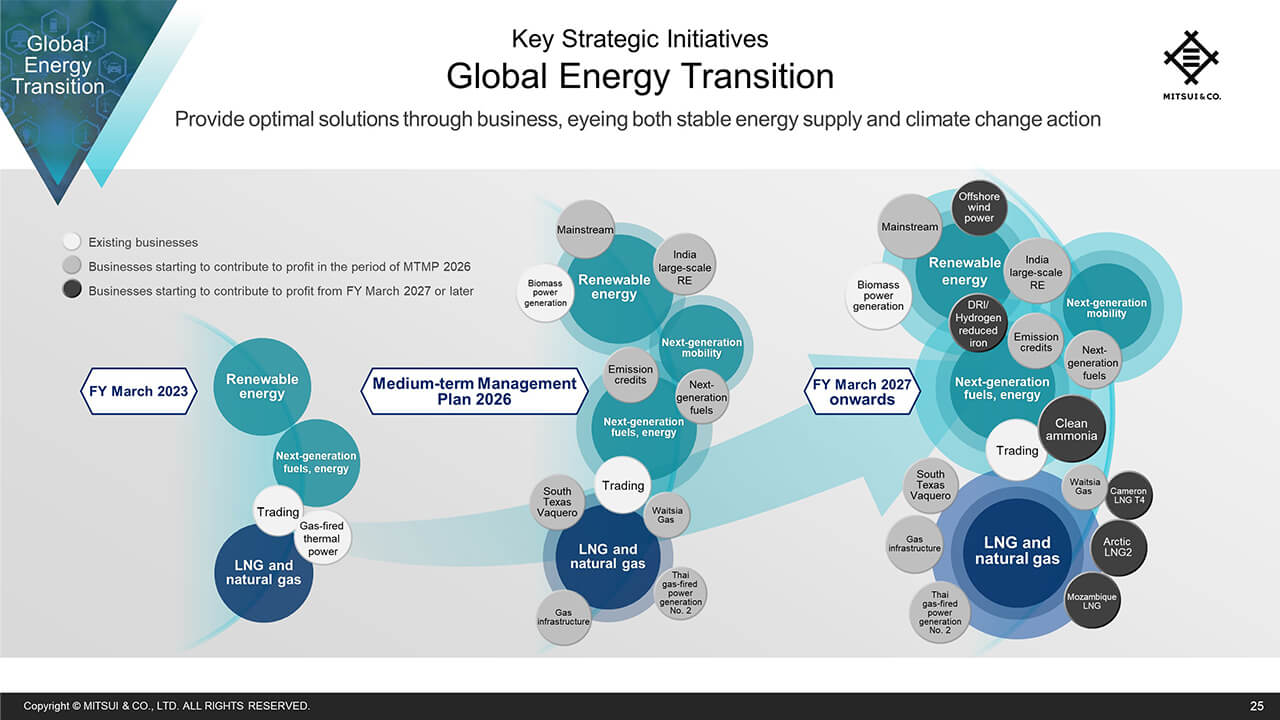

The second Key Strategic Initiative is Global Energy Transition.

We will provide the latest available optimal solutions through business, from the perspectives of both stable energy supply and climate change, in order to transition into a decarbonized society in a sustainable manner. Our path to create and grow businesses by providing various solutions to achieve a decarbonized society while fulfilling the responsibility for stable energy supply is shown on this slide.

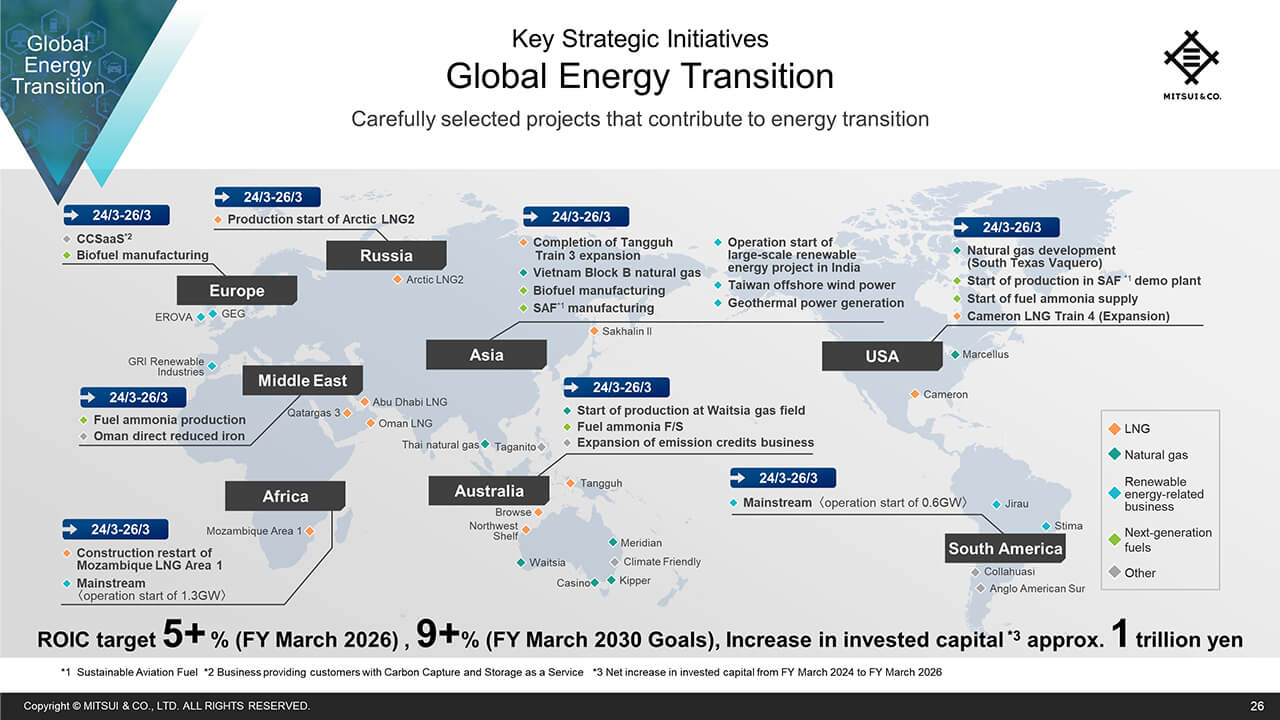

Global Energy Transition (2)

This is the overview of projects worldwide that Mitsui is working on. Projects that are under operation and fulfilling the responsibility of stable supply such as LNG, are plotted in the map. In addition, we have plotted many businesses that are expected to reach a turning point, such as final investment decisions or the commencement of operation, during the new MTMP. We will carefully select the opportunities from our pipeline and promote those businesses in order to realize a decarbonized society.

As a result, we expect a net increase in invested capital in this area of approximately 1 trillion yen over the three years of the new MTMP, and aim for ROIC to be over 5% in FY March 2026, and over 9% in FY March 2030.

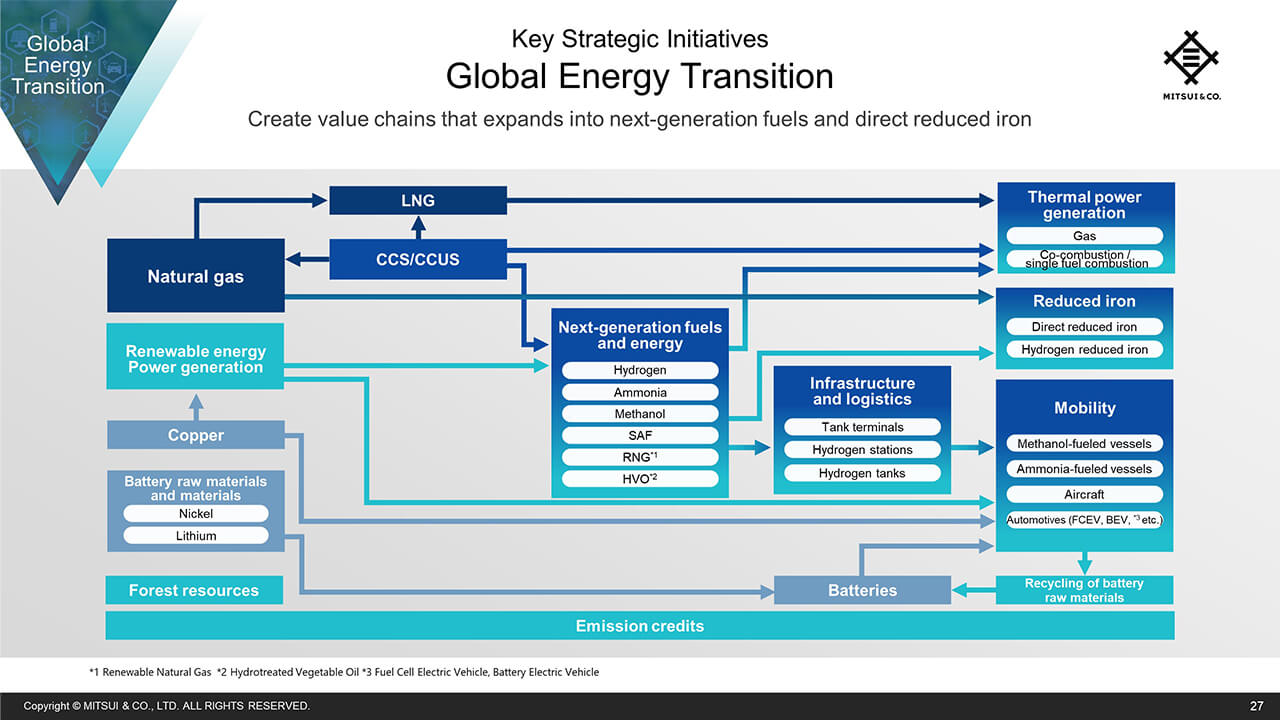

Global Energy Transition (3)

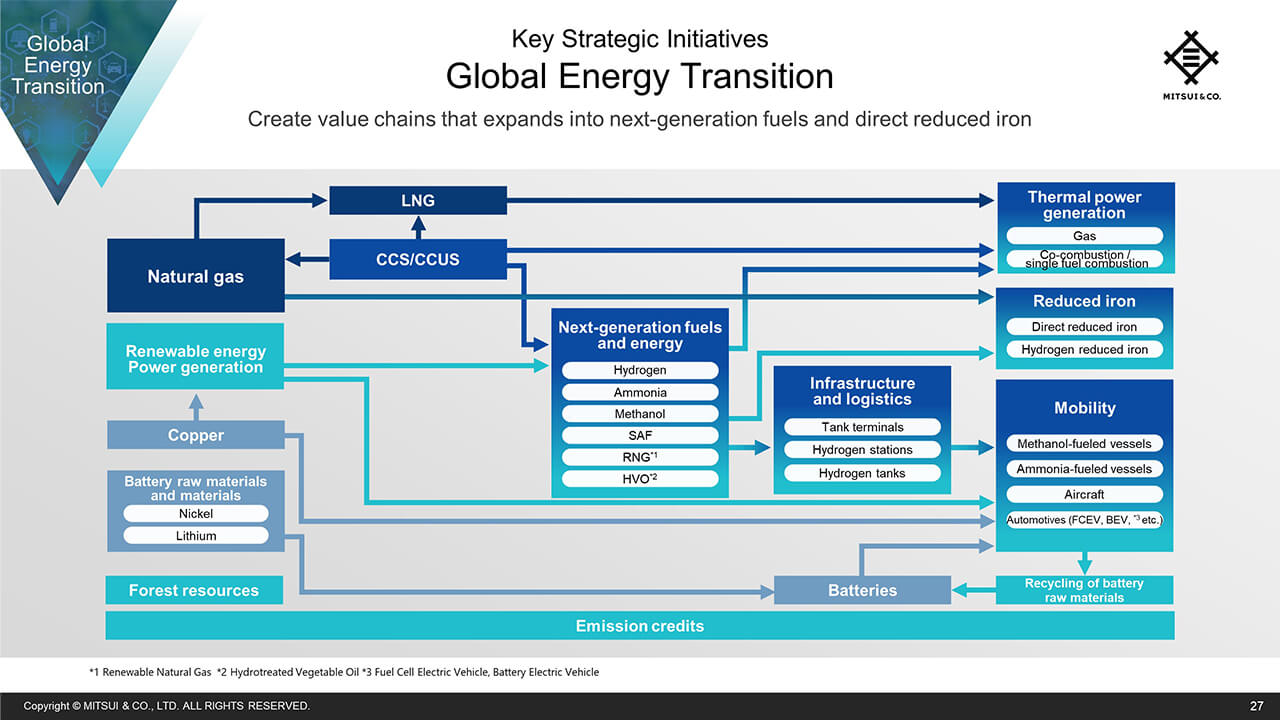

This is the value chain we intend to realize through Mitsui’s Global Energy Transition.

In addition to existing businesses such as natural gas, LNG, copper and renewable energy, we will actively engage in the business development of areas such as next-generation fuels and direct reduced iron,and strive to create new value chains during the period covered by the new MTMP.

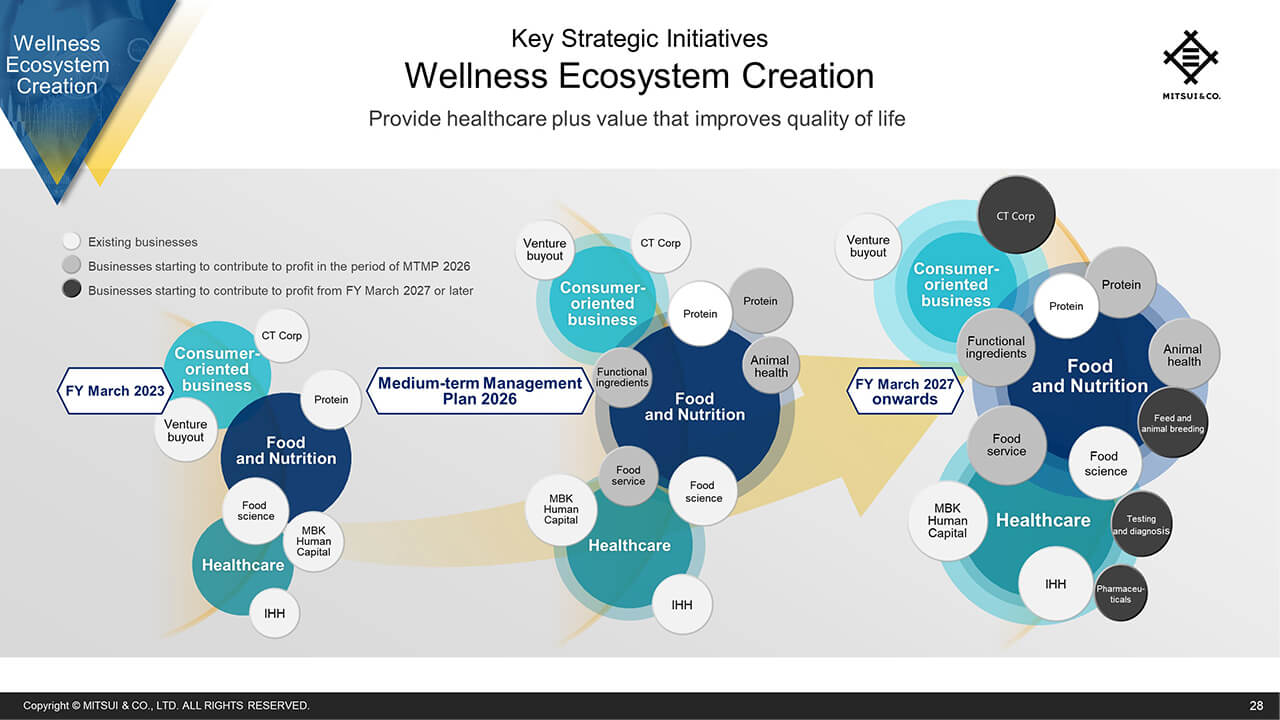

Wellness Ecosystem Creation (1)

The third Key Strategic Initiative is Wellness Ecosystem Creation. In addition to healthcare and prevention, we will contribute to the improvement in quality of life through the provision of healthy food and nutrition.

Wellness Ecosystem Creation (2)

This is the Food and Nutrition value chain realized through Wellness Ecosystem Creation. We will create much added value along the value chain such as a stable supply of food, reduction of environmental impact, and the provision of food in response to diverse needs.

In the Wellness business cluster, we will contribute to health through nutrition and food, and provide efficient and effective healthcare and prevention through the accelerated coordination of healthcare-related businesses by data utilization.

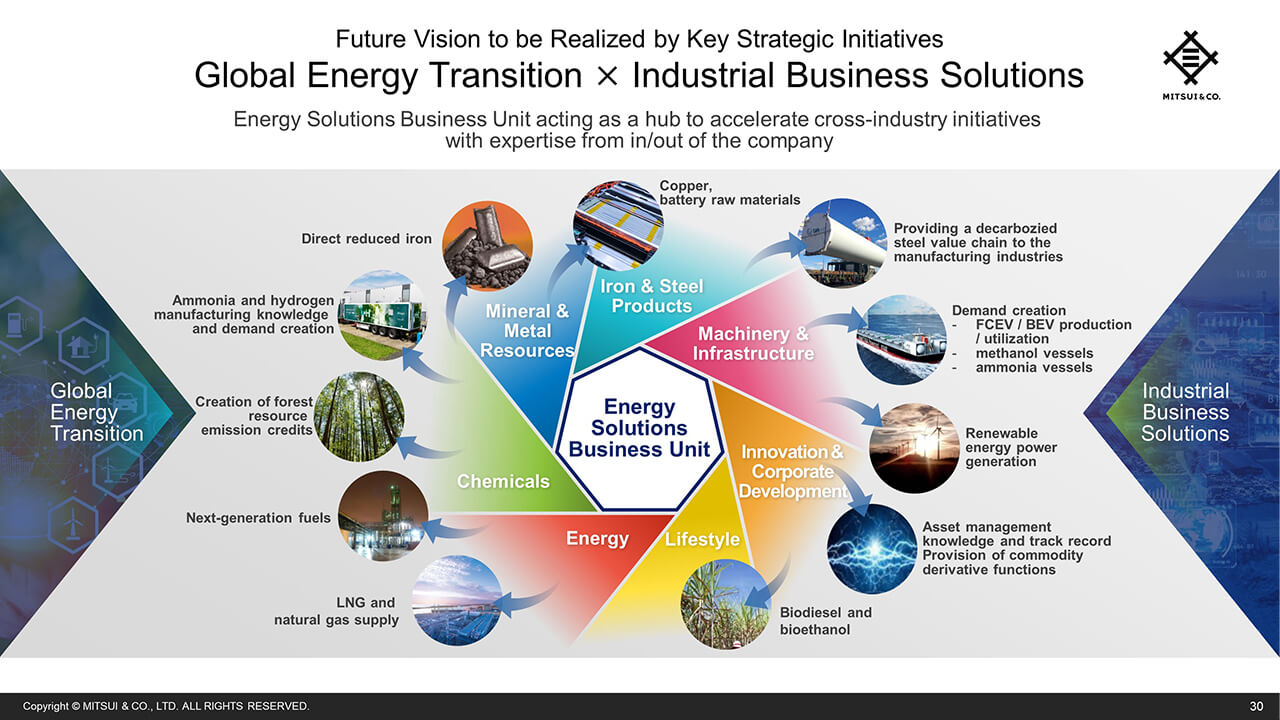

Global Energy Transition × Industrial Business Solutions

As I have explained to this point, we will promote the expansion of business along each Key Strategic Initiative, but each initiative is also closely linked to one another, therefore we can create new value chains and ecosystems by combining these initiatives.

For example, in the fusion of Global Energy Transition and Industrial Business Solutions, the Energy Solutions Business Unit is serving as a hub to amass knowledge from inside and outside the company, and to accelerate cross-industry initiatives. As a result, we have been able to concurrently promote numerous and various projects, as indicated in this diagram,

Stable Supply of Food × Wellness Ecosystem Creation

In another example, by combining Industrial Business Solutions and Wellness Ecosystem Creation, we will support stable supply of food from further upstream in the value chain such as seeds, fertilizer and crops, and make the Wellness Ecosystem devised by Mitsui much stronger.

As a result, we expect net invested capital in this area to be approximately 350 billion yen over the three years covered by the new MTMP, and aim for ROIC to be over 5% in FY March 2026.

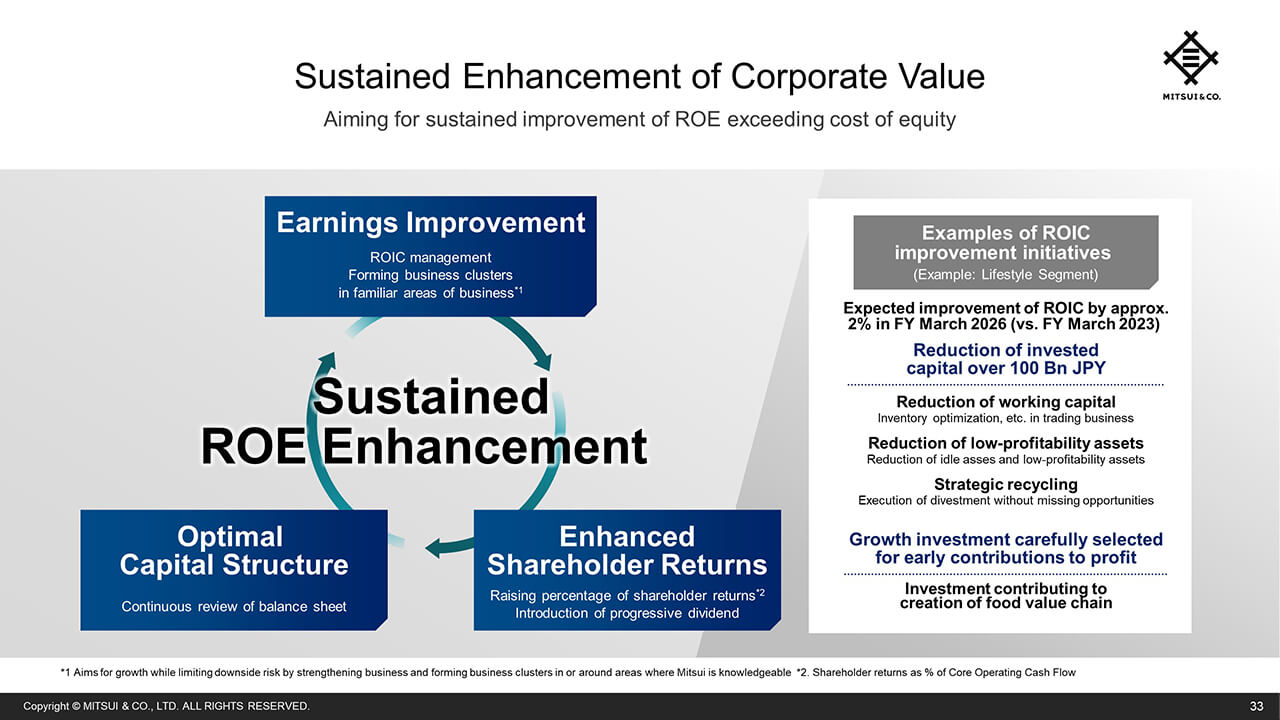

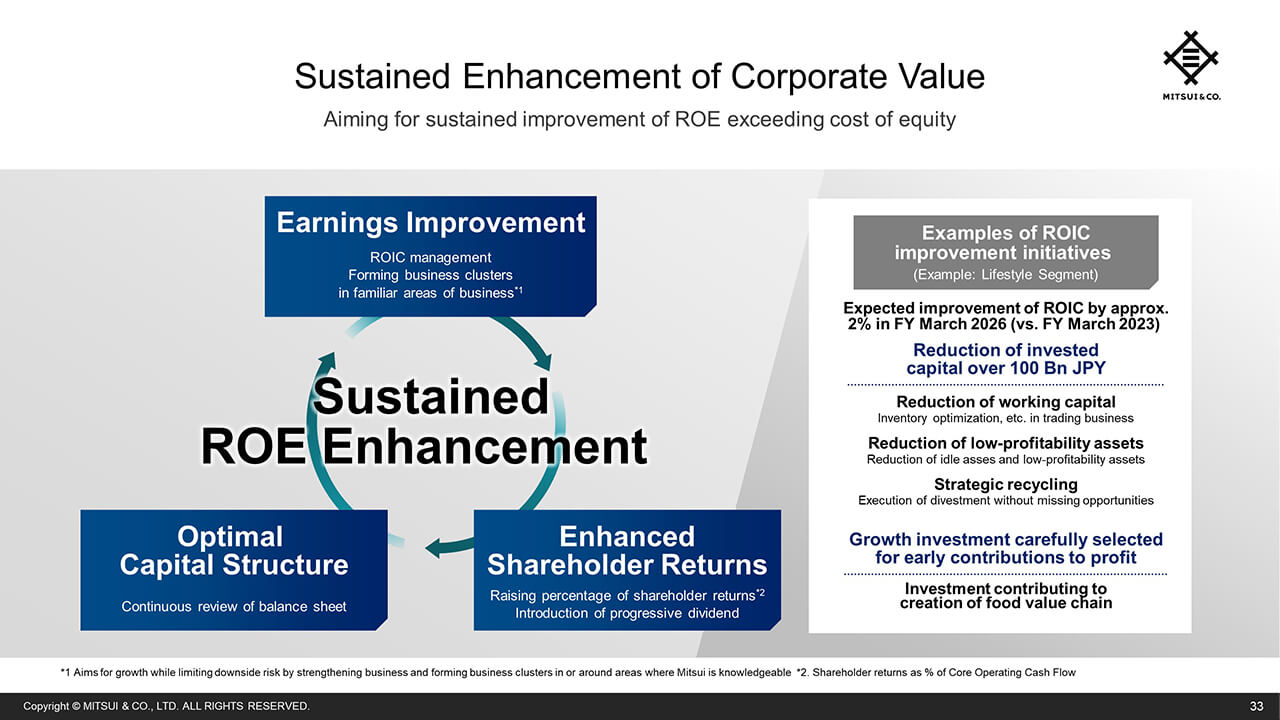

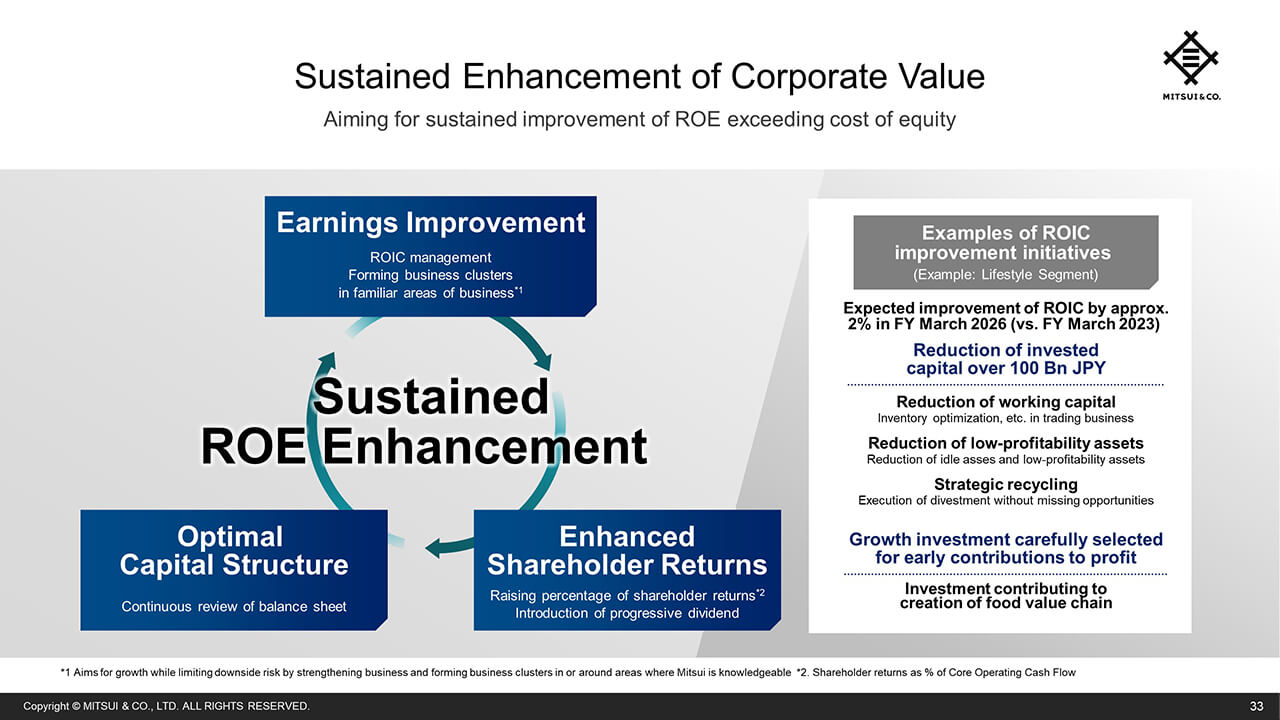

Sustained Enhancement of Corporate Value

From here, I will explain the allocation of management resources and the shareholder returns policy.

We have worked on ROIC based management and enhancement of shareholder returns during the previous MTMP. We will further deepen this approach in the new MTMP and promote earnings improvement, enhanced shareholder returns, and optimal capital structure. Based on these initiatives, Mitsui has established a 3-year average ROE of over 12% as a KPI for the new MTMP and aims for sustained improvement of ROE that exceeds the cost of equity.

In terms of ROIC management, since the previous MTMP we have been establishing ROIC targets for different businesses and monitoring the progress of achieving those targets, as well as coming up with ways for improvement.

To use the Lifestyle Segment as an example, we will optimize the amount of invested capital by reducing working capital, reducing low-profitability assets, and making strategic asset recycling, while at the same time making growth investments in areas expected to make early contributions to profit. Our target is to improve ROIC in this segment by 2% in FY March 2026.

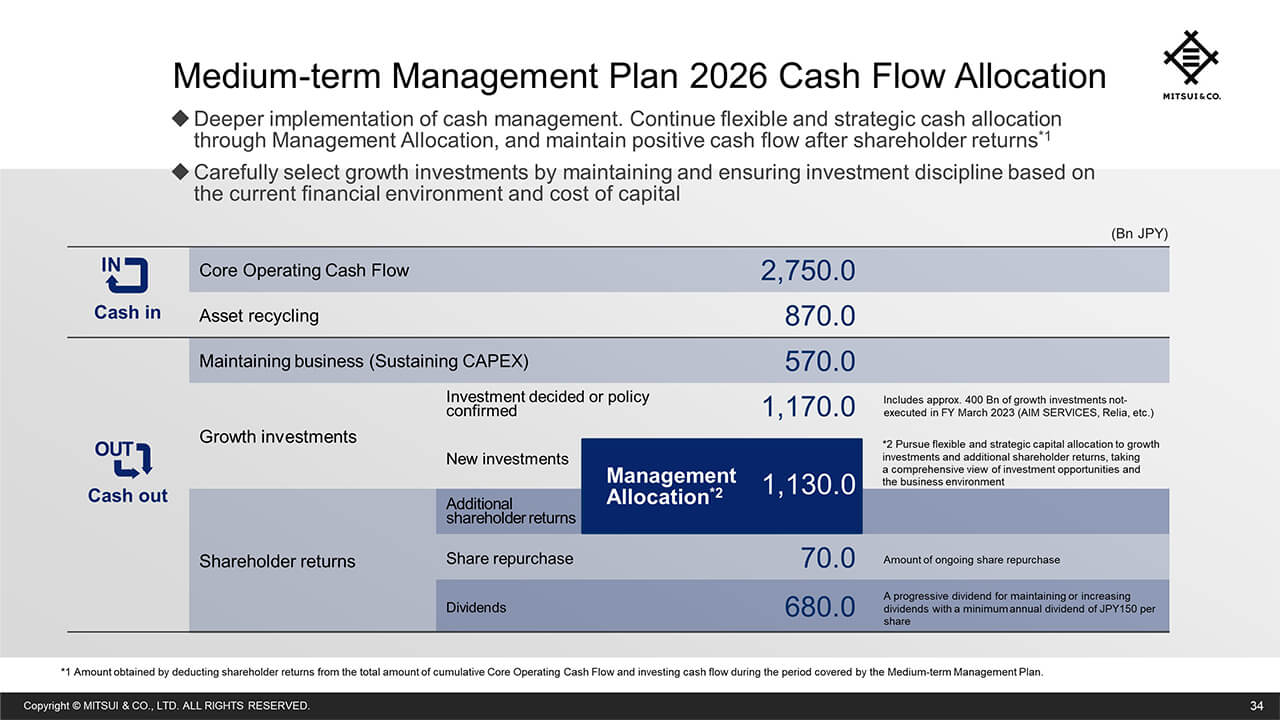

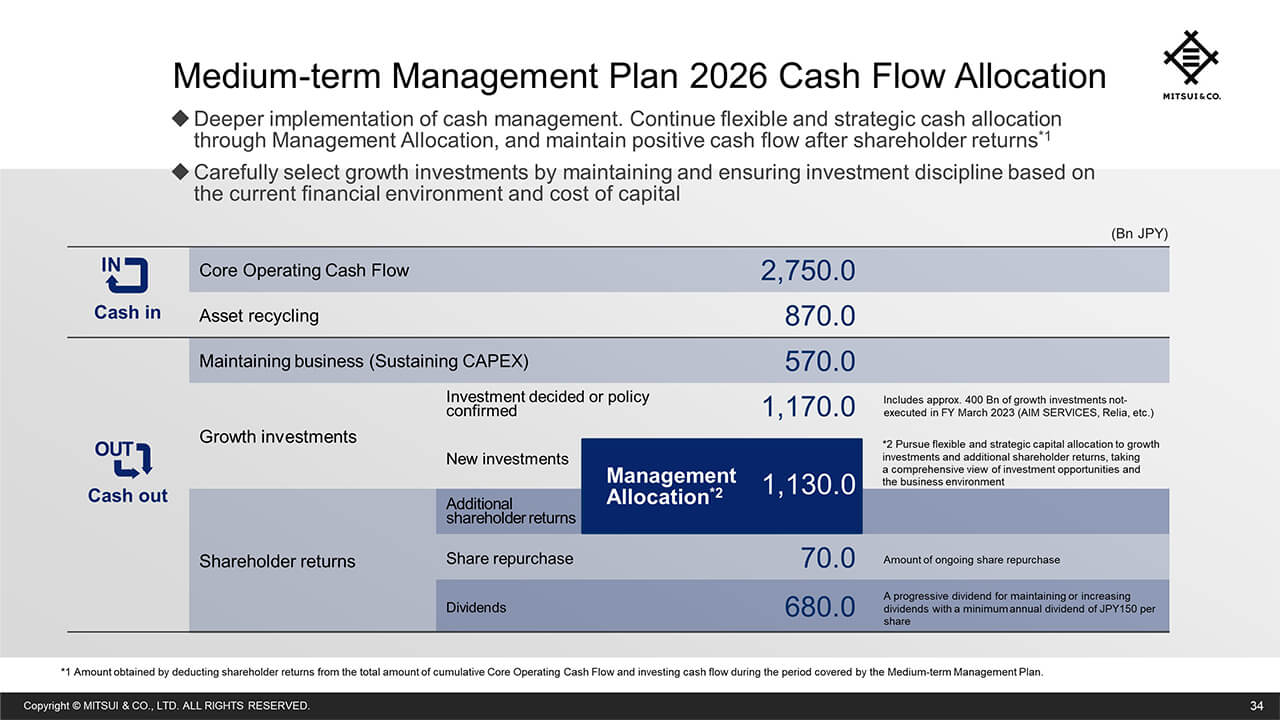

Cash Flow Allocation

Now I will explain cash flow allocation.

Under the new MTMP, we will thoroughly enhance cash management - a feature of Mitsui.

We forecast cash-in of 3.62 trillion yen, comprising Core Operating Cash Flow of 2.75 trillion yen and asset recycling of 870 billion yen.

As for cash-out, we forecast 570 billion yen for sustaining our existing businesses, and 1.17 trillion yen in post FID and policy-confirmed growth investments. This includes large scale investments such as making AIM Services our wholly owned subsidiary and the tender offer and business integration of Relia. Including these, there are approximately 400 billion yen worth of investments which were intended during the previous MTMP but did not reach execution. In addition, there are pipeline projects for which negotiations are currently ongoing and the probability of execution is considerably heightened.

As for shareholder returns, the remaining amount of ongoing share repurchase announced in Feb 2023 is 70 billion yen and the total minimum dividend is expected to be 680 billion yen.

Based on these cash in/out projections, Management Allocation is expected to be 1.13 trillion yen. Through the Management Allocation framework, we will continue strategic cash allocation aimed at balancing carefully selected growth investment and enhancement of additional shareholder returns, while maintaining our basic policy of positive cash flow after shareholder returns.

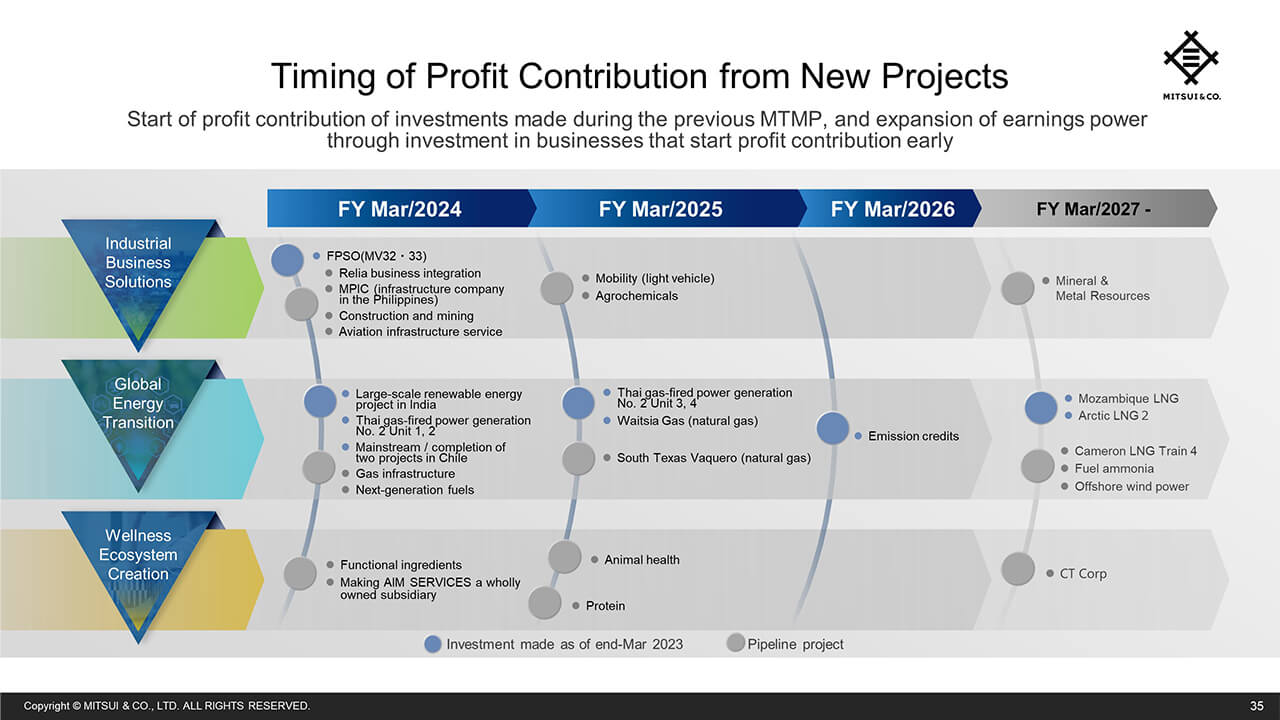

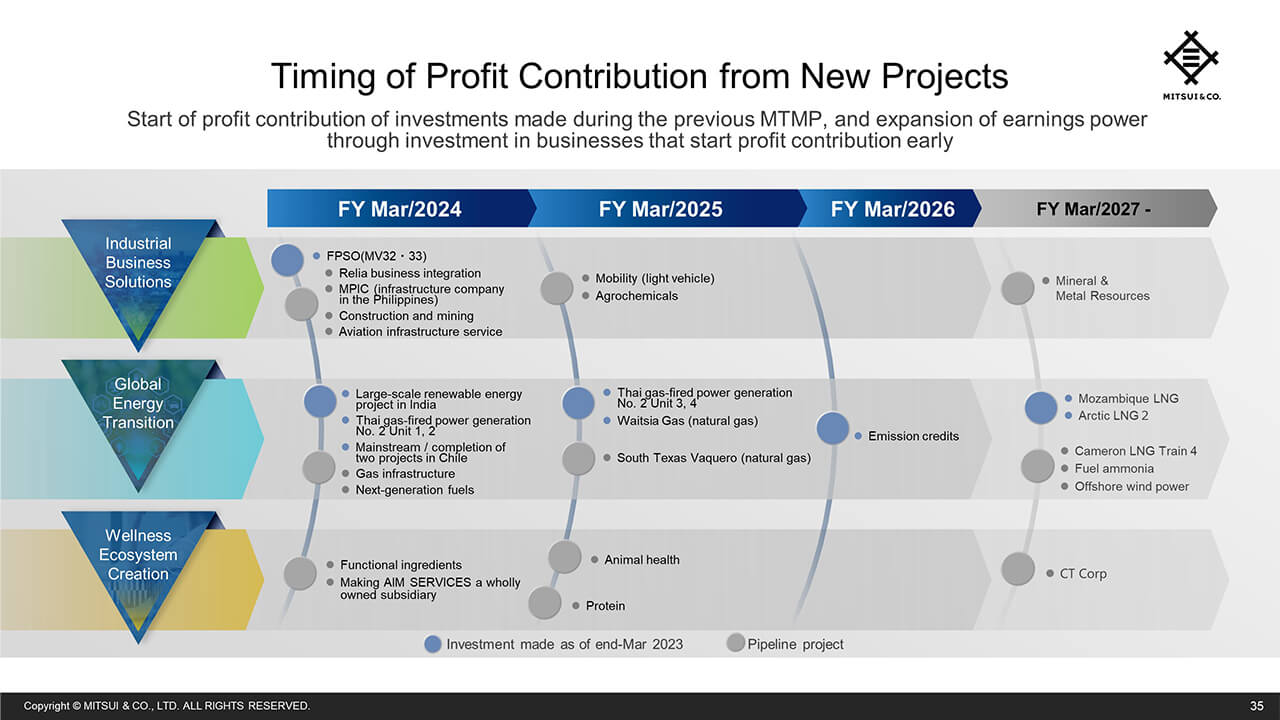

Timing of Profit Contribution from New Projects

This slide shows the expected timing of profit contribution by investments made during the previous MTMP and growth investments scheduled to be executed during the new MTMP.

You can see that we expect steady expansion of profits along each Key Strategic Initiative during the period covered by the new MTMP.

Shareholder Returns

Moving on to shareholder returns.

We will stably and flexibly enhance shareholder returns in line with the expansion of cash flow. Specifically, as explained earlier, we will increase the annual dividend from the previous forecast by 5 yen to 140 yen. We will further increase the dividend by 10 yen to 150 yen per share from the previous period in FY Mar 2024, ensure stability through the introduction of a progressive dividend, and also continue to flexibly make share repurchases as we have done in the past.

Conclusion

Finally, We will continue with our Challenge and Innovation concept to solve issues and aim to be the Partner of Choice among various stakeholders, doing so through "Creating Sustainable Futures," the theme of our new MTMP.

That concludes my presentation. Thank you very much.

Q&A: Points of focus in new MTMP

In the new Medium-term Management Plan (MTMP), I understand that in terms of tactics, you see the previous MTMP as not being wrong and that you are by and large adhering to the fundamentals of it. What is the point that you, as CEO, would most like to appeal to shareholders in three years’ time when the current MTMP has been completed? You have stated you are aiming to be the Partner of Choice, but what are your thoughts on the difference between Mitsui and other trading companies, the positioning of your company among global companies, etc.

<Hori>

Considering the increased volatility in the world, including geopolitics, and the many global issues we are facing, we have chosen Creating Sustainable Futures as the theme of this MTMP.

As a global company with its roots in Japan, we cannot survive as a top-tier global company unless we accumulate the ability and experience to build a high level of global collaboration and consortiums among companies. Therefore, we hope to become such a company by implementing various measures in this new MTMP.

As a trading company, we have various Business Units, and as I explained today, we will quickly lower the barriers between Business Units and promote cross-industry collaboration. We cannot respond globally unless we have a thorough understanding of each country, so we will penetrate more deeply into regions where we have particular strengths, and use the company's know-how to link to industrial collaboration. Only then can we function as a corporate entity that can be a globally competitive and sophisticated consortium, and that is what we intend to keep in mind as we move forward.

In the case of our company, we are involved in business not only in Japan, but also in the US, Asia, and businesses from the southern hemisphere, and we are also working on new initiatives in Europe. In addition, the importance of China as a market is indisputable. Since we are engaged in such a variety of activities on a global scale, it is important to maintain a global balance. I do believe that this is a point that people understand and commend us on.

We have a long history as a business entity, but we will work as one to increase our presence.

Q&A: Optimal capital structure

Regarding the optimal capital structure on P33 of the presentation material, while you have presented various KPIs this time, it is not clear from the outside what the balance sheet will look like in three years' time. Currently net DER at the end of FY March 2023 is 0.5 times and looking at this from the outside it appears that it will certainly decline, moving closer to zero. What are your current thoughts on the appropriate capital structure? For example, what will be the size of the balance sheet three years from now, and how will you utilize the approximately 1.2 trillion yen of cash remaining from the previous MTMP?

<Hori>

As I have previously communicated, it is true that we have in excess of 1 trillion yen as Management Allocation from the previous MTMP still in our hands.

I explained that we would apply this to strengthen our balance sheet, and as management, we feel that we have made sufficient preparations for the volatile business environment that the company faces.

In terms of how we will utilize this reserve, we have tried to get an understanding of what the world will look like when the outbreak of the COVID-19 is over, and all employees on the front lines of their business operations have taken part in this process, taking another look at the projects on the ground. Currently, we have projects in the pipeline that will add up to many times more than what we have built into our investment plan. Fortunately, employees around the world were able to move more freely in the latter half of the COVID-19 pandemic, and because of this, we were able to put together some projects a little earlier than expected. These projects are piling up, although they were not completed in time for cash outflow to be recorded in the previous MTMP, so they will be completed in the new MTMP. We will give priority to executing these projects because they are excellent opportunities, but it is important to achieve high profitability with an abundant group of projects. As is true for any company, our analysis shows that the cost of capital is on the rise, and when it comes to selecting projects that make sense from a price perspective in an inflationary economic environment, we need to be very selective.

Thus, it is necessary to carefully select and qualify projects, or to have control over the time element for these projects. It is possible that some of these projects will be of excellent quality, and I believe that the preparations we made at the end of the previous MTMP, which I mentioned earlier, will be effective in various ways.

Considering this situation, we are considering investments as a result of careful selection in the three-year model shown in the cash flow allocation, the amount of money we want to return to shareholders, our financial strength to respond to opportunities when they arise, and our ability to withstand an extremely challenging business environment.

Although the debt to equity ratio has fallen to a low level, we like the idea of having room to be flexible.

ROE is important, so we need to increase capital efficiency, and we need to commit to a certain level of shareholder returns. We have taken an all-round approach to how we allocate capital in this way, and this is the quantitative plan that we have presented in our MTMP.

Since various things can happen in the business environment in the future, our idea is not to focus too heavily on one indicator, but rather to manage by looking at our response capabilities, the breadth of our menu, and KPIs at the same time.

Q&A: Enhancement of base profit

The target of 920 billion yen in base profit for FY March 2026 means an increase of approximately 220 billion yen from the approximately 700 billion yen I think you will generate in FY March 2024, excluding one-time factors. Please tell us which areas will contribute to earnings and how certain you are of achieving this plan.

<Hori>

The base profit shown in the new MTMP is calculated from FY March 2024, based on commodity prices and foreign exchange assumptions for FY March 2026. The 170 billion yen improvement in base profit set forth in the MTMP was formulated with all Chief Operating Officers of Business Units, and is basically the result of bottom-up calculation.

During the previous MTMP, commodity prices and market volatility were high, and we had many opportunities to exercise our trading company functions, but we are assuming that the situation will normalize during the new MTMP. Past results have shown that more volatility increases opportunities for our company to make profit. However, this is not something that is factored into the plan, hance the decline we are expecting.

Of the 170 billion in base profit improvement, profit contribution from the new investments listed in the chart on P35 will be approximately 60 billion yen. Breaking this down into three areas of what we call Key Strategic Initiatives, we have Industrial Business Solutions, Global Energy Transition, and Wellness Ecosystem Creation, and these should evenly each contribute about one-third of the 60 billion yen. This includes Wellness Ecosystem Creation's food science and protein-related projects that are not named specifically.

For the remaining 110 billion yen, this is to be derived from organic growth. Of that, Industrial Business Solutions contribution is at over 30 billion yen. These include various mobility business lines, global operations in automotive and other machinery in Asia, and chemical products such as methanol and ammonia. Ammonia is not a new energy source, but an existing business. We also expect organic growth in tanks and other logistics operations, as well as volume expansion to include materials, energy, and metal resources.

Wellness Ecosystem Creation contribution is at around 10 billion in organic growth in food and wellness.

We also expect around 40 billion yen for the entire company through business efficiencies and turnarounds by exiting or getting currently loss-making businesses back into the black. This includes the area of trading, such as coffee, where we had difficult results in FY March 2023. Trading in general was favorable in FY March 2023, but the numbers were a little weak only in coffee trading. We expect this to normalize and operations to deliver results.

Global Energy Transition includes some projects that are partially recovering profits from prior investments. Including these and other small items amount to about 20 billion yen, for a total of 110 billion yen.

Q&A: Shareholder returns

Regarding the increase of shareholder returns as a percentage of Core Operating Cash Flow (COCF) to 37%, you are currently generating 1 trillion yen in COCF, but previously there was a long period during which the contribution was around 500 billion yen, and I think there is fluctuation depending on the environment at the time. Since you mentioned investment for growth, please tell us what the implications of this 37% target are, such as whether you will stick to this level even if free cash flow is in the red, or whether even in that situation this new commitment of 37% won’t be a problem owing to the capital accumulated in the previous MTMP. I think that volatility will increase in the future, so please tell us whether you think the ratio could reach a higher number such as 45% or 50%. Also, am I correct in understanding that you basically want to place more emphasis on dividends for your shareholder returns?

<Hori>

We are considering the appropriate level of shareholder returns based on base earnings calculated with neutral commodity prices and with a certain degree of normalization of volatility in the trading environment.

Since 2014, we have reached a certain level of share repurchases that lead to more efficient cash flow per share. We will continue to flexibly consider share repurchases in the future, but I believe that the efficiency per share that we are now targeting is being achieved based on the previous MTMP. In anticipation of this, we will calculate a minimum amount of dividend we would like to pay and continue to discuss this with you all going forward.

I think someone mentioned in his question that the Management Allocation of the previous MTMP was a buffer against the volatility we may see in the current MTMP. I understand that to be the case, and I hope you will understand that we have formulated our capital allocation based on the combination of this with the expected increase in base profit.

Our approach to share repurchases remains unchanged. We will consider share repurchases if we see more upside than originally anticipated, for example if commodity prices exceed the expected range and generate more cash flow than anticipated, or if there is major asset recycling. As in the previous three years, we would like to continue close dialogue with you all. We look at the stock price level, as well as whether our balance sheet is sufficient for the business environment we face. We will consider share repurchases in a flexible manner after analyzing various factors. However, I believe that one benchmark for allocation will be the ratio to cash flow.

While we would like to maintain a neutral balance of cash flow after shareholder returns, we do not think it is necessary to deny the possibility of taking a flexible approach on debt levels depending on the situation. We believe that while we must be disciplined in the way we execute projects and in our investment decisions, we should maintain the flexibility to respond to good projects as they come about, so that we can broaden our menu of management options.

Q&A: Growth investments and cash flow allocation

Could you explain the relationship between the 170 billion yen base profit growth and the cash flow allocation? According to the table on P34, the Management Allocation is 1.13 trillion yen. Given that shareholder returns is 37% of COCF, we can calculate this to be about 1 trillion yen. 750 billion yen is already planned to be used for dividends and share repurchases, about 250 billion yen of the 1.13 trillion yen will be used for shareholder returns and the remaining 900 billion yen can be used for additional investments. This is my understanding of the share cash flow allocation plan.

Is the 170 billion yen base profit growth based only on the projects in which investment decisions have been made and policies confirmed, or is it based on the assumption that a certain amount of Management Allocation will be allocated to growth investments as well? You explained that the 170 billion yen increase in base profit includes some growth investments from Management Allocation. From your perspective, does this mean that the current potential investments include projects that look favorable? Please give us an idea of how you view these investment projects overall.

<Hori>

Of the 170 billion yen in growth in base profit, I believe that many of the contributions from new investments have already been decided and policies confirmed for investment, but we also expect to make some investments with cash from the Management Allocation.

We would like to work on current projects to determine how many of the projects in the pipeline still make sense, and whether they can pass hurdles set by management.

In terms of investment projects, we have had intensive discussions with the Chief Operating Officers of each Business Unit in formulating business plans, and we have had a good response. For example, the supply chain for the Global Energy Transition is full of projects that can only be executed through collaboration among multiple Business Units within the company and also require collaboration from other big industry players outside of Mitsui.

For example, there are many projects that would not be possible without the chemical and energy businesses coming together, and in the area of mobility, there are many projects that are connected to our network of ships and automotives, as well as to the management of CO2 emissions at mining sites.

It takes a combination of work to make that into something that can generate sufficient returns in this current environment of high interest rates and inflation. And only by incorporating functions such as trading and finance in the periphery of the business can surplus profit be secured.

In order to get to that point, we need to make such preparations and improve efficiency and productivity, but we are looking into such details and are determined to make those projects work.

We intend to actively invest funds from our Management Allocation in deals that meet these assumptions, and by appropriately combining our trading capabilities, we will secure sources of earnings.

Q&A: Future expansion of total assets

Your explanation was to maintain a management structure and size at a similar level and to improve productivity while not increasing the number of employees too much, but it is expected that shareholders’ equity per employee will keep increasing into the future.

I believe that the target for ROE of over 12% will be reached naturally through the profit target of 920 billion yen, but what will you do after the MTMP period?

If you continue, the shareholders' equity will build up and in contrast, total assets need to be increased with leverage, and the amount invested per person must be increased to maintain ROE over the long term. What do you consider to be an appropriate asset size?

In the investment plan, there will be a net increase in Global Energy Transition’s invested capital by 1 trillion yen. What is your policy for the future expansion of total assets?

<Hori>

If we deliver solid results as planned, we will build up capital, but of course we always keep capital efficiency in mind while also looking at shareholder returns.

In addition, the most important factor will be the number of employees who can promote various projects in a high-level global consortium.

This may be true for any company, but it can be the bottleneck. We need to cultivate the ability to hire and train while keeping a close eye on this, and we are constantly searching for ways to create an even more agile team by combining the project management employees at the head office with the excellent employees who have been nurtured at the group companies.

This is probably one of the most important issues. If there is a limit there, of course, we will not be able to do more projects, and we would like to try as much as possible to take that limit off.

From our perspective, we can honestly say that we do not consider the absolute volume of assets we can handle as a limiting factor. There are global companies that are expanding on a much larger and more respectable scale. We are striving for that level as well, so we need to raise our level even higher toward how well we can attract that kind of talent to our company.

In the short term, it is also true that considerable time saving can be achieved by the use of new tools, and we intend to thoroughly implement measures in this area over the next three years.

We call it middle game within the company to ensure the growth of our projects, and we believe that by eliminating waste, we should be able to more proactively create time for this middle game and innovation.

Therefore, one of our goals is to thoroughly use tools including DX to increase the productivity of our people by the first half of this MTMP.

Q&A: Key Strategic Initiatives policy and consistency with previous MTMP

I would like to ask a question regarding the consistency from the previous MTMP. I understand that the three Key Strategic Initiatives are a development from the Strategic Focus of the previous MTMP, but how is Market Asia in the previous MTMP incorporated into the current MTMP?

It also appears that Industrial Business Solutions will allocate management resources to a wide range of businesses in general. Specifically, what kind of business model do you intend to expand? Could you please explain your policy based on the connection with the previous MTMP?

<Hori>

Regarding Market Asia, one of the Strategic Focus of the previous MTMP, the results of the capital alliance with Indonesia's CT Corp Group are emerging in various forms, and we expect the alliance to contribute to earnings with considerable impact in the latter half of the new MTMP, as well as during the subsequent MTMP.

In addition, regarding our recent announcement, we are planning to make a tender offer for Metro Pacific Investment Corporation, which is engaged in infrastructure business in the Philippines. We believe that this is a very good entity and that it will be able to capture the growing demand for infrastructure in the Philippines in the future.

CT Corp group I mentioned earlier is a conglomerate that is expected to grow in Indonesia, and including IHH, we see that a core business is being created in Asia.

We believe that we are now able to extend Market Asia, where we saw progress in the previous MTMP, in the new MTMP with the idea that part of it will be in Wellness Ecosystem Creation and part of it will be in Industrial Business Solutions. Furthermore, we are proud of the depth and breadth of the other two Strategic Focus.

Let me give you a more concrete picture of your question about Industrial Business Solutions.

For example, in the case of Chemicals, we have already achieved results in trading in FY March 2023, we intend to combine logistics and trading assets in such a way that they are both complementary and viable as businesses. Industrial Business Solutions will focus on businesses such as manufacturing, where we can manage the risk, or combining materials derived from fossil fuels with those derived from bio-derived materials, which will lead to a circular economy. We believe that business will expand from two points of view, regionality and cross-industry.

As for materials, we are focusing on businesses to reduce carbon intensity. Since we have been involved in the mineral & metal resources business for a long time, we are focusing on how we can move forward in this area, for example, how we can promote the direct reduced iron business in the future, which we believe will become one of the pillars of our business.

In this sense, Industrial Business Solutions can be seen as a field where we have knowledge and where we are adding new functions, such as carbon intensity, to the growing awareness of issues to improve people’s lives, and we will target the revenue streams generated in this process.

Q&A: Risk factors in new MTMP

Let me ask a question about the incorporation of risk factors into the new MTMP. You mentioned earlier that the turnaround projects will amount to 40 billion yen, so I understand that you are reaping the projects where returns have not risen as expected after investment has been made. On the other hand, how do you manage and factor in figures for the expected downside?

<Hori>

Regarding overall risk management, we are very careful to manage the time frame of the project. When project costs rise in an inflationary economy, we have to consider how to manage it and the time frame of negotiation, and we will work on it with determination. In this way, we would like to proceed carefully so that each project will lead to the expected results.

Regarding the incorporation of figures, in our accounts and budgets, we always take into account everything that should have been for accounting purposes at the end of the previous period. Since we have determined that there are no items that should be taken as allowances in accounting at this point, we do not anticipate any negative side risks and factor them into our budgets like a buffer.

Q&A: Global Energy Transition investments

My question is about the balance between Global Energy Transition investments as shown on page 27 of the presentation material and shareholder returns. I understand that businesses such as CCS, hydrogen and ammonia do not generate profits in short-term, and the scale of business risks could be large.

Recently, some companies have been curbing or reviewing shareholder returns in order to invest in the Global Energy Transition area, which is a medium- to long-term initiative. Your company is trying to enhance the shareholder returns while proceeding with Global Energy Transition at the same time. What were the discussions that led you to this conclusion, and what are your current thoughts on whether shareholder returns will be a constraint when you move forward with this type of Global Energy Transition investment in the medium- to long-term?

<Hori>

We are showing you the overall capital allocation including shareholder returns, after looking at how many opportunities we have on hand. Our basic thinking is that we can probably make the investments we would like to work on with the model we currently have. We are not holding anything back.

On the other hand, to give you an idea of how we arrived at this point, there are many potential projects, and if we were to take on all of them, it would require a very large amount of money, and it does not mean that we are investing on all.

If we set a new hurdle for projects that can produce results even in the current macroeconomic environment, the number of projects will be limited to a certain extent, or we will have to make a considerable breakthrough at the stage of building the project.

In the case of our company, for example, the Chief Operating Officers of our Business Units understand this, and they are proceeding with the projects. Therefore, we believe that there is a path that can produce sufficient results with a certain degree of control, rather than increasing the amount of investable assets.

Based on this policy, we would like to actively invest the amount of money shown in the current Management Allocation if we are certain that good projects can be built.

As for the time frame, for example, each country has various support programs, which we would of course like to take advantage of, but ultimately we need to come up with a plan in which the business is viable on a stand-alone basis.

In our case, it is also important to select partners in terms of how we share the risk with each other. In addition, we need a combination of adjacent trading chain, financing, and a little bit of traditional assets that will bring profit for the new businesses in a low-carbon society. I believe that we can proceed with such a combination of relatively low marginal costs.

We are of the view that the scale of the project will remain within a certain level because it is difficult to develop a good project without such a combination of techniques.

If a large-scale opportunity comes up and we are overwhelmingly convinced as a result of our proactive scrutiny, we should work on this. We believe that we can do this under the new MTMP, and there could be a phase in which we will work on it, while carefully watching our balance sheet and engaging with our stakeholders.

Q&A: LNG business investments

On page 26 of your presentation material, you explain various investment pipelines in each region, and among these, I have a question particularly about the investment in the LNG business. LNG business has price risk, and if you stick to the ROIC targets of 5% in FY2026 and 9% in FY2030, it would be difficult to invest in LNG due to concerns on price risk and policy risk.

LNG is very important for your company's cash flow. Please tell us how you plan to continue to invest in the LNG business, which is subject to price risk, while maintaining consistency with ROIC.

<Hori>

ROIC analysis is performed for each project individually, so we add them up vertically here. However, please be assured that we do not use this vertical addition as a reason to distort the ROIC judgment for each individual project.

As you mentioned, there is a time lag from investing and profit contribution in LNG business, but even if all LNG projects around the world, including the ones we are currently involved in, were to start operating as scheduled, our medium- to long-term analysis indicates that there would not be enough LNG projects supply to meet the needs of the market.

In that case, taking into account a certain contribution from its scarcity, the LNG projects we are working on now can be calculated on ROIC with a sufficient time horizon, so I do not think that we should reduce our LNG investment now because of ROIC.

On the other hand, this ROIC target of 5% in FY2026 and 9% in 2030 is what you get if you add up all the projects vertically, but as the next-generation energy type projects start up, they are expected to catch up with conventional energy considerably.

The result of this internal discussion is that when we add them up vertically, we can see about 9% in the fiscal year ending March 2030, and this is the image that we are showing you.

Q&A: Low-profit assets

With regard to invested capital related to ROIC, you have given the example of reducing 100 billion yen in the Lifestyle segment, but if we look at the company as a whole, how much of the low-profit assets that are being challenged are there?

<Hori>

We have not established any particular macro KPI for reducing investable assets or denominator of ROIC, while we are trying to make steady progress in all business areas, one project at a time. As we are working on our business plans one by one, for example, lifestyle industry is close to food, and we are talking about 100 billion yen. However, generally, if you look closely at any business area, you will find something like that in the billion-dollar range. Therefore, I would like you to understand that we are working throughout the company to verify the efficiency of the ROIC denominator in such units.

Q&A: Potential of Moon Creative Lab.

Could you please explain the achievements of the Moon Creative Lab after its operation or what you expect in the future?

<Hori>

Moon Creative Lab is there to create 1 from 0 through innovation. This organization is a lab that thoroughly examines how to build business models and what new businesses can be created based on the understanding and knowledge gained from the work we are undertaking. We are working with sharp discussions, based on the idea that in order to incorporate strategic design thinking and access a broader market, we need to change the way we think and the way we assemble our consortium.

Moon Creative Lab has already made some achievements. For example, in addition to the realization of DX-related business, a Moon Creative Lab graduate is working on virtual currency linked to physical gold. This is very practical work, and graduates are taking the lead in such areas, which our derivatives trading division is working on right now.

We are gradually seeing Moon Creative Lab playing an incubation role, and we would like to continue to make this a stronger platform.